8.3: Diversification

- Page ID

- 53995

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)There are a variety of reasons a company may consider diversification. Diversification strategies can help mitigate the risk of a company operating in only one industry. If an industry experiences issues or slows down, being in other industries can help soften the impact. Companies can also diversify within their own industry. There are three types of diversification:

- Related Diversification —Diversifying into business lines in the same industry; Volkswagen acquiring Audi is an example.

- Unrelated Diversification —Diversifying into new industries, such as Amazon entering the grocery store business with its purchase of Whole Foods.

- Geographic Diversification —Operating in various geographic markets, which is the corporate strategy of Starbucks, Target, and KFC.

In all three diversification strategies, the goal is to achieve synergy. How can the firm operate more efficiently and effectively through its diversification efforts?

Three Tests for Diversification

A proposed diversification move must first answer three questions to determine if it should be accepted or rejected (Porter, 1987).

- How attractive is the industry that a firm is considering entering? Unless the industry has strong profit potential, entering it may be very risky. Porter’s Five Forces Analysis can help with this assessment.

- How much will it cost to enter the industry? Executives need to be sure that their firm can recoup the expenses that it absorbs in diversifying. When Philip Morris bought 7Up, it paid four times what 7Up was actually worth. Making up these costs proved to be impossible and 7Up was sold less than 10 years later.

- Will the new unit and the firm be better off? Unless at least one side gains a competitive advantage, diversification should be avoided. In the case of Philip Morris and 7Up, for example, neither side benefited significantly from joining together.

