15.3: Launching Your Venture

- Page ID

- 50714

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)By the end of this section, you will be able to:

- Explain the importance of creating and discussing the vision statement

- Determine the documents necessary for managing risks

- Describe company culture and the purpose of a code of conduct

- Summarize how to outline and schedule the operational steps of the launch

The big day has arrived. Your opportunity recognition process noted that your idea solves a significant problem or need, you double-checked that the target market is large enough for potential profitability, you have a method to reach this target market, you have a passion to start this company, and you found resources to support the start-up. Knowing that you analyzed and addressed these topics, you now need to consider some of the more sensitive topics regarding the agreements within your team. Many entrepreneurs overlook the issues discussed here or act on them in a generic manner instead of fitting them to the specific needs of the venture. This lack of due diligence can be detrimental to the success of the business. The advice presented here can help you avoid those same mistakes.

To protect the interests of all parties involved at launch, the team should develop several important documents, such as a founders’ agreement, nondisclosure and noncompete forms, and a code of conduct. Before these are drafted, the team should ensure the venture’s vision statement is agreed upon. (See Entrepreneurial Vision and Goals for a discussion around creating a vision statement.) The entrepreneurship team needs to be in complete agreement on the vision of the venture before they can successfully create the founders’ agreement. If some team members have an interest in creating a lifestyle business (a venture that provides an income that replaces other types of employment), while other team members want to harvest the venture with significant returns, there is a clash between these expectations. An angel investor will also have a strong opinion on the vision for the venture.

Founder’s Agreement, Nondisclosure Agreement, and Noncompete Agreement

Honest and open discussions between the entrepreneurial team members, including your angel investor if an angel investor is part of your initial funding, must take place before opening the venture. These frank discussions need to include a founders’ agreement as well as the identified vision for the venture. The founders’ agreement should describe how individual contributions are valued and fit into the compensation plan and should consider and answer these questions:

- Will the entrepreneurial team members receive a monthly compensation?

- Is there a vesting plan with defined timelines aligned with equity percentages?

- What happens if a team member decides to leave the venture before an exit event? How will that team member be compensated, if at all?

Discussing the entrepreneurial team members’ expectations avoids the problem of an entrepreneurial team member expecting a large equity stake in the company for a short-term commitment to the venture, and other misguided expectations. Such problems can be avoided by addressing the following questions:

- What activities and responsibilities are expected from each team member, and what is the process or action when individual overstep their authority?

- Is there an evaluation period during which the team members discuss each other’s performance? If so, how is that discussion managed, and is there a formal process?

- What happens if a team member fails to deliver on expected actions, or if an unexpected life event occurs?

The founders’ agreement should also outline contingency plans if the business does not continue. The following questions help define those next steps and need to be answered prior to opening the venture:

- If the venture is unsuccessful, how will the dissolution of the venture be conducted?

- What happens to the assets, and how are the liabilities paid?

- How is the decision made to liquidate the venture?

- What happens to the originally identified opportunity? Does a team member have access to that idea, but with a different team, or implemented using a different business model?

Once the venture opens, discussing these topics becomes more complicated because the entrepreneurial team is immersed in various start-up activities, and new information affects their thoughts on these issues. Along with these topics, the founders’ agreement should also state the legal form of ownership, division of ownership (this refers to the division of equity at either the next round of financing, or harvesting of the company), as well as the buyout, or buyback clause. (See Entrepreneurial Journey and Pathways for a discussion on the life cycle stages of a venture, including end stages of harvesting, transition, and reincarnation of the business.)

The buyback clause addresses the situations in which a team member exits the venture prior to the next financing round or harvesting due to internal disputes with team members, illness, death, or other circumstances, clearly stating compensation and profit distribution (with consideration of what is reinvested into the venture). Discussing these topics provides agreement between all team members about how to address these types of situations. The buyback clause should also include a dispute resolution process with agreement on how the dispute solution is implemented. Identifying exactly how these items are handled within the founders’ agreement prevents future conflicts and even legal disputes.

