Solutions

- Page ID

- 97790

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Solutions

Chapter 12 Exercises

- CL

- CL

- CL

- CL

- Both

- Not recorded

- CL and possibly NCL if goods/services provided more than one year in the future

- NCL, unless decommissioning will happen within one year, then CL

- Not recorded unless lawsuit is settled/resolved

- CL

- CL

- Both

- CL or NCL, depending on term of note

- CL

- Both, depending on expiry date of points

-

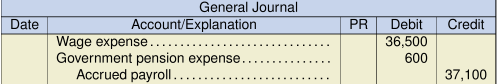

Note: The cash represents the total of the individual payroll cheques that would be written to each employee, less the amount of the advances paid.

-

Note:

(based on 5 working days per week)

(based on 5 working days per week)

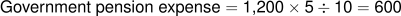

In practice, the calculation of the government pension expense would be more complicated than this. However, the company would likely omit this part of the calculation, as it is not material to the accrual.

-

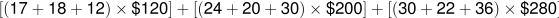

January 2021 Factor Revenue One-year subscription

12/12 $2,040 Two-year subscription

12/24 $2,400 Three-year subscription

12/36 $2,800 July 2021 Factor Revenue One-year subscription

6/12 $1,080 Two-year subscription

6/24 $1,000 Three-year subscription

6/36 $1,027 December 2021 Factor Revenue One-year subscription

1/12 $120 Two-year subscription

1/24 $250 Three-year subscription

1/36 $280 Total of all revenue amounts recognized = $10,997

Note: This calculation assumes that services are provided in equal proportions throughout the contract term. If a different assumption is more accurate, then the calculations would be adjusted to reflect the expected pattern of service.

- Total contract payments received:

= $ 45,080 Less revenue recognized in 2021 $ 10,997 Total deferred revenue at December 31, 2021 $ 34,083 This will be reported as:

Current liability $ 18,013 Non-current liability $ 16,070 Calculation:

January 2021 Factor Current Liability One-year subscription

0/12 $0 Two-year subscription

12/24 $2,400 Three-year subscription

12/36 $2,800 July 2021 Factor Current Liability One-year subscription

6/12 $1,080 Two-year subscription

12/24 $2,000 Three-year subscription

12/36 $2,053 December 2021 Factor Current Liability One-year subscription

11/12 $1,320 Two-year subscription

12/24 $3,000 Three-year subscription

12/36 $3,360 Total current liability = $18,013

Total non-current liability =

-

- Unearned revenue at December 31, 2022 =

-

Note: This is simply a reclassification, as the employee would have been paid his or her regular pay on a sick day.

- Vacation pay liability at December 31 = $24,720, per part (a)

Sick pay liability at December 31 = $0 (these benefits do not accumulate)

-

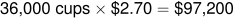

Total sales generated =

Fair value per cup =

(Denominator is total cups sold plus expected redemptions.)

Unearned revenue =

This records the redemption of the first 1,000 free cups.

- Liability at the end of 2020 will be the unearned revenue balance:

=

= $2,560

= $2,560

This will be reported as a current liability, as all loyalty cards expire within one year.

-

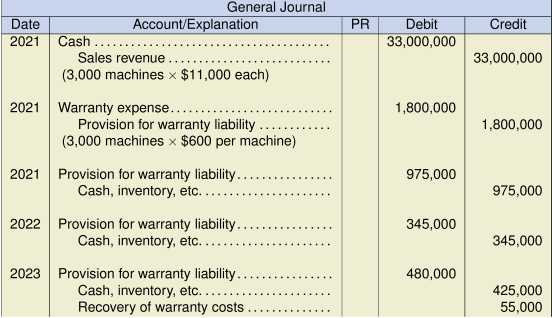

Note: This journal entry assumes that the three-year warranty period for all machines sold in 2021 has now expired. The balance of the provision must be reduced to zero once the warranty period ends. If there were still machines with remaining warranty rights, the balance of the provision would be carried forward to 2024 until the warranty period expired.

- 2021 warranty liability =

2023 warranty liability =

(assuming all warranty periods have expired by the end of 2023)

Note: In 2021, the liability would be separated into current and non-current portions, based on management's best estimate of the pattern of future warranty repairs. In 2022, the liability would be reported only as current.

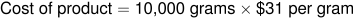

- If contract is completed:

= $ 450,000

= 500,000 Loss on contract $ (50,000) If contract is cancelled and sales still made:

Sales revenue (as above) $ 450,000

= 310,000 Cancellation penalty 75,000 Profit on contract $ 65,000 If contract is cancelled and no sales made, the $75,000 penalty still applies.

Because the option of cancelling the contract and continuing to make sales results in a profit, this is not an onerous contract. No journal entry is required.

-

If contract is completed, loss is as calculated in part (a) $ (50,000) If contract is cancelled and sales made: Sales revenue (as above) $ 450,000

310,000 Cancellation penalty 150,000 Loss on contract $ (10,000) If contract is cancelled and no sales, penalty applies $ (150,000) In this case, all options result in a loss, so this is an onerous contract. A journal entry is required to recognize the least costly option available:

-

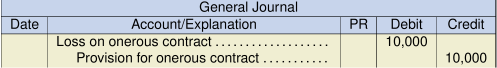

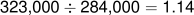

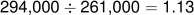

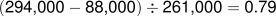

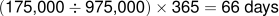

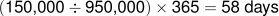

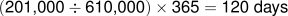

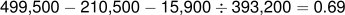

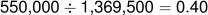

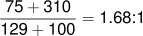

Ratio 2021 2020 Current 1.14 1.13 Quick 0.74 0.79 Days' sales uncollected 66 days 58 days Days' payable outstanding 140 days 120 days Current: 2021

2020

Quick: 2021

2020

Days' sales uncollected: 2021

2020

Days' payable outstanding: 2021

2020

- The company's cash decreased from the previous year, but this does not reveal much. The ratio analysis, however, does reveal some worrying trends in liquidity. The current ratio has been maintained at almost exactly the same level as the previous year, but it is only slightly above 1. This may indicate that the company will have difficulty meeting its short-term obligations when they come due. The quick ratio further emphasizes this point. The quick ratio declined from the previous year and is now less than 1. This means the company would not be able to fully pay its current obligations if they were to become immediately due. This could cause problems with trade creditors and the company's bank, which could lead to further actions taken by those parties that could negatively affect the business.