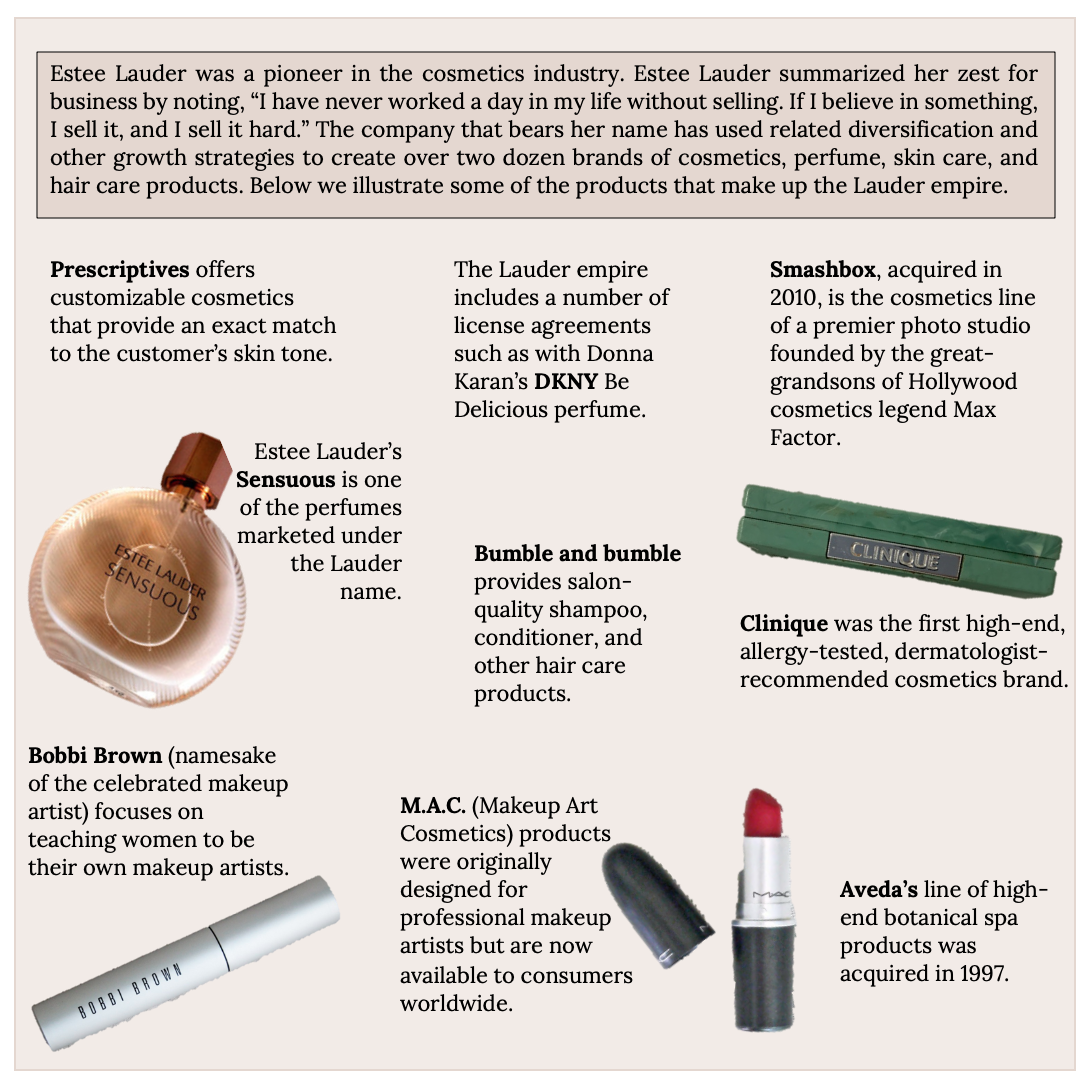

Related Diversification

Related diversification occurs when a firm moves into a new industry that has important similarities with the firm’s existing industry or industries (Figure 8.1). Because films and television are both aspects of entertainment, Disney’s purchase of ABC is an example of related diversification. Some firms that engage in related diversification aim to develop and exploit a core competency to become more successful. A core competency is a skill set that is difficult for competitors to imitate, can be leveraged in different businesses, and contributes to the benefits enjoyed by customers within each business (Prahalad & Hamel, 1990). For example, Newell Rubbermaid is skilled at identifying under-performing brands and integrating them into their three business groups: (1) home and family, (2) office products, and (3) tools, hardware, and commercial products.

Honda Motor Company provides a good example of leveraging a core competency through related diversification. Although Honda is best known for its cars and trucks, the company actually started out in the motorcycle business. Through competing in this business, Honda developed a unique ability to build small and reliable engines. When executives decided to diversify into the automobile industry, Honda was successful in part because it leveraged this ability within its new business. Honda also applied its engine-building skills in the all-terrain vehicle, lawn mower, and boat motor industries.

Sometimes the benefits of related diversification that executives hope to enjoy are never achieved. Both soft drinks and cigarettes are products that consumers do not need. Companies must convince consumers to buy these products through marketing activities such as branding and advertising. Thus, on the surface, the acquisition of 7Up by Philip Morris seemed to offer the potential for Philip Morris to take its existing marketing skills and apply them within a new industry. Unfortunately, the possible benefits to 7Up never materialized.

Unrelated Diversification

“Don’t put all your eggs in one basket” is often a good motto for individual investors. By building a portfolio of stocks, an investor can minimize the chances of suffering a huge loss. Some executives take a similar approach. Rather than trying to develop synergy across businesses, they seek greater financial stability for their firms by owning an array of companies. Warren Buffett’s Berkshire Hathaway has long enjoyed strong performance by purchasing companies and improving how they are run. Below we illustrate some of the different groups in their very diversified portfolio of firms.

| Berkshire’s insurance group includes firms such as General Reinsurance Corporation and GEICO. They maintain capital strength at exceptionally high levels, which gives them an advantage even a caveman could understand. | Berkshire’s financial health is also fueled by utilities and energy companies that are part of the MidAmerican Energy Holdings Company. | Their apparel businesses include well-known names such as Fruit of the Loom and Justin Brands. |

| Building companies include Acme Building Brands, makers of the famous brick, as well as paint company Benjamin Moore & Co. | FlightSafety International Inc. is a Berkshire firm that engages in high-tech training for aircraft and ship operators. | Retail holdings include a number of furniture businesses such as R.C. Willey Home Furnishings, Star Furniture Company, and Jordan’s Furniture, Inc. |

| Hungry for more businesses to manage, Berkshire acquired The Pampered Chef, Ltd.—the largest direct kitchen tools seller—in 2002. | Buffett had a sweet tooth for See’s Candies, whom he purchased from the See’s family in 1972. | Shareholders were all on board for the purchase of the Burlington Northern Santa Fe Corporation railroad in 2009. |

Why would a soft-drink company buy a movie studio? It’s hard to imagine the logic behind such a move, but Coca-Cola did just this when it purchased Columbia Pictures for $750 million. This is a good example of unrelated diversification, which occurs when a firm enters an industry that lacks any important similarities with the firm’s existing industry or industries (Table 8.1). Luckily for Coca-Cola, its investment paid off—Columbia was sold to Sony for $3.4 billion just seven years later.