If the entrepreneurship team includes an angel investor, the angel investor typically has the final say in these questions. In the best possible scenario, the angel investor has experience creating a founders’ agreement and can provide valuable insights into working through this document. One common approach to creating this document, given the angel investor’s available time, is for the entrepreneurship team to discuss and agree on the final document, then have the angel investor review the document for final approval. Making Difficult Business Decisions in Response to Challenges will help in finalizing your founders’ agreement.

After completing the formal vision statement and the founders’ agreement, you might want to have an attorney evaluate the documents. This checkpoint can identify gaps or decisions that were not stated clearly. After receiving the examined documents back, the team should once again review the documents for agreement. If everyone is satisfied with the documents, each entrepreneurship team member should sign the document and receive a copy. If, later, the entrepreneurship team decides a change needs to be made to either the vision statement or the founders’ agreement, an addendum can be created, again with all parties agreeing to any changes.

Two other formal documents your team might want to consider include a nondisclosure agreement and a noncompete agreement. These documents can be applied to all employees, including the startup team, with consideration of extending to other contributors such as contractual personnel. A nondisclosure agreement agrees to refrain from disclosing information about the venture. Topics that might be included in this document include trade secrets, key accounts, or any other information of high value to the venture or potentially useful to a competitor. A noncompete agreement states that the person signing the agreement will not work for a competing organization while working for the venture, and generally for a set length of time after leaving the venture. Often, this time period is one year, but it can be longer depending on the know-how or intellectual property the exiting team member has.

Company Culture and Code of Conduct

In conjunction with these formal documents, the founding team should determine the culture they would like to build for their venture. Ideally, the organization’s company culture is made up of the behaviors and beliefs that support the success of the organization. For example, when you walk into a business, is there a bustle of noise and activity, or is the business calm and restrained? This impression results from the organization’s culture. We could compare the difference between walking into a high-end jewelry store and walking into a fast food restaurant. Both businesses have distinctly different cultures. If the venture is highly dynamic with fast-paced decisions and constant change, then the culture should support this type of venture. Perhaps the team wants to create a work hard, play hard culture. In that case, standards that support ad hoc team creation for impromptu discussions should be encouraged, rather than setting up a bureaucratic culture that requires approval of all meetings and deliberation of decisions prior to action. Many tech companies support a work hard, play hard culture. This culture is reinforced with open office spaces that provide opportunities to collaborate with colleagues. Or perhaps ping pong tables and kitchens are provided to encourage interaction. Even the hours of operation contribute to culture creation by either encouraging employees to set their own hours or restricting work hours through regulated entry. In contrast, a more bureaucratically structured environment may fit a venture whose success relies upon compliance with external regulations and the use of highly sensitive or private information. An example of a bureaucratic culture aligns with many financial institutions. The culture within a bank conveys security of our deposited funds; we want a bank to have processes and systems in place that reinforce that we can trust the bank with our finances.

