13.5: Case Studies

- Page ID

- 21558

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Casinos and Crime

Source: Photo courtesy of emdot, http://www.flickr.com/photos/emdot/22751767.

Earl Grinols and David Mustard are economists and, like a lot of people, intrigued by both casinos and crime. In their case, they were especially curious about whether the first causes the second. It does, according to their study. Eight percent of crime occurring in counties that have casinos results from the legalized gambling. In strictly financial terms—which are the ones they’re comfortable with as economists—the cost of casino-caused crime is about $65 per adult per year in those counties. Earl Grinols and David Mustard, “Measuring Industry Externalities: The Curious Case of Casinos and Crime,” accessed June 7, 2011, casinofacts.org/casinodocs/Grinols-Mustard-Casinos_And_Crime.pdf.

When casinos come to town, the following specific crimes increase:

- Robbery (in all three major categories: of individuals, of their homes, of their cars)

- Aggravated assault

- Rape

The crimes also increased to some extent in neighboring counties.

Situation: A casino regular runs out of money after a string of bad cards. She coasts out to the street and drops her purse in front of an out-of-towner. When the chivalrous guy bends over to pick it up for her, she picks his back pocket. With the $100 stolen from the wallet, she heads back into the casino, spends $40 on hard liquor, loses the rest at the roulette table, and goes home. She wakes up alone, though some underwear she finds on her floor makes her think she probably didn’t start the night that way. She can’t remember.

- Sole proprietorship

- What is a sole proprietorship?

- What are the basic legal steps to take on the way to making a sole proprietorship?

- How are taxes paid in this kind of organization?

- In most casino states and counties, laws protect owners from liability claims arising from problems caused by gambling. In ethical terms, however, if you’re the sole proprietor of the casino, do you feel any responsibility for this episode? Why or why not? If you feel responsibility, to whom would it be? What could you do to set things right?

- Partnership

- In business, what is a partnership?

- You own only 5 percent of a partner-owned casino, and don’t pay too much attention to what goes on inside. In fact, you don’t like gambling and only invested in the enterprise as a favor to a friend. Do you feel any ethical responsibility for this episode? Why or why not?

- Nonprofit organization

- What is a nonprofit organization?

- You’re an equal partner in a nonprofit organization that runs the casino to support the cause of building schools for children in impoverished sections of Peru. You spend a few months every year down there building schools and giving free English-language classes. In ethical terms (and regardless of what the law allows), do you believe anyone involved in this episode should be able to sue you personally for their suffering? Why or why not?

- Large, public corporation

- Large public corporations protect their owners from the ethical implications of what the corporation does through the business’s organizational structure. What is that structure, and how does it protect shareholders?

- Say that the casino under discussion in this set of questions is the MGM Grand Hotel and Casino in Las Vegas, which is owned by a large, public corporation. You have five shares of stock inherited a few years ago when a relative died. You are legally protected from liability claims. In ethical terms, however, do you believe that anyone involved in this episode should be able to sue you personally—or just plain blame you—for their suffering? Why or why not?

- The woman in the story is your eighteen-year-old daughter. Does that change any of your answers?

- What is an externality? What externalities probably belong to casinos? Are there any positive externalities that probably belong to casinos?

- Pigouvian taxes (named after economist Arthur Pigou, a pioneer in the theory of externalities) attempts to correct externalities—and so formalize a corporate social responsibility—by levying a tax equal to the costs of the externality to society. The casino, in other words, that causes crime and other problems costing society, say, $1 million should pay a $1 million tax.

- In terms of casinos, would such a tax more or less satisfy any ethical claim that could be made against them for the social problems they cause? Why or why not?

- The way these social scientists measured the cost of each crime was, more or less, by totaling the quantifiable costs—that is, those things that could receive a price tag fairly readily. If, for example, your car gets stolen and sold for parts by a desperate gambler, you can put a price on the crime’s cost by checking the car’s Kelly Blue Book value. Added to that there are administrative costs—at the police station, the insurance company—and those too may be figured in terms of time and wages. Still, quite a bit of the cost of crime escapes (as the authors readily admit) their measure. Their calculations don’t include lost productivity, social service, and welfare costs. They also don’t include emotional costs, the tears, and distress of the victim. Is there any way for those costs—especially the emotional suffering—to be put into dollars and cents? If so, how? If not, is there some other kind of requirement that could be strapped onto casinos to help make them socially responsible for their activities?