The collection period for receivables has also slowed by 8 days from the previous year, which indicates that it is taking longer to collect from customers. This trend will further exacerbate any cash flow problems the company has in meeting its current payment obligations. The actual collection period of 66 days may be reasonable, but the company's credit terms and general industry conditions would need to be examined to see if this is in line with what is expected for this type of business.

The payment period for the company's suppliers shows the most alarming trend. The company is now taking 140 days to pay its payable, an increase of 20 days over the previous year. This could indicate serious cash flow problems, and may cause loss of credit with suppliers which could, ultimately, result in an inability to obtain a supply of inventory. The standard credit terms offered by suppliers will need to be examined to put this calculation into context. As well, the supplier list should be examined to see if there are any related parties involved that are granting more favourable credit terms than would be normally expected.

Overall, the company appears to have some problems in managing its working capital, which could lead to more serious liquidity problems in the future. The company seems to be using trade creditors as its main source of short term financing, which may cause a degrading of the company's credit and reputation with those suppliers. However, more information is required to fully understand these trends.

Chapter 13 Exercises

- Financing is generally obtained through three sources: borrowing the funds, issuing shares, and using internally generated funds. Using borrowed money to leverage, where the interest rate from the borrowing is less than the return from generating the profit, can maximize the returns paid to shareholders, and the related interest paid is tax deductible. However, borrowed funds must be repaid, which affects the company's liquidity and solvency risk. Issuing shares, on the other hand, does not impact liquidity and solvency risk, but it may result in the dilution of ownership and associated lower market value and less dividends per share. Using internally generated funds may be appropriate if the company has excess cash profits and has determined that this project is the best use for these funds.

- Based on the information provided, borrowing is the most suitable source of financing for Evergreen Ltd. With a debt to total assets ratio of 56%, Evergreen Ltd. is underleveraged as compared with competitors operating in the same industry, averaging 60%. As a result, Evergreen Ltd. will likely be able to finance the expansion by borrowing and still maintain an acceptable level of liquidity and solvency risk lower than, or equal to, the 60% industry standard benchmark. If Evergreen Ltd. has significant amounts of property, plant, and equipment, it may be able to obtain the loan and secure it with its existing tangible assets. However, more information would be required before making a concrete recommendation.

-

-

- The market interest rate at the time of signing the note would have been 5% because the note was issued at face value, meaning that the 5% stated rate was the same as the market rate at that time.

- The yield is the same as the market or effective rate, which is 5% in this case. Had the market rate been greater or lower than the face rate, the yield would be equal to the market rate.

- The current portion of the long-term debt is the principal portion of the debt that will be paid within one year of the reporting (balance sheet) date. In this case, as no principal portions are due until the note's maturity on January 1, 2024, no amount will be reported as a current portion of long-term debt as at the December 31, 2021, reporting date. However, when the balance sheet at December 31, 2023, is prepared, the long-term note payable of $400,000 will be classified as a current liability because it will be due within one year of the December 31, 2023, reporting date.

-

-

-

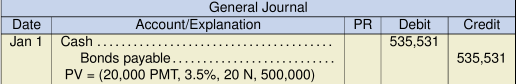

Face value of bond $ 500,000 Present value of bond 535,531 Premium $ 35,531

-

-

- If the note face value is $120,000, the duration is three years, and the PV is equal to $95,260, the interest rate would be:

Interest rate = (+/- 95,260 PV, 3 N, 120,000 FV) = 7.999 (or 8%)

-

Date Interest @ 8% Balance Jan 1, 2021 95,260 Dec 31, 2021 7,621 102,881 Dec 31, 2022 8,230 111,111 Dec 31, 2023 8,889 120,000

PMT = (+/- 25,000 PV, 3 N, 8 I/Y) = 9,700.84 (or 9,701)

Payments each December 31 would be $9,701.

-

To calculate the market rate (yield) at the time of the issuance to two decimal places:

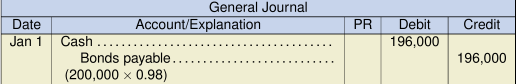

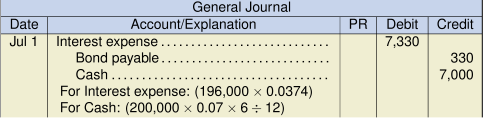

I/Y = (+/- 196,000 PV, 7,000 PMT, 10 N, 200,000 FV) = 3.74%

-

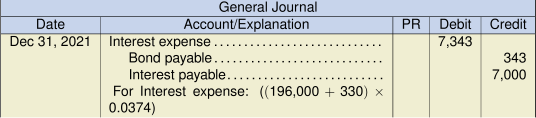

Hobart Services Ltd. Statement of Financial Position As at December 31, 2021 Current liabilities: Interest payable $ 7,000 Long-term liabilities: Long-term bonds payable, 7%, due January 1, 2026 $ 196,673 Check Figures:

Note: There is no current portion of long-term debt in this case because there is no pay-down of the principal. Looking at the payment schedule, the balance owing is increasing due to the amortization of the discount.