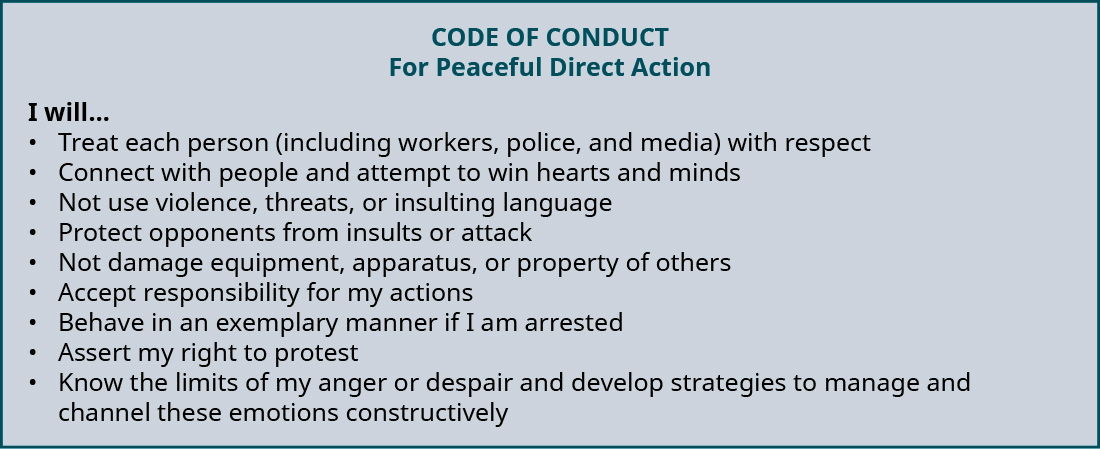

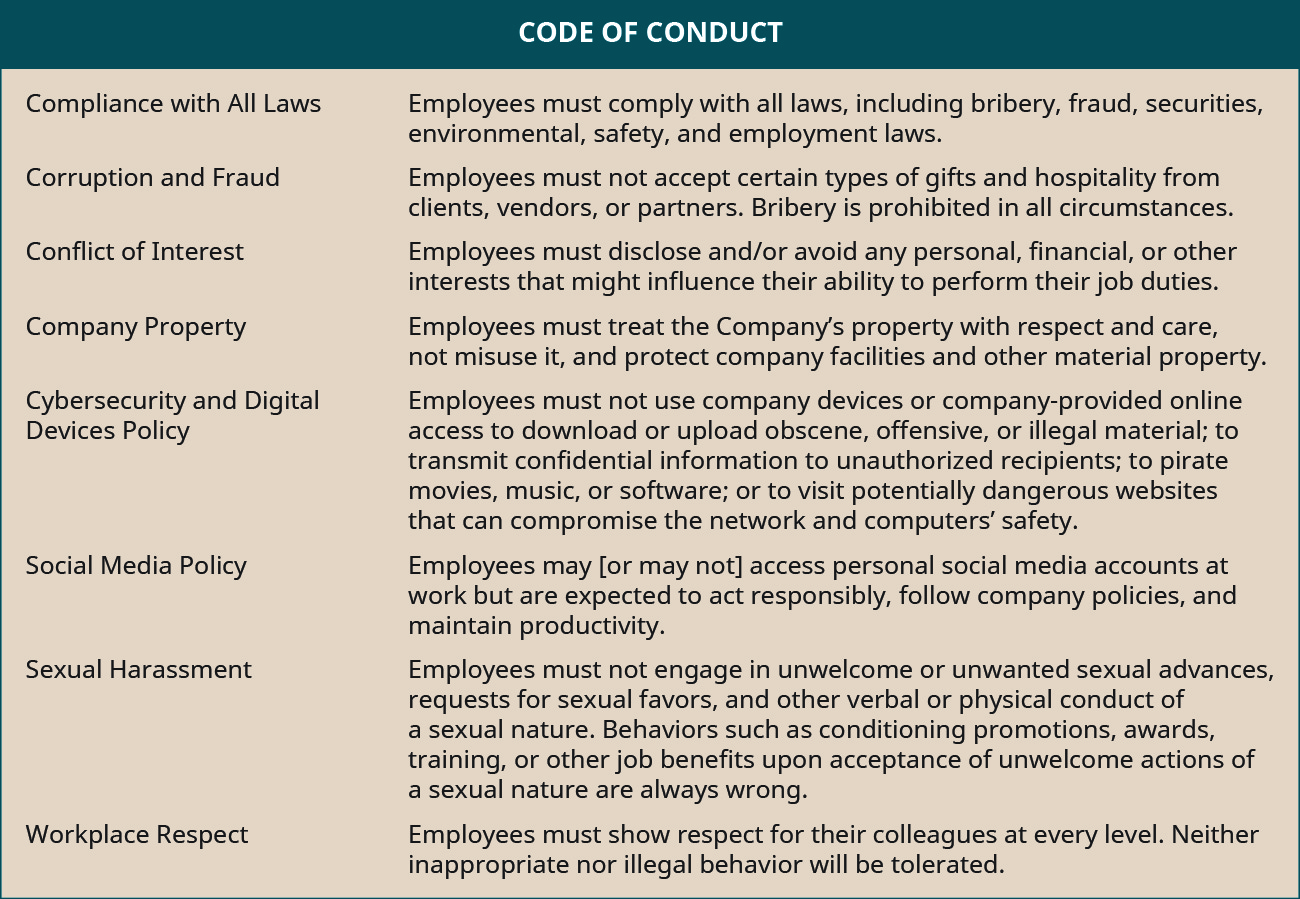

The culture-defining process should include the entrepreneurship team’s creation of a code of conduct. Some organizations develop a code of conduct that includes guiding principles, while other organizations create detailed descriptions of what is acceptable and what isn’t acceptable. Your venture’s code of conduct should fit with your venture’s vision, the culture desired, and the entrepreneurship team’s values. Codes of conduct should be created as documents that include a sensitivity to people within the company as well as the greater community. A code of conduct addresses the values that the organization supports, as well as ethical considerations. The purpose of a code of conduct is to help guide employee actions to align with the desired behavior. Including uniquely specific examples that align with the specific venture, can further communicate the desired behaviors. There are many varieties of codes of conduct; the main point is to create a code that supports the values and behaviors that you want to advance throughout your organization. Figure 15.2 and Figure 15.3 show two approaches to developing a code of conduct that fits the company’s culture and vision. The first example might be used by an advocacy-based venture that desires a principle-based approach to guiding employee behaviors through a code of conduct that provides general guidelines, rather than a more rule-based approach as presented in the second example. These two examples highlight the importance of creating a code of conduct that fits the beliefs and culture that you want to encourage within your venture.

Earlier, we discussed the importance of the lead entrepreneur taking the initiative to discover the investor’s business knowledge and learning about the investor’s previous experience in funding an entrepreneurial venture. The code of conduct is another area that entrepreneurial teams frequently skip over by accepting a generic code of conduct rather than recognizing that there are a multitude of topics, phrases, and principles that should be uniquely designed to fit the venture. These two examples demonstrate the vastly different topics addressed within a code of conduct as evidence for why your code of conduct must fit your intentions for how you will conduct business and support the success of your venture.