Most unrelated diversification efforts, however, do not have happy endings. Harley-Davidson, for example, once tried to sell Harley-branded bottled water. Starbucks tried to diversify into offering Starbucks-branded furniture. Both efforts were disasters. Although Harley-Davidson and Starbucks both enjoy iconic brands, these strategic resources simply did not transfer effectively to the bottled water and furniture businesses.

A different example, lighter firm Zippo tried to avoid this scenario. According to CEO Geoffrey Booth, the Zippo lighter is viewed by consumers as a “rugged, durable, made in America, iconic” brand (Associated Press, 2011). This brand has fueled ninety years of success for the firm. But the future of the lighter business is bleak. This downward trend is likely to continue as smoking becomes less and less attractive in many countries. To save their company, Zippo executives want to diversify.

In particular, Zippo wants to follow a path blazed by Eddie Bauer and Victorinox Swiss Army Brands Inc. The rugged outdoors image of Eddie Bauer’s clothing brand has been used effectively to sell sport utility vehicles made by Ford. The high-quality image of Swiss Army knives has been used to sell Swiss Army–branded luggage and watches. As of 2020, Zippo has diversified into pocket knives, money clips, pocket flashlights, key holders, writing instruments, and tape measures. Trying to figure out which of these diversification options would be winners, such as the Eddie Bauer-edition Ford Explorer, and which would be losers, such as Harley-branded bottled water, was a key challenge facing Zippo executives.

Geographic Diversification

Firms may also diversify through expanding geographically. Big box stores such as Target and Best Buy use this strategy. Starbucks and KFC have found success with international expansion as well as domestic expansion. Synergy is developed in several ways. Many of the administrative functions such as logistics, procurement, human resources, and legal can be consolidated at the corporate level, so they do not need to be duplicated at each location. New store development is also made easier. Having already developed new stores, the firm can establish a process that it has learned from previously establishing stores, and can implement this best practice to efficiently build out, equip, and supply new stores.

Horizontal Integration: Mergers and Acquisitions

Horizontal integration refers to pursuing a diversification strategy by acquiring or merging with a rival. The term merger is generally used when two similarly sized firms are integrated into a single entity. In an acquisition, a larger firm purchases and absorbs a smaller firm. Examples of each are illustrated below..

| Horizontal Integration Examples |

| ExxonMobil is a direct descendant of John D. Rockefeller’s Standard Oil Company. It was formed by the 1999 merger of Exxon and Mobil. As in many mergers, the new company name combines the old company names. |

| Starbucks acquired competitor Seattle’s Best Coffee—which had a presence in Borders Bookstores and Subway Restaurants—in order to target a more working-class audience without diluting the Starbucks brand. |

| Bill Hewlett and Dave Packard formed Hewlett-Packard in a garage after graduating from Stanford in 1935. HP has pursued horizontal integration through a merger with Compaq computers and the acquisition of Palm, a digital personal assistant. Both failed miserably. |

| DaimlerChrysler was formed in 1998 when Chrysler entered into what was billed as a “merger of equals” with Germany’s Daimler-Benz AG. The marriage failed, with billions of dollars in losses, and Chrysler is currently owned by Italian automaker Fiat. |

| There tend to be many of mergers in the banking industry. Recently, BB&T merged with SunTrust Banks and adopted the new name Truist Financial Corp. |

| The merger of wireless carriers Sprint and T-Mobile combined the number three and four companies in the market. The new company name dropped Sprint and operates under the name T-Mobile. |

Rather than rely on their own efforts, some firms try to expand their presence in an industry by acquiring or merging with one of their rivals. This strategic move is known as horizontal integration (Table 8.2). An acquisition takes place when one company purchases another company. Generally, the acquired company is smaller than the firm that purchases it. A merger joins two companies into one. Mergers typically involve similarly sized companies. Disney was much bigger than Miramax and Pixar when it joined with these firms, thus these two horizontal integration moves are considered to be acquisitions.

Horizontal integration can be attractive for several reasons. In many cases, horizontal integration is aimed at lowering costs by achieving greater economies of scale. This was the reasoning behind several mergers of large oil companies, including BP and Amoco in 1998, Exxon and Mobil in 1999, and Chevron and Texaco in 2001. Oil exploration and refining is expensive. Executives in charge of each of these six corporations believed that greater efficiency could be achieved by combining forces with a former rival. Considering horizontal integration alongside Porter’s Five Forces model highlights that such moves also reduce the intensity of rivalry in an industry and thereby make the industry more profitable.