-

-

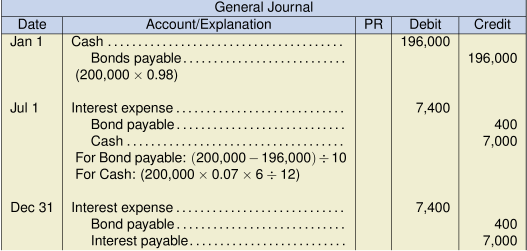

Hobart Services Ltd. Statement of Financial Position As at December 31, 2021 Current liabilities: Interest payable $ 7,000 Long-term liabilities: Long-term bonds payable, 7%, due January 1, 2026 $ 196,800 Check Figures:

- The total cost of borrowing will be the same for both methods, though the pattern of recognition as illustrated in the two interest schedules above is different throughout the life of the bonds.

- Effective interest rate:

I/Y = (+/- 785,000 PV, 20,000 PMT, 40 N, 800,000 FV) = 2.5756% every 6 months

* Fee is capitalized and will be amortized over the life of the bond. See full amortization schedule above.

-

-

Hobart Services Ltd. Statement of Financial Position As at December 31, 2021 Current liabilities: Interest payable $ 20,000 Long-term liabilities: Long-term bonds payable, 5%, due January 1, 2041 $ 785,442 - When a note or bond is issued, the brokerage fees and any other directly attributable costs should be included in the fair value and amortized over the life of the debt. As a result, these types of additional costs will affect both the amount of the bond discount (or premium) amortized and the interest expense over the term of the bond. Exceptions to this are where the debt will subsequently be measured at fair value under the fair value option. In this case, the transaction costs would be expensed at the time of issuance and not included in the initial fair value measurement. [CPA Handbook, Accounting, Part II, Section 3856.07 and Part I, IFRS 9].

When a note or bond is issued, the brokerage fees and any other directly attributable costs should be included in the fair value and amortized over the life of the debt. As a result, these types of additional costs will affect both the amount of the bond discount or premium amortized and the interest expense over the term of the bond. Exceptions to this are where the debt will subsequently be measured at fair value under the fair value option. In this case, the transaction costs would be expensed at the time of issuance and not included in the initial fair value measurement. (CPA Handbook, Accounting, Part II, Section 3856.07 and Part I, IFRS 9)

- ASPE

- IFRS (IFRS 9)

- The risk for Tribecca increased in this case, so the fair value of its debt owing decreased. The offsetting entry to the decrease (debit) to bonds payable is an unrealized gain. An entry booking a gain seems like an illogical outcome, given that the company is now worse off than before due to higher risk.

- Under IFRS, this debt is to be reported as a current liability on the December 31, 2021, financial statements because it was not refinanced by the reporting date. The only exception is if the refinancing was done under an agreement that existed at December 31, 2021, and the decision about the refinancing was solely up to management's discretion.

- Under ASPE, this debt can be reported as a long-term liability because it has been refinanced on a long-term basis before the financial statements are completed. In this case, the entity's financial statements are not yet finalized, so ASPE would permit the debt to be included with long-term liabilities.

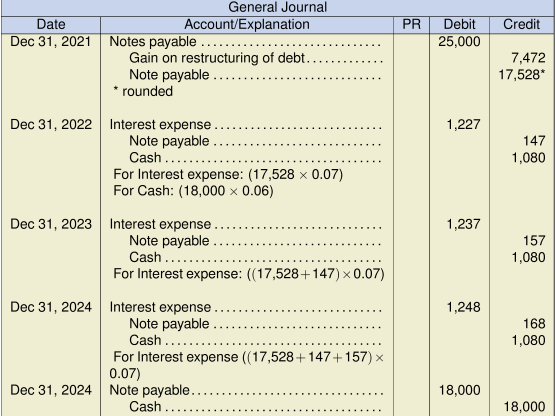

Settlement or modification:

Old debt: $25,000 (amount due):

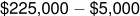

New annual interest payment: ![]()

New debt (PV using the old rate): PV (1,080 PMT, 8 I/Y, 3 N, 18,000 FV) = 17,072

The new debt is more than 10% difference of the old debt's value, so the renegotiation would be considered a settlement and not a modification in terms. A settlement requires the old debt to be removed from the records and the present value amount of the note payable with the new terms be recorded.

The PV of the new note payable at the current market rate would be:

PV (1080 PMT, 7 I/Y, 3 N, 18,000 FV) = 17,527.62

The entries would be:

- Initial fair value amount of the house on January 1, 2021:

PV = (5.75%, 6 N, 800,000 FV) = $ 572,015 Dec 31, 2021 Interest: (  )

)= 32,891 Carrying value of the note, Dec 31, 2021 = $ 604,906 - The assessed value for the house of $590,000 is only a tax assessment notice for purposes of tax levies and payments. Though it is intended to reflect some sort of value of the house, it may not necessarily be an accurate measure. The more accurate measure in this case would be the present value of the future cash flows of the note, using a known, agreed-upon bank rate. The tax assessment amount of $590,000 can be compared to the present value of $572,015 for consistency and reasonableness. In this case, the amounts are close.