These preparatory documents should be personalized to align with the entrepreneurial team and desired behaviors that support the success of the venture. Although standard language and forms addressing these topics are available online, these generic models aren’t intended to meet your unique venture’s needs or the entrepreneurial team’s needs. Taking the time to discuss and prepare these documents pays off in well-crafted documents and aligns the entrepreneurship teams’ vision, goals, and dreams for their venture.

Google’s code of conduct

Review Google’s code of conduct as you think about developing your own code of conduct. What do you like about Google’s code of conduct? What would you change? How does this example help you in creating a code of conduct for your venture?

Operational Steps to Launch

The next action is outlining the operational steps in the venture creation process. A good approach is to create a chart that identifies how you should proceed. The goal in creating this chart is to recognize what actions need to be taken first. For example, if you need a convection oven for your business, what is the timeline between ordering and receiving the oven? If you need ten employees to manually prepare and package your product, how long will it take to interview and hire each person? According to Glassdoor, the hiring process took 23 days in 2014 and appears to be lengthening in time as organizations become more aware of the importance of hiring the right person.2 What about training? Will your employees need training on your product or processes before starting the venture? These necessary outcomes need to be identified and then tracked backwards from the desired start date to include the preparatory actions that support the success of the business. You’ve probably heard the phrase that timing is everything. Not only do entrepreneurs need to be concerned about finding the right time to start the venture, they also need the right timing to orchestrate the start-up of the venture.

