13.2: Corporations

- Page ID

- 50701

By the end of this section, you will be able to:

- Distinguish between C Corporations, S Corporations, and B Corporations

- Distinguish between privately and publicly held corporations

- Explain how corporations are taxed

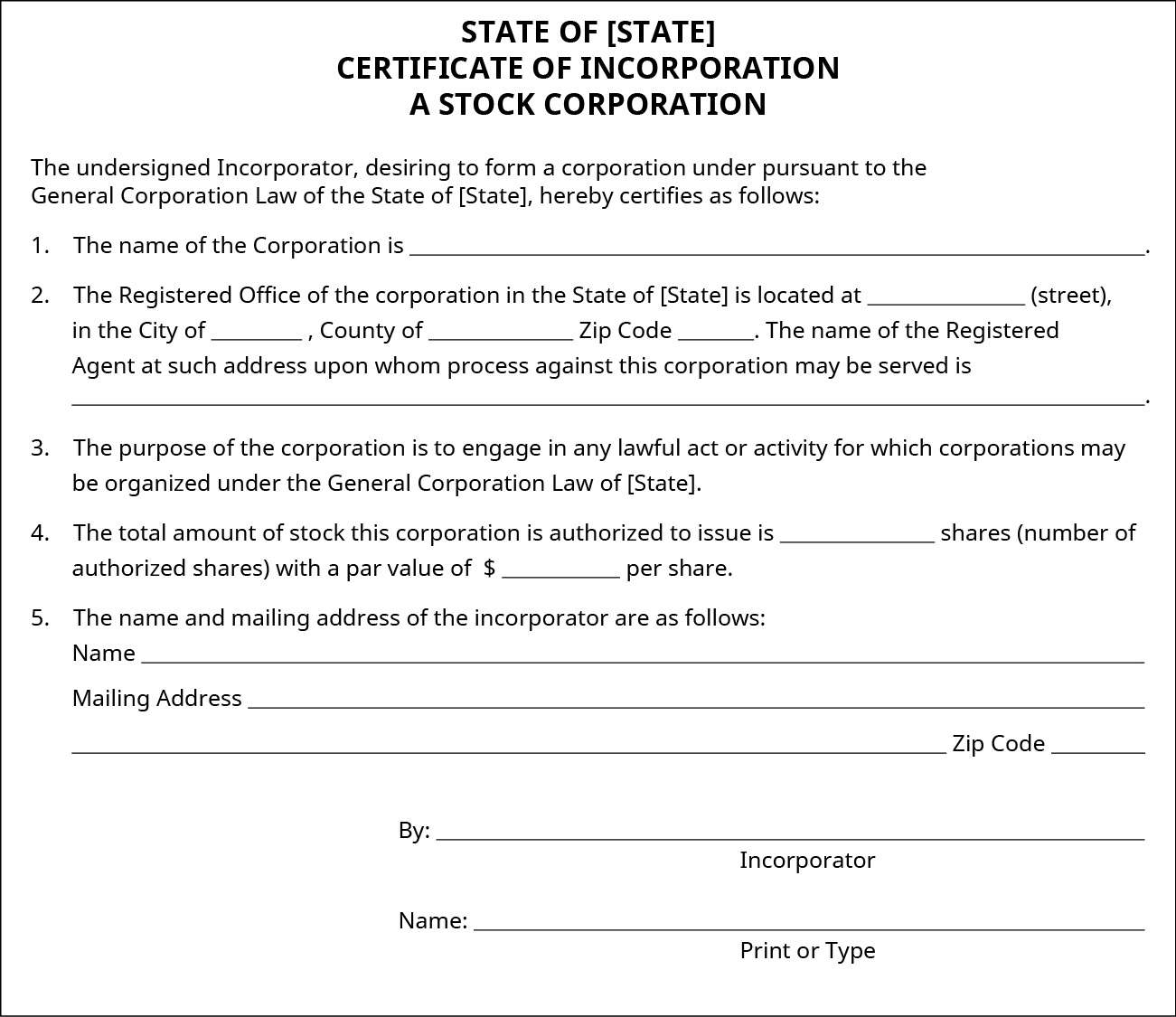

A corporation is a complex business structure created by filing the appropriate documents with the state of incorporation (Figure 13.4). They are created when the original incorporators (owners) file a formal document called the articles of incorporation, or other similar documentation, with a state agency, often the secretary of state’s office or the state division of corporations. Corporations operate as a separate legal entity apart from the owners. The owners are called shareholders and can be individuals, other domestic or foreign corporations, LLCs, partnerships, and other legal entities. Corporations may be for-profit or not-for-profit, as discussed previously.