Some purchased firms are attractive because they own strategic resources such as valuable brand names. Acquiring Tasty Baking was appealing to Flowers Foods, for example, because the name Tastykake is well known for quality in heavily populated areas of the northeastern United States. Some purchased firms have market share that is attractive. Part of the motivation behind Southwest Airlines’ purchase of AirTran was that AirTran had a significant share of the airline business in cities—especially Atlanta, home of the world’s busiest airport—that Southwest had not yet entered. Rather than build a presence from nothing in Atlanta, Southwest executives believed that buying a position was prudent.

Horizontal integration can also provide access to new distribution channels. Some observers were puzzled when Zuffa, the parent company of the Ultimate Fighting Championship (UFC), purchased rival mixed martial arts (MMA) promotion Strikeforce. UFC had such a dominant position within MMA that Strikeforce seemed to add very little for Zuffa. Unlike UFC, Strikeforce had gained exposure on network television through broadcasts on CBS and its partner Showtime. Thus, acquiring Strikeforce might help Zuffa gain mainstream exposure of its product (Wagenheim, 2011).

Despite the potential benefits of mergers and acquisitions, their financial results often are very disappointing. One study found that more than 60% of mergers and acquisitions erode shareholder wealth while fewer than one in six increases shareholder wealth (Henry, 2002). Some of these moves struggle because the cultures of the two companies cannot be meshed. Other acquisitions fail because the buyer pays more for a target company than that company is worth and the buyer never earns back the premium it paid.

In the end, between 70% to 90% of mergers fail, according to a Harvard Business Review study, often at huge losses (Lakelet Capital, 2009). For example, Mattel purchased The Learning Company in 1999 for $3.6 billion and sold it a year later for $430 million—12% of the original purchase price. Similarly, Daimler-Benz bought Chrysler in 1998 for $37 billion. When the acquisition was undone in 2007, Daimler recouped only $1.5 billion worth of value—a mere 4% of what it paid. Thus, executives need to be cautious when considering using horizontal integration.

Vertical Integration Strategies

When pursuing a vertical integration strategy, a firm gets involved in new portions of the value chain (Table 8.3). This approach can be very attractive when a firm’s suppliers or buyers have too much power over the firm and are becoming increasingly profitable at the firm’s expense. By entering the domain of a supplier or a buyer, executives can reduce or eliminate the leverage that the supplier or buyer has over the firm. Considering vertical integration alongside Porter’s five forces model highlights that such moves can create greater profit potential. Firms can pursue vertical integration on their own, such as when Apple opened stores bearing its brand, or through a merger or acquisition, such as when eBay purchased PayPal.

In the late 1800s, Carnegie Steel Company was a pioneer in the use of vertical integration. The firm controlled the iron mines that provided the key ingredient in steel, the coal mines that provided the fuel for steel making, the railroads that transported raw material to steel mills, and the steel mills themselves. Having control over all elements of the production process ensured the stability and quality of key inputs. By using vertical integration, Carnegie Steel achieved levels of efficiency never before seen in the steel industry.

When using vertical integration, firms get involved in different elements of the value chain. This concept gets top billing at American Apparel, a firm that describes its business model as “vertically integrated manufacturing.” The elements of their integrated process for designing, manufacturing, wholesaling, and selling basic T-shirts, underwear, leggings, dresses, and other clothing and accessories for men, women, children, and dogs is illustrated below.

| American Apparel Vertical Integration |

| Backward Vertical Integration — entering a supplier’s business—is evident as all clothing design is done in-house—often using employees as models. |

| Manufacturing is conducted in an 800,000 square foot factory in downtown Los Angeles. |

| Ironically, it was a Canadian named Dov Charney who founded American Apparel in 1989. |

| The vertical integration process allows the company to keep pace with the fast-moving world of fashion. It takes just a couple of weeks to go from idea to retail floor. |

| Forward Vertical Integration – American Apparel uses forward vertical integration—entering a buyer’s business—by operating 250 plus company-owned stores worldwide. |

Today, oil companies are among the most vertically integrated firms. Firms such as ExxonMobil and ConocoPhillips can be involved in all stages of the value chain, including crude oil exploration, drilling for oil, shipping oil to refineries, refining crude oil into products such as gasoline, distributing fuel to gas stations, and operating gas stations.