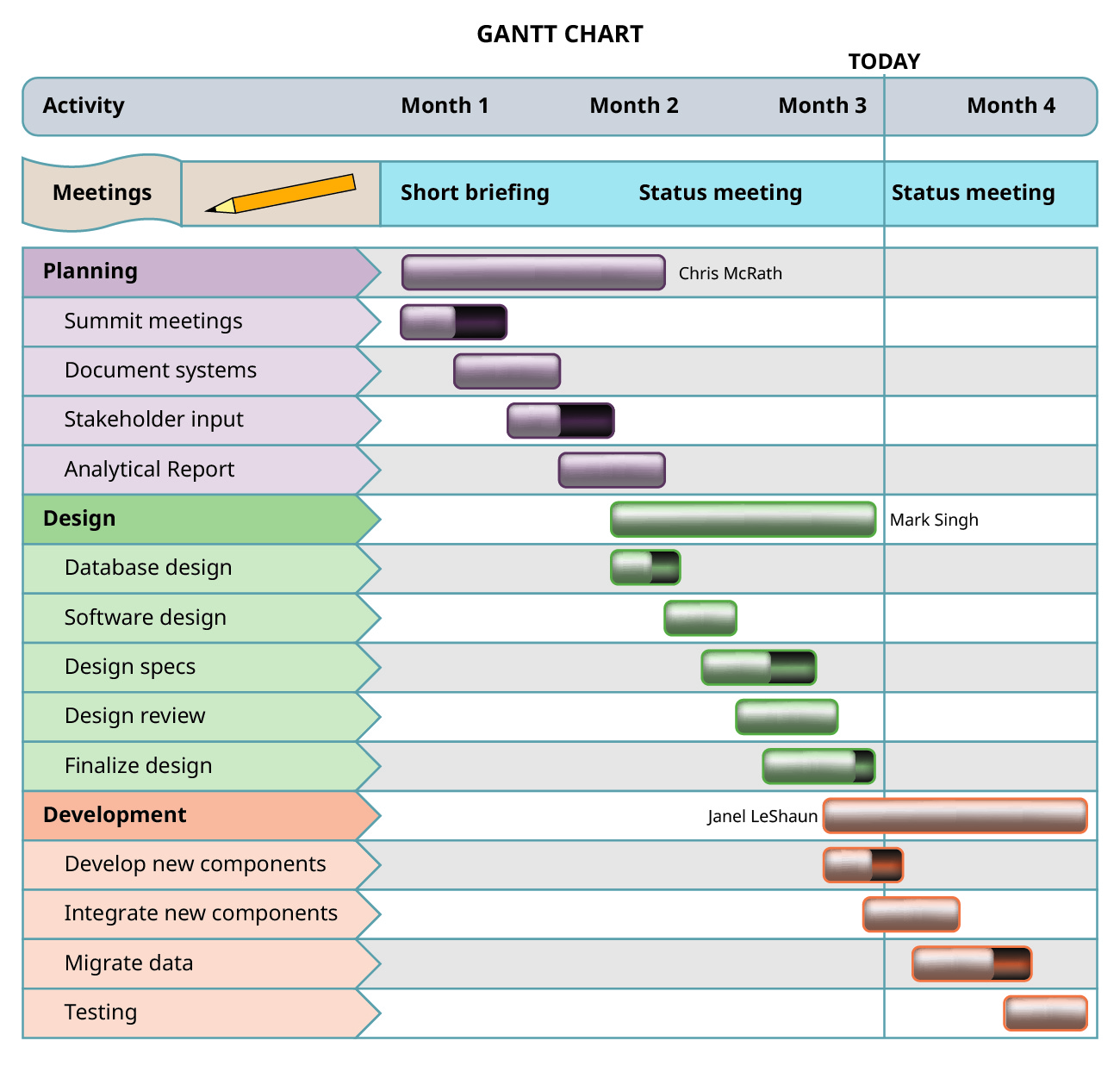

Below is a sample Gantt chart, a method to track a list of tasks or activities aligned with time intervals. You can use this tool to help identify and schedule the operational steps that need to be completed to launch the venture. One approach to creating a Gantt chart is for each team member to independently create a list of operational activities or tasks required to start the venture that fall under their area of involvement. Then the team can create a master list of activities to discuss: This helps clarify who is contributing to or owning each task. Next, have all team members create their own Gantt chart based on their task list: That is, the time required for each task should be spelled out, including steps that must happen sequentially (when one task cannot be started until another step is complete). Once again, bring all team members together to create one master Gantt chart. This will help ensure that dependencies from member to member are accounted for in the planning. These contingencies and dependencies need to be identified and accommodated for in the master schedule. For example, in Figure 15.4, we see that Mike Smith cannot perform system testing until Sam Watson has developed the system modules, and in turn, that task can’t be done until Mike Smith has documented the current systems. After completing the chart, agree on assignments of responsibility to follow through on the activities, based on the timelines from the Gantt chart.

See the Suggested Resources for more information on how to use a Gantt chart to assist in tracking the actions needed to support the start-up of your venture and to organize each action based on your necessary timelines. You might want to reach out to other sources to find examples of how other entrepreneurs worked through their operational start-up steps.