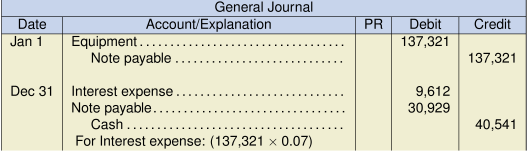

- The purchase price of the equipment should be recorded at the present value of the future cash flows of the instalment note at the imputed interest rate of 7%. This is the best measure of the fair value of the asset because it represents the present value of an agreed series of future cash flows at a known market rate. The listing price represents a tentative amount asked for the equipment and could be above or below the price that is agreed to between both parties.

- PV = (40,541 PMT, 7 I/Y, 4 N) = 137,321

- From the perspective of a creditor, an instalment note payment includes both the interest and principal, whereas, for an interest-bearing note, the principal amount is not due until maturity. In other words, the instalment note provides a regular reduction of the principal balance as part of every payment received, reducing the creditor's investment in the debt and freeing up cash to use elsewhere.

For Hornblower Corp.:

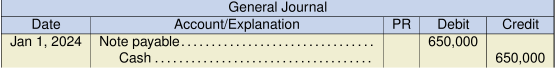

- Determine if this is a modification of terms or settlement:

Present value of old debt is $700,000.

Present value of new debt using the historic rate:

PV = (45,500 PMT, 8 I/Y, 2 N, 650,000 FV) = 638,409

This loan is deemed as a modification in terms because the present value of the future cash flows of the new debt using the old rate of $638,409 does not differ by an amount greater than 10% of the present value of the old debt of $700,000.

There will be no entry for Hornblower Corp. due to the restructure of the loan. The old debt remains on the books of Hornblower Corp. at $700,000 and no gain or loss is recognized. A note disclosure regarding the modification of terms is required.

- The interest expense is based on the future cash flows specified by the new terms with the pre-restructuring carrying amount of the debt of $700,000. The effective interest rate is calculated as follows:

I/Y = (+/- 700,000 PV, 45,500 PMT, 2 N, 650,000 FV) = 2.98% (rounded)

-

Interest Reduction in Date Payment @ 2.98% Carrying Amount Balance Dec 31, 2021 700,000 Dec 31, 2022 45,500 20,860 24,640 675,360 Dec 31, 2023 45,500 20,140* 25,360 650,000 * Rounded

-

For Firstly Trust:

- Present value of old debt is $700,000.

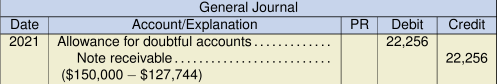

Present value of new debt using the historic rate: PV = (45,500 PMT, 8 I/Y, 2 N, 650,000 FV) = $ 638,409 Loss $ 61,591

Note: If Firstly Trust had previously recorded an allowance for doubtful accounts for this note, the debit entry would be to the AFDA account instead of the bad debt expense.

-

Payment Interest Reduction in Date 7% @ 8% Carrying Amount Balance Dec 31, 2021 638,409 Dec 31, 2022 45,500 51,072 5,572 643,981 Dec 31, 2023 45,500 51,519* 6,019 650,000 * Rounded -

-

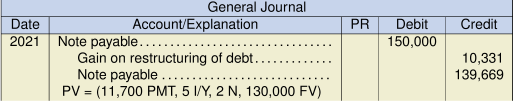

- Determine if the changes should be accounted for as a settlement or as a modification:

Old debt: $150,000

New terms using old rate of 10%:

PV = (11,700 PMT, 10 I/Y, 2 N, 130,000 FV) = 127,744

The present value of the new terms using the old rate of 10% differs by an amount larger than 10% of the present value of the old debt of $150,000. As a result, the renegotiated debt is considered a settlement. The old debt is removed from the books of Ulting Ltd. with a gain/loss being recognized, and the new debt is recorded.

Interest Schedule:

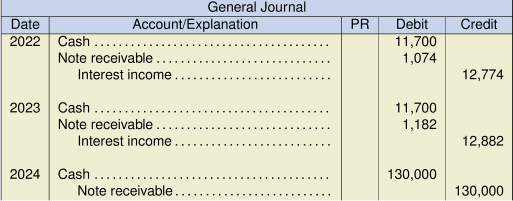

Payment Interest Reduction in 9% @ 5% Carrying Amount Balance 139,669 11,700 6,983.45 4,717 134,952 11,700 6,747.62 4,952 130,000

-

Interest schedule:

Payment Interest Adjust to 9% @ 10% Carrying Amount Balance 127,744 11,700 12,774 1,074 128,818 11,700 12,882 1,182 130,000

Chapter 14 Exercises

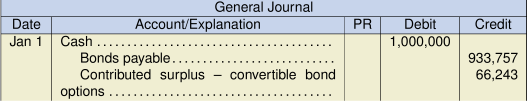

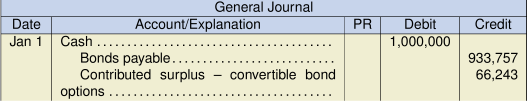

- PV = (60,000 PMT, 8 I/Y, 4 N, 1,000,000 FV) = $933,757

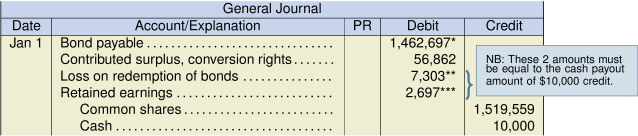

- For IFRS, the residual method is used. This allocates the proceeds first to the liability component and the residual to the equity component. The debt component is measured first as the par value compared to the present value of future cash flows without the convertible feature:

Total proceeds at par $ 1,000,000 PV of the debt component by itself (933,757) Incremental value of option $ 66,243 Entry:

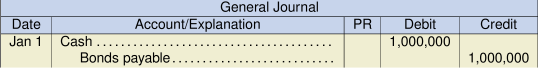

- Under ASPE, the zero-equity method can be used as a policy choice. The equity component would be measured at $0 and the rest to the debt component.