The risk of not being vertically integrated is illustrated by the 2010 Deepwater Horizon oil spill in the Gulf of Mexico. Although the US government held BP responsible for the disaster, BP cast at least some of the blame on drilling rig owner Transocean and two other suppliers: Halliburton Energy Services (which created the cement casing for the rig on the ocean floor) and Cameron International Corporation (which had sold Transocean blowout prevention equipment that failed to prevent the disaster). In April 2011, BP sued these three firms for what it viewed as their roles in the oil spill.

Vertical integration also creates risks. Venturing into new portions of the value chain can take a firm into very different businesses. A lumberyard that started building houses, for example, would find that the skills it developed in the lumber business have very limited value to home construction. Such a firm would be better off selling lumber to contractors.

Vertical integration can also create complacency. Consider, for example, a situation in which an aluminum company is purchased by a can company. People within the aluminum company may believe that they do not need to worry about doing a good job because the can company is guaranteed to use their products. Some companies try to avoid this problem by forcing their subsidiary to compete with outside suppliers, but this undermines the reason for purchasing the subsidiary in the first place.

Backward Vertical Integration

A backward vertical integration strategy involves a firm moving back along the value chain and entering a supplier’s business. Some firms use this strategy when executives are concerned that a supplier has too much power over their firms. In the early days of the automobile business, Ford Motor Company created subsidiaries that provided key inputs to vehicles such as rubber, glass, and metal. This approach ensured that Ford would not be hurt by suppliers holding out for higher prices or providing materials of inferior quality.

Although backward vertical integration is usually discussed within the context of manufacturing businesses, such as steel making and the auto industry, this strategy is also available to firms such as Disney that compete within the entertainment sector. ESPN is a key element of Disney’s operations within the television business. Rather than depend on outside production companies to provide talk shows and movies centered on sports, ESPN created its own production company. ESPN Films is a subsidiary of ESPN that was created in 2001. ESPN Films has created many of ESPN’s best-known programs, including Around the Horn and The Dance documentary. By owning its own production company, ESPN can ensure that it has a steady flow of programs that meet its needs.

Forward Vertical Integration

A forward vertical integration strategy involves a firm moving further down the value chain to enter a buyer’s business. Disney has pursued forward vertical integration by operating more than three hundred retail stores that sell merchandise based on Disney’s characters and movies. This allows Disney to capture profits that would otherwise be enjoyed by another store. Each time a Frozen book bag is sold through a Disney store, the firm makes a little more profit than it would if the same book bag were sold by a retailer such as Target.

Forward vertical integration also can be useful for neutralizing the effect of powerful buyers. Rental car agencies are able to insist on low prices for the vehicles they buy from automakers because they purchase thousands of cars. If one automaker stubbornly tries to charge high prices, a rental car agency can simply buy cars from a more accommodating automaker. It is perhaps not surprising that Ford purchased Hertz Corporation, the world’s biggest rental car agency, in 1994. This ensured that Hertz would not drive too hard of a bargain when buying Ford vehicles. By 2005, selling vehicles to rental car companies had become less important to Ford and Ford was struggling financially. The firm then reversed its forward vertical integration strategy by selling Hertz.

eBay’s purchase of PayPal and Apple’s creation of Apple Stores are two examples of forward vertical integration. Despite its enormous success, one concern for eBay is that many individuals avoid eBay because they are nervous about buying and selling goods online with strangers. PayPal addressed this problem by serving, in exchange for a fee, as an intermediary between online buyers and sellers. eBay’s acquisition of PayPal signaled to potential customers that their online transactions were completely safe—eBay was now not only the place where business took place but eBay also protected buyers and sellers from being ripped off.

Apple’s ownership of its own branded stores set the firm apart from computer makers such as Hewlett-Packard, Dell, and Lenovo that only distribute their products through retailers like Best Buy and Office Depot. Employees at Best Buy and Office Depot are likely to know only a little bit about each of the various brands their store carries. In contrast, Apple’s stores are popular in part because store employees are experts about Apple products. They can therefore provide customers with accurate and insightful advice about purchases and repairs. This is an important advantage that has been created through forward vertical integration.

Key Takeaways

- Diversification strategies involve a firm stepping beyond its existing industries and entering a new value chain. Generally, related diversification (entering a new industry that has important similarities with a firm’s existing industries) is wiser than unrelated diversification (entering a new industry that lacks such similarities). Geographic diversification is another strategy to drive synergy.

- A horizontal diversification strategy involves trying to compete successfully within a single industry.

- Mergers and acquisitions are popular moves for executing a concentration strategy, but executives need to be cautious about horizontal integration because the results are often poor.