Grace

Source: Photo courtesy of Andre Chinn, http://www.flickr.com/photos/andrec/2608065730.

The W. R. Grace Company was founded by, yes, a man named W. R. Grace. He was Irish and it was a shipping enterprise he brought to New York in 1865. Energetic and ambitious, while his company grew on one side, he was getting civically involved on the other. Fifteen years after arriving, he was elected Mayor of New York City. Five years after that, he personally accepted a gift from a delegation representing the people of France. It was the Statue of Liberty.

Grace was a legendary philanthropist. He provided massive food donations to his native Ireland to relieve famine. At home, his attention focused on his nonprofit Grace Institute, a tuition-free school for poor immigrant women. The classes offered there taught basic skills—stenography, typewriting, bookkeeping—that helped students enter the workforce. More than one hundred thousand young women have passed through the school, which survives to this day.

In 1945, grandson J. Peter Grace took control of the now worldwide shipping company. A decade later, it became a publicly traded corporation on the New York Stock Exchange. The business began shifting from shipping to chemical production.

By the 1980s, W. R. Grace had become a chemical and materials company, and it had come to light that one of its plants had been pouring toxins into the soil and water underneath the small town of Woburn, Massachusetts. The poisons worked their way into the town’s water supply and then into the townspeople. It caused leukemia in newborns. Lawsuits in civil court, and later investigations by the Environmental Protection Agency, cost the corporation millions.

J. Peter Grace retired as CEO in 1992. After forty-eight years on the job, he’d become the longest-reigning CEO in the history of public companies. During that time, he also served as president of the Grace Institute.

The nonfiction novel A Civil Action came out in 1996. The best-selling, award-winning chronicle of the Woburn disaster soon became a Hollywood movie. The movie, starring John Travolta, continues to appear on television with some regularity.

To honor the Grace Institute, October 28 was designated “Grace Day” by New York City in 2009. On that day, the institute defined its mission this way: “In the tradition of its founding family, Grace Institute is dedicated to the development of the personal and business skills necessary for self-sufficiency, employability, and an improved quality of life.” “Our Mission,” Grace Institute, accessed June 1, 2011, www.graceinstitute.org/mission.asp.

- The specific theory of corporate social responsibility encompasses four kinds of obligations: economic, legal, ethical, and philanthropic.

- How are business leaders meant to organize these four responsibilities? Which ones take precedence over the others and why?

- Judging the man named W. R. Grace through the lens of CSR, how well did he respond to his obligations? Explain.

- Judging the company’s more recent activities in the 1980s through the lens of CSR, how well did it respond to its obligations? Explain.

- The triple-bottom-line theory of corporate responsibility promotes three kinds of sustainability: economic, social, and environmental.

- What does the term sustainability mean within this theory and within each of the three categories?

- The W. R. Grace company has a long history. From the information provided, what are some of the steps the company has taken to become economically sustainable? Explain.

- What are some of the steps the W. R. Grace company has taken to promote social sustainability? Explain.

- What is environmental sustainability? How can the dumping of toxic waste in Woburn be categorized as unethical within the area of environmental sustainability concerns? Explain.

- Stakeholder theory affirms that for companies to perform ethically, management decisions must take account of and respond to stakeholder concerns.

- What is a stakeholder?

- Looking back at the early company in New York in the 1800s, who would have been some of the stakeholders surrounding the Grace shipping company?

- Looking to more recent history, to the corporation as a producer of industrial chemicals in Woburn, Massachusetts, who were some of the major stakeholders surrounding Grace?

- Explain why the Grace Institute, which receives generous support from the W. R. Grace industrial chemical corporation—and the women receiving training there—are stakeholders in the W. R. Grace corporation.

- The Grace Institute—the people employed there and the women receiving free training—depend to some extent on the chemical company being profitable. Could you construct an argument in favor of the chemical company being environmentally irresponsible if that allows profits, and therefore necessary support for the Institute?

- As this question is being written, the share price of W. R. Grace is $26.17, and there are a total of 72,780,100 shares out there in the world. You’ve saved some money from a summer job and invested in Grace, 100 shares to be exact. That costs you $2,617, and means you own a not-overwhelming 0.000137 percent of the company. Next, you e-mail this to the CEO: “I worked hard for my $2,617, I bought stock to see that amount rise, and I want you to pour a little bit more of the profits into research and development of new products, and a little less into the Grace Institute.” Assuming the CEO is a proponent of stakeholder ethics, what do you suppose the response would be?