Incorporating a company means that the corporation operates as an entity that has some of the same rights as an individual. For example, individuals and corporations can sue and be sued, and corporations have the rights to own property, to enter into and enforce contracts, to make charitable and political donations, to borrow and lend money, and to operate a business as if the corporation were an individual. Most states require a corporation to be registered in that state in order to conduct business operations and to enter into and defend lawsuits in that state, especially if the business was incorporated in a different state. Registration is not the same as forming the initial corporation; it is simply the process of filing informational documents by entities that have already been incorporated in another state. States also tax the operations or sales a corporation makes in the state in which it has certain operations.

Overview of Corporations

Corporations are the only type of entity that the law allows to sell shares of stock. No other entity, like an LLC or a partnership, may do so. Those individuals or other entities that buy stock become shareholders and own the corporation. Some corporations have millions of shareholders, and others have as few as one. State incorporation laws vary: Some require at least three shareholders, but others allow a one-owner business to incorporate. Thus, an entrepreneur may start a company as the sole owner of the company and later incorporate and sell shares of stock or bonds to other investors in the company.

Corporations sell, or issue, stock to raise capital, or money, to operate their businesses. The holder of a share of stock (a shareholder) purchases a piece of the corporation and has a claim to a part of its assets and earnings. In other words, a shareholder is now an owner of the corporation. Thus, a share of stock (also called equity) is a type of security that signifies proportionate ownership in the issuing corporation. Stocks are bought and sold predominantly on stock exchanges, although there can also be a private sale between a seller and a buyer. These transactions have to conform to a very complex set of laws and government regulations (e.g., the Federal Securities Acts of 1933/34), which are meant to protect investors.

Use of a corporation allows the entrepreneur to shield themselves, and other owners, from personal liability for most legal and financial obligations. The benefit of limited liability is one of the primary reasons entrepreneurs incorporate. However, the administration of a corporation requires more formality than other types of entities, such as sole proprietorships and partnerships. A corporation must follow the rules for such entities. The requirements include maintaining bylaws, holding annual shareholder and director meetings, keeping minutes of shareholder and director major decisions, ensuring that officers and directors sign documents in the name of the corporation, and importantly, maintain separate bank accounts from their owners and keep detailed financial and corporate records. A failure to follow the rules could lead to the loss of limited liability, known as “piercing the corporate veil.”

Piercing the Corporate Veil of Limited Liability

As we have discussed, entrepreneurs should generally form a separate legal entity to limit personal liability arising from business obligations, such as contracts. Incorporating or organizing as an LLC can limit owners’ personal liability to the extent of their investments. This liability shield is not without exception, however: in particular, a situation called “piercing the corporate veil.” A recent 2018 case example (Woodruff Construction, LLC v. Clark, No. 17-1422 [Iowa Ct. App. Aug. 15, 2018]) demonstrates this point.

Factual Overview: The defendant was the sole owner of a corporation and entered into a contract to remove sludge for the plaintiff at a waste treatment facility. The defendant never completed the work. The plaintiff sued and won a $400,000 judgment against the corporation for breach of contract. However, the plaintiff was not able to collect from the corporation due to insufficient assets. The plaintiff then asked the court to pierce the veil of the corporation, which would allow recovery from the corporate owner’s personal finances.

Piercing the Veil: Evidence showed that although the defendant kept a separate bank account for the corporation, he had commingled its funds with his personal finances, which is a distinct violation of fiduciary duty. He used the bank accounts for the corporation interchangeably with other bank accounts. Furthermore, the defendant did not follow required corporate formalities because he had no bylaws or resolutions, no voting records, and no documentation of or minutes from shareholder meetings.