This TED Talk features Paul Tasner sharing how he found himself changing his career at the age of 66, reinforcing the idea that the world of entrepreneurship is open to all people regardless of age, race, background, health, or geographic location. In this presentation, he references a variety of activities he needed to experience in order to understand the process of starting his venture. Regardless of what we learned in our past experiences, launching a new venture includes new experiences and decisions.

After watching this video, do you have some ideas regarding starting a new venture around the idea of senior entrepreneurs? How could you support this group or build a network that creates a community of support for this large population?

Launch Considerations

Sage advice in launching the new venture is to quickly recognize when you don’t have the answer or information to make the best decisions. In the early stage of launching the venture, the level of uncertainty is high, as is the need for agility and spontaneity. Even identifying the actual moment when the venture becomes a new venture can be difficult to determine. Should the venture be recognized as a new venture after receiving the necessary licenses or tax identification number, or when the first sale occurs, or when funds are first invested, or by some other method?

It is also important to keep in mind the end goal of the venture, often referred to as "begin with the end in mind." For example, many highly successful ventures never earn a dollar in sales. Depending on the entrepreneurial team’s vision and the business model selected, the venture could be highly valuable from a harvest, or sale of the venture, perspective. Frequently, this decision is dictated by the angel investor. These people frequently started their own venture, harvested the venture, and as a result have funds available to invest in other new ventures. In most cases, the angel investor expects to cash out of the venture at some point in the future. These are investors who are not interested in holding a long-term equity position but rather expect to grow the venture into a position where another company buys out the venture. This buyout is also known as the harvesting of the venture and the point at which the angel investor receives a percentage of the harvested dollar sale to cover the equity stake in the new venture. Because of this pattern, entrepreneurs are often advised to “begin with the end in mind” when launching a new venture. If the goal is to sell the venture to another company, we want to identify that company before launching the venture. Of course, at this point, this is only a desire or hope, as you cannot require or expect another company to have an interest in your new venture. But you can design the new venture to align with this end goal by making decisions that support this end goal.

Consider the example of YouTube, a startup with zero dollars in sales but with a harvest price of $1.65 billion in stock from Google. The startup team, former PayPal colleagues, understood that the technology was being developed for video searching and recognized that creating a platform to house video-sharing would be desired by companies such as Google at some point in the future. Consider the tight timeline between 2005 when YouTube began supporting video sharing, and the harvest of YouTube to Google in 2006, 21 months later. This example clearly points to the importance of beginning with the end in mind.

A New Greeting Card Concept

Is there a connection between ship architecture and greeting cards? Most people would quickly say there isn’t any connection between these two disparate ideas. However, Wombi Rose and John Wise studied ship architecture, with Wise moving on to a boat-building start-up in Louisiana when they reconnected and decided to start a new venture. While traveling in Vietnam, the two ship architects came across the paper-cutting process of kirigami, similar to origami, but rather than folding paper, the paper is cut. The two engineers realized that the same design software used in building ships could also be used in creating these three-dimensional paper objects. Despite the declining greeting card industry’s sales, these two entrepreneurs decided to enter the greeting card industry with a new approach to greeting cards. Pop-up kirigami art folds flat until the envelope opens, and a kirigami object pops up. Lovepop, the name of their greeting card line, has grown to 30 employees and $6.7 million in revenue.3

What evidence is there that Rose and Wise followed the concept of “begin with the end in mind”? If Rose and Wise followed this advice, and you were a part of this team, at what point would you begin seeking a buyer for this company? What milestones might you select for harvesting the company? Consider what actions you would accomplish to increase the sale amount to the maximum amount.

Launching your venture is a unique experience for every entrepreneurial team and for every venture. These novel situations and uncertainties create both challenges and new learning opportunities. Accepting that a multitude of possibilities exists and recognizing the importance of researching and discussing actions are valuable to the success of the team. Angel investors hold a wealth of knowledge, and with an equity stake in the venture, these investors should be included in all discussions. If you have an angel investor on your team, you have an added advantage to tap into the expertise available to support the venture. In conjunction with a well-aligned angel investor, conducting research to explore decisions will improve your venture’s success. Although these decisions might seem difficult, the next section addresses how to approach difficult decisions and the role emotional connections for the venture and its team play in those decisions.