- There are a number of arguments supporting the proposal that corporations are autonomous entities (apart from owners and directors and employees) with ethical obligations in the world. The moral requirement argument contains four elements:

- Corporations are already involved in the broad social world and the ethical dilemmas defining it, and therefore they are obligated to participate and help solve problems.

- Well-established, successful, and powerful corporations can be involved in the effective resolution of broad social problems, and that ability implies an obligation to do so.

- Corporations rely on much more than their owners and shareholders. They need suppliers, employees, a town in which to locate, consumers, air to breathe, and water to drink. That reliance implies an obligation to care for the welfare and protection of those things.

- Because businesses cause problems in the larger world, they’re obligated to participate in the problems’ resolution.

How can each of these general arguments be specified in the case of W. R. Grace?

- Summarize the externality argument in favor of corporations having ethical obligations in the world. How can it be specified in the case of W. R. Grace?

The Body Shop

Source: Photo courtesy of the Italian Voice, http://www.flickr.com/photos/desiitaly/2254327579.

The Body Shop is a cosmetics firm out of England, founded by Anita Roddick. “If business,” she writes on the company’s web page, “comes with no moral sympathy or honorable code of behaviors, then God help us all.” “Our Values,” The Body Shop, accessed June 7, 2011, www.thebodyshop.com/_en/_ww/services/aboutus_values.aspx.

Moral sympathy and an honorable code of behaviors has certainly helped The Body Shop. Constantly promoted as an essential aspect of the company and a reason to buy its products, the concept of corporate social responsibility has been a significant factor in the conversion of a single small store in England to a multinational conglomerate.

Maybe it has been too significant a factor. That’s certainly the suspicion of many corporate watchers. The suspicion isn’t that the actual social responsibility has been too significant but that the actions of corporate responsibility have been much less energetic than their promotion. The social responsibility has been, more than anything else, a marketing strategy. Called greenwashing, the accusation is that only minimally responsible actions have been taken by The Body Shop, just enough to get some good video and mount a loud advertising campaign touting the efforts. Here’s the accusation from a website called thegoodhuman.com:

The Body Shop buys the palm oil for their products from an organization that pushed for the eviction of peasant families to develop a new plantation. So much for their concern about creating “sustainable trading relationships with disadvantaged communities around the world.” “Greenwash of the Week: The Body Shop Business Ethics,” The Good Human, September 30, 2009, accessed June 7, 2011, www.thegoodhuman.com/2009/09/30/greenwash-of-the-week-the-body-shop-business-ethics.

- What is the enlightened self-interest argument in favor of corporate social responsibility? How does the case of The Body Shop illustrate and make that argument?

- From the perspective of the enlightened self-interest argument in favor of corporate social responsibility, what can be made of the accusation that The Body Shop is a greenwasher? Explain.

- With reference to Milton Friedman’s marketplace ethics—essentially the idea that corporations have only one ethical responsibility, to make money—what can be made of the greenwashing accusation? Is it possible that it’s not so much an accusation as a compliment?

- If a corporation acts in a way that does good in the world, does motive matter, does it matter why the corporation does what it does? Justify your answer.

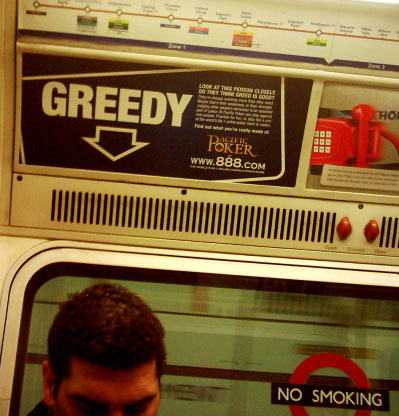

Greed is Good

Source: Photo courtesy of the Annie Mole, http://www.flickr.com/photos/anniemole/2750611025.

It’s probably the most repeated business ethics line in recent history. Michael Douglas—playing Wall Street corporate raider Gordon Gekko—stands in front of a group of shareholders at Teldar Paper and announces, “Greed is good.”

Teldar has been losing money, but the company, Douglas believes, is fundamentally strong. The problem’s the management; it’s the CEO and chief operations officer and all their various vice presidents. Because they don’t actually own the company, they only run it, they’re tempted to use the giant corporation to make their lives comfortable instead of winning profits for the actual owners, the shareholders. As one of those shareholders, Douglas is proposing a revolt: get rid of the lazy executives and put in some new directors (like Douglas’s friends) who actually want to make money. Here’s the pitch. Douglas points at the CEO and the rest of the management team up at their table:

All together, these men sitting up here own less than 3 percent of the company. And where does the CEO put his million-dollar salary? Not in Teldar stock; he owns less than 1 percent.