Finding: The court allowed the plaintiff to pierce the corporate veil. This means that the defendant, the sole owner of the corporation, had to pay over $400,000 out of his personal funds. (Note: Although it is true that LLCs have fewer formal requirements, this case would likely have had the same result if the owner were an LLC because the rules are essentially the same for piercing the veil of limited liability.)

Critical Thinking:

- How can you protect yourself from this happening to you?

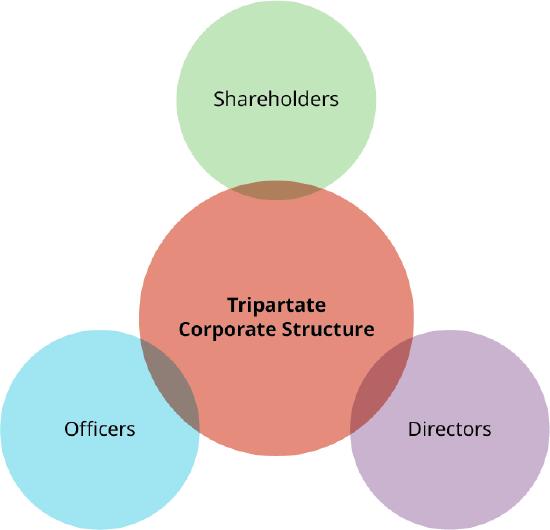

Most corporations use a three-part (or tripartite) approach to ownership and management (Figure 13.5). After the corporation is created and operations start, the shareholders typically elect a board of directors, and the board has oversight responsibilities for the operations of the company. The board then appoints officers who are responsible for the day-to-day operations of the corporation.

For small organizations, state law allows shareholders to directly manage a company without using a board of directors. This type of corporation is a closed corporation or a closely held corporation, and is common for entrepreneurial startups. State incorporation law, coupled with federal tax law under the IRS, regulates the formation and operation of a closely held corporation. The basic rules state that, generally, a closely held corporation is a corporation that has more than 50 percent of the value of its outstanding stock owned (directly or indirectly) by five or fewer individuals at any time during the last half of the tax year.3

