3.18: Chapter Three- Review Questions

- Page ID

- 88519

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \) \( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)\(\newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\) \( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\) \( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\) \( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\) \( \newcommand{\Span}{\mathrm{span}}\) \(\newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\) \( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\) \( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\) \( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\) \( \newcommand{\Span}{\mathrm{span}}\)\(\newcommand{\AA}{\unicode[.8,0]{x212B}}\)

Chapter 3: Review Questions

- Is the Income Statement a “flow” or a “static” statement?

- Do Income Statement numbers get bigger, smaller, or neither – as time passes?

- When, if ever, and how, if so, do the Income Statement numbers revert to zero?

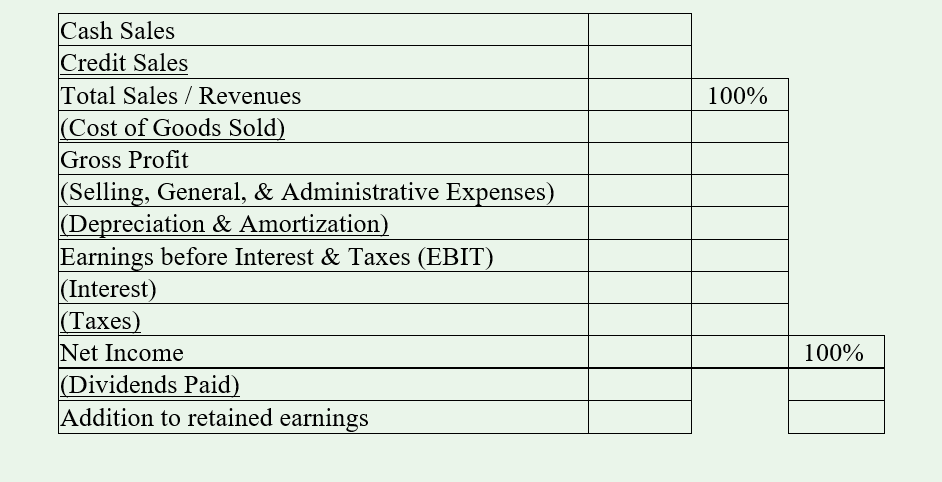

- Using the template below, create an Income Statement in both dollar terms and in “common size,” using the same company as you used in the prior problem set.

- Are Revenues and Expenses respectively debit or credit balance accounts?

- Differentiate between a “cash” versus a “non-cash expense”? What are the tax implications for each?

- Which Income Statement item distinguishes between operating matters and all the stuff below it? By what two names is it referred?

- What is the “Addition to Retained Earnings”? How is it calculated, and what is its relationship to “Retained Earnings”?

- What is “Depreciation Expense”?

- Among Property, Plant and Equipment, which is/are depreciated and which not?

- Explain each of the four interpretation problems financial analysts encounter in reading the accountant’s reports.

- How are audits opinions potentially different from one another? Does the financial analyst care?

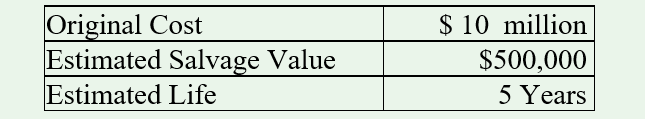

- You are given the following information. Create a table and calculate the annual depreciation and account balances, using all three reporting methods discussed:

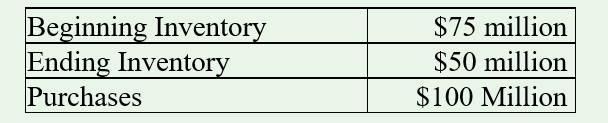

- Calculate the Cost of Goods Sold, given the following inventory data:

- What does “COGS” include?

- By what criterion does the accountant “impute” depreciation to COGS?

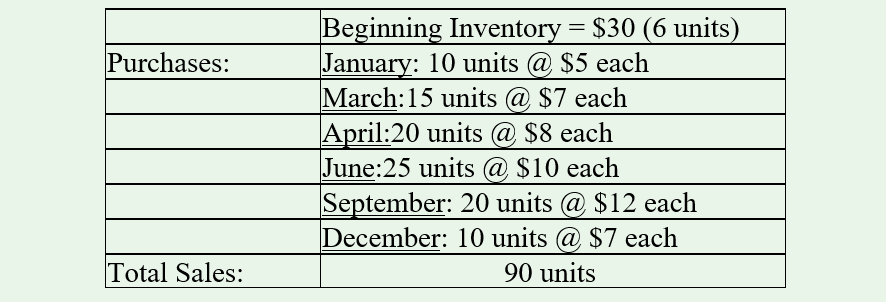

- Given the data below, calculate the FIFO and LIFO Ending Inventory, and COGS.

- Define “LIFO Base.”

- What is the technical interim reporting issue in using LIFO?

- Can the corporation switch back and forth from FIFO to LIFO?