Dramatic pause. Douglas earnestly faces his fellow shareholders.

You own the company. That’s right—you, the stockholder. And you’re all being royally screwed over by these bureaucrats with their steak lunches, their hunting and fishing trips, their corporate jets and golden parachutes. Teldar Paper has 33 different vice presidents, each earning over 200 thousand dollars a year. Now, I have spent the last two months analyzing what all these guys do, and I still can’t figure it out. One thing I do know is that our paper company lost 110 million dollars last year. The new law of evolution in corporate America seems to be survival of the unfittest. Well, in my book you either do it right or you get eliminated.

He adds,

In the last seven deals that I’ve been involved with, there were 2.5 million stockholders who have made a pretax profit of 12 billion dollars.Wall Street, directed by Oliver Stone (Los Angeles: Twentieth Century Fox, 1987), film.

- Douglas says, “In my book you either do it right or you get eliminated.”

- In economic terms, what does “do it right” mean?

- In ethical terms, and with reference to a marketplace morality resembling the one Milton Friedman proposes, what does “do it right” mean?

- The structure of most large, publicly held corporations separates owners from actual managers who are hired to run the company. They’re employed agents of the owners. What does that mean as far as their ethical obligations go with respect to the purpose of the company they are leading?

- In the real world, the paper company Weyerhaeuser promotes itself as socially and environmentally responsible. On their web page, they note that they log the wood for their paper from certified forests at a percentage well above that required by law. “Forest Certification,” Weyerhaeuser, accessed June 7, 2011, www.weyerhaeuser.com/Sustainability/Footprint/Certification. Carefully defining a “certified forest” would require pages, but basically the publicly held corporation is saying that they don’t just buy land, clear-cut everything, and then move on. Instead, and at a cost to themselves, they leave some trees uncut and plant others to ensure that the forest they’re cutting retains its character.

- How could Douglas’s speech at Teldar be rewritten as a criticism of the management at Weyerhaeuser?

- What specific criticism would Douglas launch at Weyerhaeuser managers who spend corporate money planting trees?

- If it turned out that the sustainable forest initiative cost Weyerhaeuser some money up front, but ultimately won them positive publicity and consequently more consumers, would Douglas approve of the practice? Explain.

- One broad argument against the various ideas of corporate social and environmental responsibility is that corporations can’t have moral responsibilities at all. How could that argument be specified in the case of Weyerhaeuser?

- According to the Weyerhaeuser web page, the US government sets certain rules for sustainability with respect to forests. Weyerhaeuser complies and then goes well beyond those requirements. According to Milton Friedman and the ideals of marketplace responsibility, broad questions about social and environmental corporate responsibilities should be answered by democratically elected governments because that’s the institution we’ve developed to manage our ethical life. Governments should try to succeed in the ethical realm by making good laws; companies should try to succeed in the economic realm by making good profits.

- Weyerhaeuser notes on its web page that in China and Uruguay it obeys local regulations with respect to logging. Apparently, however, the company isn’t doing quite as much in those places to avoid the environmental problem of deforestation. Land is very inexpensive in vast, poor nations like these two, and it looks like Weyerhaeuser more or less does what’s required and that’s it. Maybe the company simply buys acres, cuts them, and moves on. Make the case that in ethical terms, the corporate actions in Uruguay and China are more respectable than the actions here in the States.

- The first part of Douglas’s speech concerned problems with the corporate organization’s structure, and with out-of-control managers: people employed to run a company who promptly forget who their bosses are. The speech’s second part is about what drives life in the business world:

The point is, ladies and gentleman, that greed—for lack of a better word—is good.

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms—greed for life, for money, for love, knowledge—has marked the upward surge of mankind.

Greed, Douglas says, is an imperfect word for what he’s describing. What words might have been better? What words might advocates of marketplace ethics propose?

- One word that might have worked better than greed is ambition. Whether the word is greed or ambition, it has, according to the Douglas character, marked the upward surge of mankind. Assume that’s true. Can you speculate about how the upward surge would play out in a developing nation like Uruguay when a multinational comes to town, brings money, creates jobs, and wrecks the forests?