Entry:

Also, the residual method can also be used as explained above. Entry is the same as the entry for IFRS:

Entry:

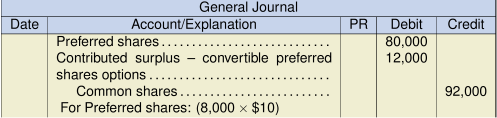

- Under IFRS, the residual method is applied whereby cash is allocated to the value of the debt instrument first, and the residual is allocated to equity. The debt value is calculated as $576,000 and the warrants are accounted for as equity instruments.

- Under ASPE one option is to measure the component that is most easily measurable first (usually the debt component) and apply the residual to the other equity component. This is the option under IFRS, and the journal entry will, therefore, be the same:

Another option is to measure the equity component using the zero-equity method. This means that equity is measured at $0 and the journal entry would be:

- Allocating the entire issuance to the debt component, and therefore zero to equity, results in a higher debt to total assets ratio as compared with the residual method. A lower debt to total assets ratio indicates better debt paying ability and long-run solvency.

-

*

**

-

Note: The bonds payable carrying value would no longer include any unamortized premium, so the face value or par value would be the carrying value at maturity.

- Due to common shares market price volatility, there is a risk in waiting to convert the bonds. If the bondholder does not convert when the common share market value is high, no gain will be realized. Conversely, if the common shares market price declines too far, the bondholder risks not being able to sell the bonds, rendering the conversion rights worthless.

Residual method, using the fair value of the warrants first and the residual to the bonds:

Zero-equity method, which measures the equity component at $0:

Residual method:

Zero-equity method, which measures the equity component at $0:

Fair value of bonds without warrants is (![]() ) = $396,000

) = $396,000

* ![]()

** ![]()

Residual method:

Zero-equity method:

* PV (10%, 5N, 135,000 PMT, 1,500,000 FV)

| * | |

* Same calculation as in previous part

** ![]()

*** ![]()

* PV(8%, 3N, 50,000 PMT, 1,000,000 FV)

| * | |

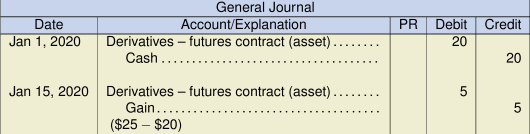

- January 1, 2020: No journal entry necessary since the fair value of the forward contract would be $0.

-

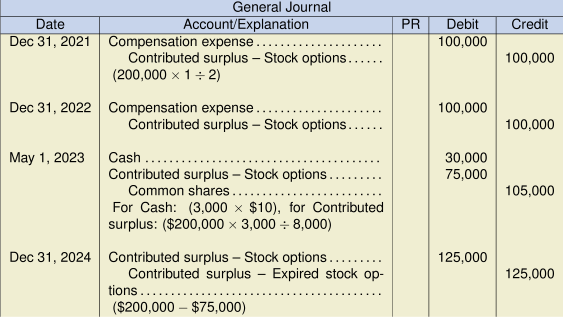

January 1, 2020: No entry on the grant date.

- January 1, 2021: No entry on the grant date.

- The market price of the shares of $15 on May 1, 2023, is not used in recording the exercise of the stock options. From an accounting perspective, the market price is not relevant. It is, nonetheless, relevant to the employees in making their decision to exercise their stock options. The market price is mentioned to indicate that the timing of the exercise is justified, or at least makes sense. Employees exercising a stock option would have paid $10 and could resell the shares immediately for $15, for a gain of $5 per share.

Chapter 15 Exercises

| Item | Taxable | Deductible | Permanent |

| Temporary | Temporary | Difference | |

| Difference | Difference | ||

| A property owner collects rent in advance. The amounts are taxed when they are received. | X | ||

| Depreciation claimed for tax purposes exceeds depreciation charged for accounting purposes. | X | ||

| Dividends received from an investment in another company are reported as income, but are not taxable. | X | ||

| A provision for future warranty costs is recorded but is not deductible for tax purposes until the expenditure is actually incurred. | X | ||

| Membership dues at a golf club are reported as a promotion expense but are not deductible for tax purposes. | X | ||

| Construction revenue is reported using the percentage of completion method but is not taxed until the project is finished. | X | ||

| The present value of the costs for the future site remediation of an oil-drilling property has been capitalized as part of the asset's carrying value. This will increase the amount of depreciation claimed over the life of the asset. These costs are not deductible for tax purposes until they are actually incurred. | X | ||

| A revaluation surplus (accumulated other comprehensive income) is reported for assets accounted for under the revaluation model. The gains will not be taxed until the respective assets are sold. | X | ||

| Included in current assets is a prepaid expense that is fully deductible for tax purposes when paid. | X | ||

| A penalty is paid for the late filing of the company's income tax return. This penalty is not deductible for tax purposes. | X |

| Amount | |||

| Accounting profit | $ | 350,000 | |

| Permanent difference: | |||

| Life insurance not taxable | (100,000) | ||

| Temporary difference: | |||

| Depreciation not deductible | 20,000 | ||

| Taxable profit | 270,000 | ||

| Tax rate | 20% | ||

| Current tax payable | $ | 54,000 | |

| Tax expense comprised of: | |||

| Current tax expense | $ | 54,000 | |

|

Deferred tax income ( |

(4,000) | ||

| Total tax expense | $ | 50,000 |

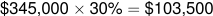

- Current Tax:

Amount Accounting profit $ 3,500,000 Permanent differences: None Temporary differences: Construction not yet taxable (900,000) Capital allowance > depreciation (1,100,000) Taxable profit 1,500,000 Tax rate 30% Current tax payable $ 450,000 Temporary difference re: depreciation calculated as follows:

Cost of asset $ 6,800,000 Accumulated depreciation 1,200,000 Carrying value 5,600,000 Less tax base 4,500,000 Excess capital allowance $ 1,100,000 Deferred Tax Liability:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Construction revenue 900,000 0 (900,000) 30% (270,000) PPE 5,600,000 4,500,000 (1,100,000) 30% (330,000) Total (600,000) -

-

Profit before tax $ 3,500,000 Income taxes Current expense (450,000) Deferred expense (600,000) (1,050,000) Net profit for the year $ 2,450,000

- Current Tax:

Amount Accounting profit $ 3,700,000 Permanent differences: None Temporary differences: Construction now taxable 900,000 Capital allowance < depreciation 400,000 Taxable profit 5,000,000 Tax rate 30% Current tax payable $ 1,500,000 Temporary difference re: depreciation calculated as follows:

Cost of asset $ 6,800,000 Accumulated depreciation 2,600,000 Carrying value 4,200,000 Less tax base 3,500,000 Excess capital allowance $ 700,000 Since last year's excess was $1,100,000, $400,000 of the temporary difference reversed during the year.

Deferred Tax Liability:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Const. rev. 0 0 0 30% 0 PPE 4,200,000 3,500,000 (700,000) 30% (210,000) Total (210,000) Opening bal. (600,000) Adjustment 390,000 -

-

Profit before tax $ 3,700,000 Income taxes Current expense (1,500,000) Deferred income 390,000 (1,110,000) Net profit for the year $ 2,590,000

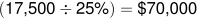

- Opening deferred tax liability balance of $17,500 implies an opening temporary difference of

. If the carrying amount at 31 December 2021 was $320,000, then the tax base must have been

. If the carrying amount at 31 December 2021 was $320,000, then the tax base must have been  .

.

At 31 December 2022, the carrying amount will be

At 31 December 2022, the tax base will be

Current Tax:

Amount Accounting profit $ 416,000 Permanent differences: Non-deductible entertainment 21,000 Temporary differences: Warranty not deductible in 2022 56,000 Capital allowance > depreciation (8,000) Taxable profit 485,000 Tax rate 25% Current tax payable $ 121,250 Deferred Tax Liability:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Warranty (56,000) 0 56,000 25% 14,000 PPE 270,000 192,000 (78,000) 25% (19,500) Total (5,500) Opening bal. (17,500) Adjustment 12,000 -

-

Profit before tax $ 416,000 Income taxes Current expense (121,250) Deferred income 12,000 (109,250) Net profit for the year $ 306,750 -

Current Liabilities Income taxes payable $ 121,250 Non-Current Liabilities Deferred income taxes 5,500

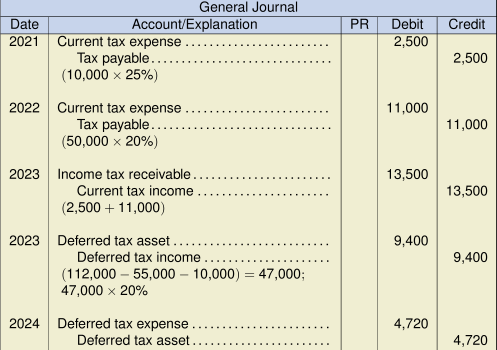

- Current Tax:

2021 2022 2023 Accounting profit 110,000 242,000 261,000 Permanent differences: Dividend (10,000) (10,000) (10,000) Temporary differences: (plug to balance) (15,000) (36,000) 34,000 Taxable profit 85,000 196,000 285,000 Tax rate 20% 23% 23% Current tax payable/exp. 17,000 45,080 65,550 Deferred Tax Liability – 2021:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 15,000 0 (15,000) 20% (3,000) Opening bal. 0 Adjustment (3,000) Deferred Tax Liability – 2022:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 51,000 0 (51,000) 23% (11,730) Opening bal. (3,000) Adjustment (8,730) Deferred Tax Liability – 2023:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 17,000 0 (17,000) 23% (3,910) Opening bal. (11,730) Adjustment (7,820) - Summary: Income Statement

2021 2022 2023 Current tax expense 17,000 45,080 65,550 Deferred tax expense (income) 3,000 8,730 (7,820) Balance Sheet

2021 2022 2023 Deferred tax liability 3,000 11,730 3,910 -

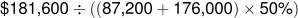

Profit before tax $ 242,000 Income taxes Current 45,080 Deferred resulting from temporary differences 8,280 Deferred resulting from tax rate change 450 53,810 Net profit for the year $ 188,190 Note: The deferred tax resulting from the rate change is calculated as the opening temporary difference from 2021 multiplied by the rate differential:

. The deferred tax resulting from temporary differences is calculated as the current year temporary differences multiplied by the current rate:

. The deferred tax resulting from temporary differences is calculated as the current year temporary differences multiplied by the current rate:  . Deferred tax adjustments resulting from rate changes must be disclosed separately from deferred tax adjustments resulting from changes in temporary differences.

. Deferred tax adjustments resulting from rate changes must be disclosed separately from deferred tax adjustments resulting from changes in temporary differences.