- Vertical integration occurs when a firm gets involved in new portions of the value chain. By entering the domain of a supplier (backward vertical integration) or a buyer (forward vertical integration), executives can reduce or eliminate the leverage that the supplier or buyer has over the firm.

Exercises

- Studies have shown that executives’ pay increases when their firms get larger. What role, if any, do you think executive pay plays in diversification decisions? Is this an ethical issue?

- Identify a firm that has recently engaged in diversification. Search the firm’s website to identify executives’ rationale for diversifying. Do you find the reasoning to be convincing? Why or why not?

- Suppose the president of your college or university decided to merge with or acquire another school. What schools would be good candidates for this horizontal integration move? Would the move be a success?

- Given that so many mergers and acquisitions fail, why do you think that executives keep making horizontal integration moves?

- Identify a well-known company that does not use backward or forward vertical integration. Why do you believe that the firm’s executives have avoided these strategies?

- Some universities have used vertical integration by creating their own publishing companies. The Harvard Business Press is perhaps the best-known example. Are there other ways that a university might vertically integrate? If so, what benefits might this create?

References

Henry, D. (2002, October 14). Mergers: Why most big deals don’t pay off. Business Week, 60–70.

Lakelet Capital. (2009, June 15). Reasons why mergers & acquisitions fail and succeed.https://lakeletcapital.com/reasons-why-mergers-acquisitions-fail-and-succeed.

Porter, M. E. (1987). From competitive advantage to corporate strategy. Harvard Business Review, 65(3), 102–121. https://hbr.org/1987/05/from-competitive-advantage-to-corporate-strategy.

Prahalad, C. K., & Hamel, G. (1990). The core competencies of the corporation. Harvard Business Review, 86(1), 79–91. https://hbr.org/1990/05/the-core-competence-of-the-corporation.

Associated Press. (2011, March 21). Zippo’s burning ambition lies in retail expansion. The Daily Journal. www.smdailyjournal.com/business/zippo-s-burning-ambition-lies-in-retail-expansion/article_80c8ef2e-4495-5823-8e02-9bff74109b2f.html.

Wagenheim, J. (2011, March 12). UFC buys out Strikeforce in another step toward global domination. Sports Illustrated. https://www.si.com/more-sports/2011/03/13/strikeforce-purchased.

Image Credits

Figure 8.3: Kindred Grey (2020). “Estee Lauder brand and acquired companies.” CC BY NC SA 4.0. Image of perfume: Dhini van Heeren (2011). “Estee Lauder.” CC BY NC SA 2.0. Retrieved from: flic.kr/p/9y9KuY. Image of Compact: Kindred Grey (2020). Public Domain. Image of Lipstick: eleni koureas (2018). Public Domain. Retrieved from: https://unsplash.com/photos/iHlQwyDbpIQ Image of mascara: Heidi Uusitorppa (2015). CC BY NC ND 2.0. Retrieved from: https://flic.kr/p/qXE2HD. Adaptation of Figure 8.4 from Mastering Strategic Management (2015) (CC BY NC SA 4.0). Retrieved from https://open.lib.umn.edu/app/uploads/sites/11/2015/04/dc7b4d33bd5026e10056a657c971692a.jpg.

Figure 8.4: FancyPants. “Honda outboard motor on a pontoon boat.” Public Domain. Retrieved from https://en.Wikipedia.org/wiki/Honda#/media/File:Hondaoutboard.jpg.

Figure 8.5: Fred, David J. “Close-up of a lit 1968 slim model Zippo lighter.” CC BY-SA 2.5. Cropped. Retrieved from https://commons.wikimedia.org/wiki/File:Zippo-Slim-1968-Lit.jpg.

Figure 8.6: Hydropeek. “UFC POSTER-fire.” CC BY 2.0. Retrieved from flic.kr/p/7UzfdX.

Figure 8.7: Unknown author. “Platform supply vessels battle the blazing remnants of the off shore oil rig Deepwater Horizon.” Public Domain. Retrieved from en.Wikipedia.org/wiki/File:Deepwater_Horizon_offshore_drilling_unit_on_fire_2010.jpg.

Figure 8.8: Buron444. “1939 Ford Corporation ad for their V8 pick-up truck.” Public Domain. Retrieved from en.Wikipedia.org/wiki/File:Ford_1939.jpg.

Figure 8.9: Keiows, Laitr. “Parking lot at HAA Kobe.” CC BY 3.0. Retrieved from en.Wikipedia.org/wiki/Auto_auction#/media/File:Parking_lot_at_HAA_Kobe.jpg.