C Corporations, S Corporations, and B Corporations

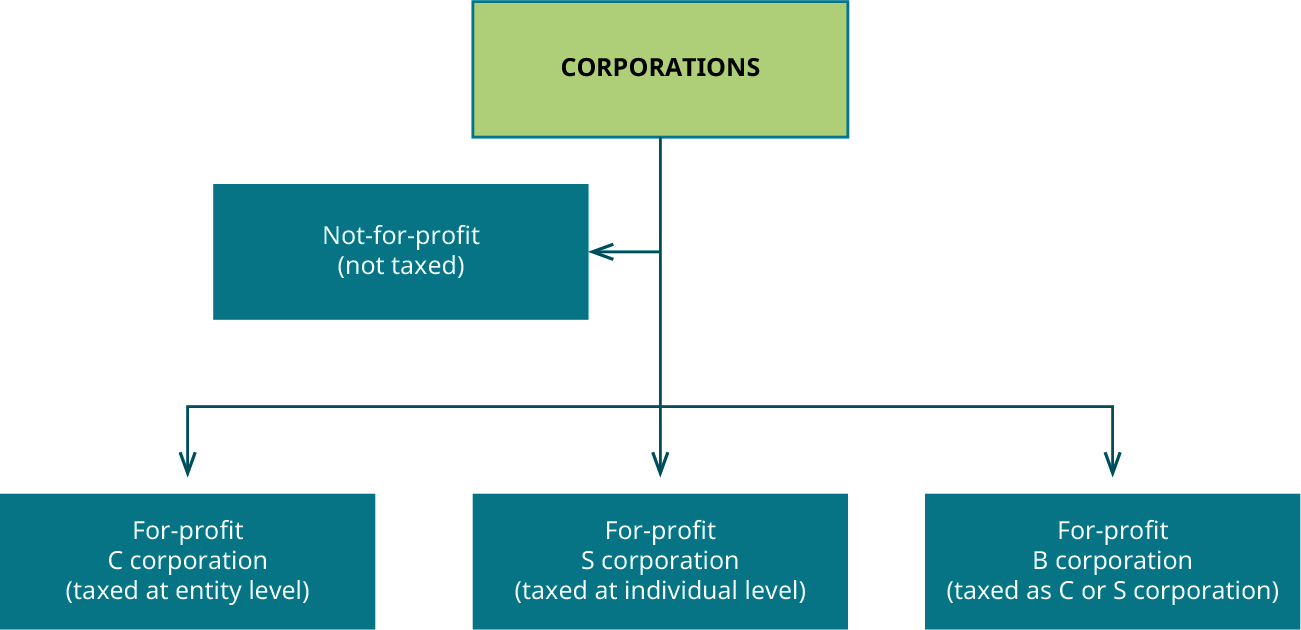

The categorization of corporations as either C corporations or S corporations is largely a tax distinction. An S corporation is a “pass-through” entity, where shareholders report and claim the business’s profits as their own and pay personal income taxes on it. Alternatively, the government taxes a C corporation at the corporate level, and then levies taxes again on the owners’ personal income tax returns if corporate income is distributed to the shareholders as dividends.

Conversely, the distinction between B corporations and C or S corporations is not one based on taxes at all, but rather on purpose and approach. A certified B corporation is a business that meets a very high standard of social and environmental performance, public transparency, and accountability to balance profit with social purpose. B corporations can also be C corporations or S corporations. Figure 13.6 summarizes these types of corporations.

The Unique Nature of B Corporations and/or Benefit Corporations

A new form of nontraditional, for-profit corporation is the benefit corporation, which may or may not also be a B corporation. While B corporations and benefit corporations share some common goals, B corporations go through a certification process. Becoming a certified B corporation is a formal process that involves compliance with various standards and an audit of this compliance (managed by the B corporation organization).4 The essence of these new B corporations is that “they recognize the imperative to do no harm and create positive impact throughout the value chain.”5 According to the B corporation organization, these certified businesses are legally required to consider the impact of their decisions on their workers, customers, suppliers, community, and the environment. As of 2019, there are approximately 3,000 certified B corporations in sixty-five countries, covering 150 different industries.6 The B corporation certification is somewhat like a seal of approval for businesses voluntarily trying to be socially responsible. A benefit corporation is a corporation recognized by a governmental agency under state law (about thirty states now recognize benefit corporations with legal requirements of higher purpose, accountability, and transparency) but does not carry the certification of a B corporation. However, in terms of purpose as related to corporate social responsibility, the two entities are very similar.

The benefit corporation’s objective is directed toward maximization of benefits for all stakeholders, meaning that the company benefits any person with an interest or concern in the business. It does not only maximize stockholder profits. Maximization of stakeholder benefits is directed through the corporate charter of a benefit corporation. The state of incorporation directs how benefit corporations are created, but generally, this “new governance model broadens the perspective of traditional corporate law by incorporating concepts of purpose, accountability, and transparency with respect to all corporate stakeholders, not just stockholders.”7 This means that the use of this type of business structure needs to be carefully considered by the entrepreneur because the responsibility of the business will include consideration of the stakeholders outlined in the corporate charter, not just the profit maximization for the shareholders.

B Corporation Certification

The B corporation website explains the process for becoming a B corporation. This involves three specific steps: Verified Performance, Legal Accountability, and Public Transparency. Go to https://bcorporation.net/about-b-corps and read about B corporations to learn what requirements they need to meet to be allowed to display the following B corporation logo shown in Figure 13.7.

Privately Held versus Publicly Held Corporations

Terminology relating to whether a company is publicly or privately owned can sometimes be confusing. For example, large corporations such as Exxon or Amazon are private corporations, but their stock is publicly held. This means that any member of the investing public can own stock in the corporation. A true public corporation is, in reality, a quasi-governmental entity, an entity owned or sponsored by the government. Government-owned corporations include the US Postal Service, the Corporation for Public Broadcasting, AmeriCorps, and Amtrak. Government-sponsored corporations include Freddie Mac and Fannie Mae, mortgage-related entities. A privately held corporation, common in Europe, is a company that does not allow members of the investing public to own stock. The founder’s family or friends, or perhaps a private group of investors such as a venture capital firm, may hold it. Examples include Facebook before it went public in 2012, or Cargill or Mars.