- Current Tax:

2021 2022 2023 Accounting profit 110,000 242,000 261,000 Permanent differences: Dividend (10,000) (10,000) (10,000) Temporary differences: (plug to balance) (15,000) (36,000) 34,000 Taxable profit 85,000 196,000 285,000 Tax rate 20% 23% 23% Current tax payable/exp. 17,000 45,080 65,550 Deferred Tax Liability – 2021:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 15,000 0 (15,000) 23% (3,450) Opening bal. 0 Adjustment (3,450) NOTE: Deferred tax is recorded at the rate expected to be in effect. This is substantively enacted rate at the end of 2021.

Deferred Tax Liability – 2022:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 51,000 0 (51,000) 23% (11,730) Opening bal. (3,450) Adjustment (8,280) Deferred Tax Liability – 2023:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 17,000 0 (17,000) 23% (3,910) Opening bal. (11,730) Adjustment 7,820 - Summary:

2021 2022 2023 Current tax expense 17,000 45,080 65,550 Deferred tax expense (income) 3,450 8,280 (7,820) Deferred tax liability 3,450 11,730 3,910 -

Profit before tax $ 242,000 Income taxes Current 45,080 Deferred 8,280 53,360 Net profit for the year $ 188,640 Note: The deferred tax resulting from the rate change does not need to be reported as it was already accounted for in 2021.

-

ending balance of carry forward after applying loss to reduce current taxable income to 0

ending balance of carry forward after applying loss to reduce current taxable income to 0

Ending deferred tax =

Adjustment to deferred tax asset =

There is no adjustment for current taxes in 2024 because taxable income has been reduced to 0 by the carryforward.

-

No j/e in 2023 for the benefit of the loss carry forward, as the asset is not recognized. However, disclosure will be made of the unrecorded carry forward amount (47,000).

No j/e in 2024, as current tax will be 0 and no deferred tax asset will be established. However, disclosure is required of the current tax expense components:

Current tax expense

$ 3,780 Less benefit of loss carried forward (3,780) Current tax expense $ 0 As well, disclosure of the remaining, unrecorded loss carried forward (26,000) would continue.

- Current Tax:

Amount Accounting profit $ 750,000 Permanent differences: Non-deductible fines 12,000 Non-taxable dividends (7,500) Temporary differences: Previously taxed revenue now earned (95,000) New subscriptions taxed but not earned 68,000 Capital allowance < depreciation 13,000 Taxable profit 740,500 Tax rate 30% Current tax payable $ 222,150 Deferred Tax:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Unearned revenue (220,000) 0 220,000 30% 66,000 PPE 298,000 192,000 (106,000) 30% (31,800) Total 34,200 Opening bal. 38,400 Adjustment (4,200) Unearned revenue

Carrying amount PPE

Tax base PPE

-

-

Profit before tax $ 750,000 Income taxes Current expense (222,150) Deferred expense (4,200) (226,350) Net profit for the year $ 523,650 -

2022 2021 Current assets Income taxes receivable – 16,250 Non-current assets Deferred income taxes 34,200 38,400 Current liabilities Income taxes payable 222,150 –

- Deferred Tax Liability – 2021:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 180,000 165,000 (15,000) 25% (3,750) Opening bal. 0 Adjustment (3,750) Deferred Tax Liability – 2022:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 160,000 135,000 (25,000) 30% (7,500) Opening bal. (3,750) Adjustment (3,750) Deferred Tax Liability – 2023:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 140,000 135,000 (5,000) 35% (1,750) Opening bal. (7,500) Adjustment 5,750 Deferred Tax Liability/Asset – 2024:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 120,000 135,000 15,000 35% 5,250 Opening bal. (1,750) Adjustment 7,000 Deferred Tax Asset – 2025:

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Temp Diff 100,000 110,000 10,000 30% 3,000 Opening bal. 5,250 Adjustment (2,250) NOTE: The carrying amount/tax base are determined by taking the original cost of $200,000 and deducting the accumulated depreciation/accumulated capital allowances at the end of each year.

- Current taxes

2021 2022 2023 2024 2025 Accounting profit (loss) reported 150,000 60,000 (440,000) (80,000) 350,000 Temporary difference: Depreciation expense 20,000 20,000 20,000 20,000 20,000 Capital allowance claimed for tax purposes (35,000) (30,000) 0 0 (25,000) Taxable profit (loss) 135,000 50,000 (420,000) (60,000) 345,000 Enacted tax rate 25% 30% 35% 35% 30% Tax payable (refund) 33,750 15,000 (48,750)* 0** 15,000*** * In 2023, a tax refund is generated as follows:

Tax loss applied to 2021 taxable profit 135,000 Rate 25% Refund 33,750 Tax loss applied to 2022 taxable profit 50,000 Rate 30% Refund 15,000 Total refund and tax income for the year $ 48,750 ** In 2024, the additional loss cannot be carried back, as there are no further taxable profits to apply it against. Therefore, no tax refund is generated.

*** In 2025, the current tax payable is determined as follows:

Taxable profit 345,000 Less loss carry forward applied: 2023 tax loss (420,000) Applied to 2021 135,000 Applied to 2022 50,000 2024 loss (60,000) Total loss available in 2025 (295,000) Taxable profit after loss carry forward applied 50,000 Tax rate 30% Tax payable 15,000 -

2023 2024 Opening balance of loss 0 (235,000) Current tax loss/profit (420,000) (60,000) Carried back to 2021 and 2022 185,000 – Balance to carry forward (235,000) (295,000) Probability of use 80% 10% Expected benefit (188,000) 0 Tax rate 35% 35% Deferred tax asset 65,800 0 Opening balance 0 65,800 Adjustment required 65,800 (65,800) In 2024, management's estimate of its ability to utilize the tax losses has dropped to 10%, which means it is no longer probable that the asset can be realized. At this point, the asset should be derecognized.

