11.3: Conducting a Feasibility Analysis

- Page ID

- 50688

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

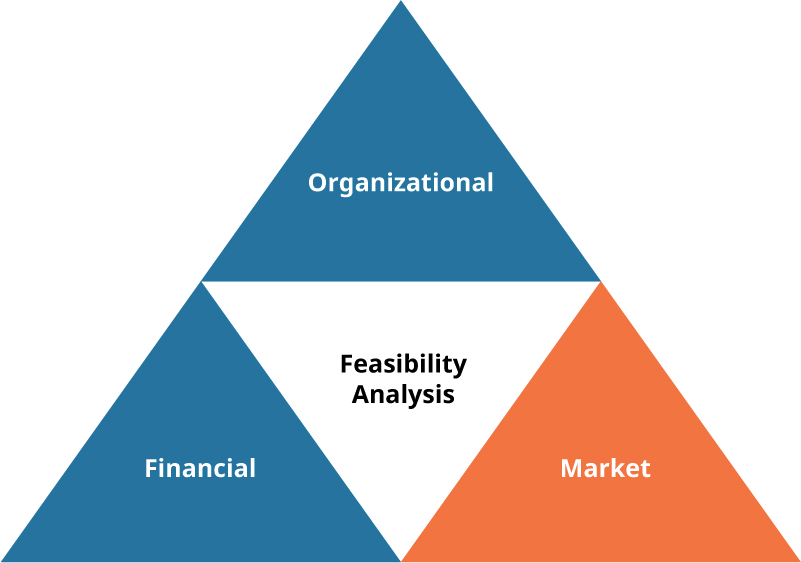

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12. The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned.47

Financial Feasibility Analysis

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13.

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

T×A=ST×A=S

Target(ed) Customers/Users×Average Revenue per Customer=Sales ProjectionTarget(ed) Customers/Users×Average Revenue per Customer=Sales Projection

Another critical part of planning for new business owners is to understand the breakeven point, which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss.48 Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity. The financial concepts and statements introduced here are discussed fully in Entrepreneurial Finance and Accounting.

Market Feasibility Analysis

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 11.14. You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM), that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM).

Figure 11.14

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

Market Feasibility Analysis

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

Location Feasibility

You’re considering opening a boutique clothing store in downtown Atlanta. You’ve read news reports about how downtown Atlanta and the city itself are growing and undergoing changes from previous decades. With new development taking place there, you’re not sure whether such a venture is viable. Outline what steps you would need to take to conduct a feasibility study to determine whether downtown Atlanta is the right location for your planned clothing store.

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision. This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

Love Beyond Walls

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls (www.lovebeyondwalls.org), an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?