Publicly Traded Corporations

A publicly held corporation is, as described, an entity in which members of the investing public own the stock. A term commonly applied to such corporations is a publicly traded corporation, meaning that the stock can be bought and sold in the public marketplace, such as the New York Stock Exchange. A publicly traded corporation has more access to investors and thus more capital, but it must operate under a formal set of rules established by the Securities and Exchange Commission and Congress, assuming the shares are sold publicly in the United States. Audits of publicly traded companies also have to follow the rules of the Public Company Accounting Oversight Board (PCAOB). “The PCAOB oversees the audits of public companies and broker-dealers in order to protect investors and the public interest by promoting informative, accurate, and independent audit reports.”8 Following the SEC and PCAOB rules emphasizes investor protection but can be complex, as it increases both startup and operating costs for the venture due to increased regulation and reporting.

A publicly traded company is required to have a board of directors with a dual mandate to both consult with management regarding the strategic direction of the company and oversee company performance. The board of directors does not manage the company, and the members are separate from management.9 The board will have numerous committees to assist in its functionality, and one of the committees is the audit committee. The audit committee of a publicly traded company must hire an outside auditor approved by the PCAOB to audit the books of the publicly traded company. Further, the chief executive office and chief financial officer of the publicly traded company must sign a certification of earnings report, guaranteeing their truthfulness. The rules and regulations with which compliance is required are more demanding for a publicly traded company than for a privately held or closely held company.

Closely Held Corporations

A closely held corporation, also known as a close corporation, is the same as a privately held corporation for the purposes of securities laws. However, the concept has a secondary meaning related to management structure. A close corporation is also a management structure for a corporation that is often selected by small companies that use the less-formal management style of a general partnership yet retain the limited liability of a corporation. In essence, there are fewer formalities for a close corporation, and it allows greater control for the small group of shareholders.

A close corporation is required to have an annual shareholder meeting and keep corporate minutes. All of this detail is required to be recorded in the corporate records, even if there is just one shareholder. Sole proprietors using a corporation as a business structure must follow the rules regarding corporations in the state in which they were incorporated. Some states may even dissolve a corporation that does not have an annual meeting or keep proper corporate records. When a corporation is dissolved, the shareholders become personally liable for corporate debts, and shareholders’ limited liability is lost. Managing a closely held company requires the entrepreneur to follow state guidelines while operating the corporation accordingly.

The shares of a closely held corporation are not traded on the open market and typically have just a few shareholders. Closely held corporations have fewer reporting requirements than publicly traded companies and typically are not required to have audited financial statements, unless the corporate charter says otherwise. Audited financial statements are costly and are required for publicly traded companies. The audited financial statements help investors buying and selling stock in the stock market value shares and are not necessarily needed for a closely held corporation. However, it is difficult to value a closely held corporation because there is no ready market for the ownership shares.

Not-for-Profit Corporations

Nonprofit corporations are created in one a state but may operate or solicit donations in other states. A nonprofit corporation operating or soliciting donations in multiple states needs to register to operate as a nonprofit corporation in every state in which it operates.

Not-for-profit corporations are organized in a similar fashion to for-profit corporations, with a board of directors and officers, but they have no shareholders, stock, or owners. The stakeholders of a non-for-profit corporation play an important role, monitoring overhead and allocation of funds. Since most of the funds are donations and are tax deductible, public watchdogs may monitor the financial statements of federally tax-exempt organizations. The fact that the Internet provides easy access to financial data related to federally tax-exempt nonprofits provides watchdog organizations easy access to financial data and the ability to analyze the operations and compensation for the nonprofit’s organizers and employees.

Bombas: Achieving Profit and Nonprofit Goals

In a 2017 interview with Robin Roberts of ABC News, Bombas socks (Figure 13.8) co-founder David Heath said: “Back in 2011, I came across a quote on Facebook that said…that socks were the number one most requested clothing item in homeless shelters.”10 So he decided to start a new company that was an overnight success, boosted by an appearance on Shark Tank in 2014. He created his company, Bombas, with co-founding entrepreneur Randy Goldberg. They founded their company with the goal of giving back to the community by donating socks to the homeless, with its actual product idea as a secondary goal.11 They have donated over 25 million items through more than 2,500 partners across the country.12

Bombas is now a successful sock company that uses a business entity as a way to address the shortage of sock donations in homeless shelters. Heath and Goldberg spent two years inventing pairs of high-quality socks with extras such as reinforced foot beds and anti-blister tabs, coupled with contoured seaming. For these entrepreneurs though, it was not just about sock technology, it was about doing something meaningful at the same time—a combination of profit and nonprofit goals. Therefore, they made a commitment to those in need, and since 2013, the company has donated more than 10 million pairs of socks to homeless shelters, due to their buy one, give one model of marketing socks.

The socks that Bombas donates to the homeless are not cheap throw-away token socks. Rather, they have been designed for their homeless wearers, for example, with antimicrobial treatment to prevent bacteria if they cannot be washed as frequently and reinforced seams for durability, since the homeless do not have the money to keep buying new ones.13

In essence, the company makes customers, and the company partners with the homeless.

- Is Bombas really paying for this project to help the homeless or is the customer?

- Is Bombas just facilitating the good idea and customers are paying for it, or do you think Bombas is also contributing some of its profit?

Go to the Bombas website to watch the video that explains what they do as part of their B corporation commitment.

Overview of Corporate Taxation

All for-profit corporations are subject to income tax at the federal level, and usually at the state level as well. Regardless of tax elections, both C- and S corporations are subject to taxation.

Tax planning is a major issue for most corporations and may explain some key decisions, such as where they are located. That could involve decisions about which state the corporate headquarters are in, or even in which nation the headquarters are located. This is because tax laws may vary significantly by both state and nation.

The current federal income tax rate for corporations in 2019 is 21 percent, down drastically from 35 percent, which was the rate prior to 2018. Many states add a state-level income tax, ranging from 2 percent to 12 percent, while some states such as Texas do not have a corporate income tax in an effort to attract corporations to the state.14

Taxation of C Corporations

C corporations pay corporate income taxes on profits made. Individual shareholders are also subject to personal income taxes on any dividends they receive. Most attorneys and accountants refer to this concept as the double taxation disadvantage. However, the historical tax disadvantage has been recently reduced because of the decrease in the income tax rate paid by C corporations by the Tax Cuts and Jobs Act.15 This decrease, in turn, reduces the double tax disadvantage. Further, the ability to retain and reinvest profits in the company at a lower corporate tax rate is an advantage.

A C corporation does come with a degree of added formality, or as some may refer to it, red tape. According to most states’ corporation laws, as well as federal tax and securities laws, the corporation must have company bylaws and must file annual reports, financial disclosure reports, and financial statements. They must hold at least one meeting each year for shareholders and directors where minutes are taken and maintained to display transparency. A C corporation must also keep voting records of the company’s directors and a list of the owners’ names and ownership percentages.

Despite the tax implications, the C corporation structure is the only one that makes sense for most large US businesses because it allows for the wide-scale sale of a large amount of stock to the general investing public without limits. A C corporation can have an unlimited number of shareholders that are individuals or other business entities, and are either US citizens or foreign nationals.

Taxation of S Corporations

As previously discussed, the S corporation is a corporate entity in which the firm’s profit is passed through its stockholders (shareholders), usually in proportion to their investment—this is known as pass-through taxation. Essentially, this amounts to tax management by the corporate owners. The IRS taxes the corporate profits at the personal income tax rates of the individual shareholders. S corporations (S stands for “small”), also called subchapter S corporations, must comply with several important restrictions with which entrepreneurs must comply.

S corporations have a limit on shareholders. Unlike with C corporations, the Internal Revenue Code limits the number of S corporation shareholders to 100 or fewer, and owners can only be individuals, (or estates and certain types of tax-exempt entities). Additionally, the individual shareholders must also be US citizens or legal permanent residents. Furthermore, S corporations may only have one class of stock, whereas C corporations may have multiple classes. For example, in a C corporation, there might be voting shares, nonvoting shares, common shares (the type most people buy), and preferred shares (which are repaid first in the event of bankruptcy).