In 2025, the balance of the loss ($295,000) can be fully used against current taxable profit ($345,000). In 2025, the company will record current tax income of

. This will offset the current tax expense of

. This will offset the current tax expense of  , leaving a net current tax expense of $15,000. Although there is no deferred tax adjustment as the asset was previously derecognized, disclosure of the two different components of current tax expense will be required.

, leaving a net current tax expense of $15,000. Although there is no deferred tax adjustment as the asset was previously derecognized, disclosure of the two different components of current tax expense will be required. -

2021 2022 2023 2024 2025 Current tax expense (income) 33,750 15,000 (48,750) 0 15,000 (from part b) Deferred tax expense (income) – PPE 3,750 3,750 (5,750) (7,000) 2,250 (from part a) Deferred tax (income) expense – loss 0 0 (65,800) 65,800 0 (from part c) Total tax expense (income) 37,500 18,750 (120,300) 58,800 17,250

- Current Tax:

Amount Accounting profit $ 150,000 Permanent differences: None Temporary differences: Unearned rent taxed in current year 96,000 Construction revenue not taxable (90,000) Capital allowance > depreciation (4,000) Taxable income 152,000 Tax rate 30% Current tax payable $ 45,600 Future Tax:

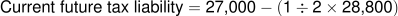

Item Carrying Amount Tax Base Temp. Diff. Rate Deferred Tax Unearned rent revenue (96,000) 0 96,000 30% 28,800 Construction revenue 90,000 0 (90,000) 30% (27,000) PPE 108,000 119,000 11,000 30% 3,300 Total 5,100 Opening bal. 4,500 Adjustment 600 NOTE: Opening balance =

DR

DRSummary:

Current tax expense $ (45,600) Future tax benefit 600 Total tax expense $ (45,000) - Balance sheet presentation

Non-current assets Future income taxes $ 17,700 Current liabilities Income taxes payable 45,600 Future income taxes 12,600 NOTE:

One-half of the future tax related to unearned revenue is classified as current and one-half as non-current because this is way in which the underlying unearned revenue would be classified. The future tax related to construction revenue is classified as current because the underlying construction in process account would be classified this way. The future tax related to the PPE is classified as non-current because PPE would be classified as non-current.

-

Income Statement Presentation:

Income tax expense $ (45,600) Balance Sheet Presentation:

Current liabilities Income tax payable $ 45,600 No future tax amounts are recorded.

Chapter 16 Exercises

| DC or DB | |

| The employer has no obligation to the fund beyond the required payment | DC |

| Accounting for this type of plan is more complicated | DB |

| The employer bears the investment risk with this type of plan | DB |

| A liability is only recorded when the required payment is not made by year-end | DC |

| Accounting for this type of plan will likely require the use of actuarial specialists | DB |

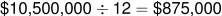

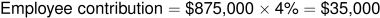

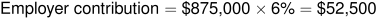

monthly salary

monthly salary

Note:

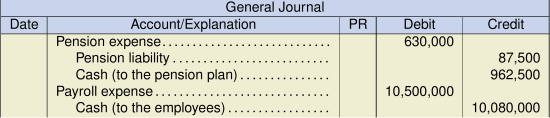

- The company will report a pension expense of $630,000 in the appropriate section of the income statement.

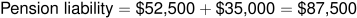

- The company will report a pension liability of $87,500 on December 31, 2022. This will be reported as a current liability, as the funds are remitted to the plan in January 2023.

| Current Service Cost | $ | 1,600,000 | |

| Interest on DBO | 936,000 | ||

| Interest on Assets | (900,000) | ||

| Pension Expense | $ | 1,636,000 |

-

Pension Plan Company Accounting Records DBO Plan Net Cash Annual OCI Assets Defined Pension Benefit Expense Balance Opening balance 6,300,000 CR 5,950,000 DR 350,000 CR Service cost 575,000 CR 575,000 DR Interest: DBO 441,000 CR 441,000 DR Interest: assets 416,500 DR 416,500 CR Contribution 682,000 DR 682,000 CR Benefits paid 186,000 DR 186,000 CR Remeasurement 20,500 DR 20,500 CR gain: assets Journal entry 103,000 DR 682,000 CR 599,500 DR 20,500 CR Closing balance 7,130,000 CR 6,883,000 DR 247,000 CR -

- The company will report a non-current liability of $247,000 on December 31, 2021.

-

Pension Plan Company Accounting Records DBO Plan Net Cash Annual OCI Assets Defined Pension Benefit Expense Balance Opening balance 4,400,000 CR 4,550,000 DR 150,000 DR Service cost 565,000 CR 565,000 DR Interest: DBO 352,000 CR 352,000 DR Interest: assets 364,000 DR 364,000 CR Contribution 422,000 DR 422,000 CR Benefits paid 166,000 DR 166,000 CR Remeasurement 52,000 CR 52,000 DR loss: assets Remeasurement 176,000 CR 176,000 DR loss: DBO Journal entry 359,000 CR 422,000 CR 553,000 DR 228,000 DR Closing balance 5,327,000 CR 5,118,000 DR 209,000 CR -

-

Non-Current Liabilities: Net defined benefit liability $ 209,000 Accumulated Other Comprehensive Income: Net remeasurement losses on defined benefit liability $ (228,000)

- 2020:

Pension Plan Company Accounting Records DBO Plan Net Cash Annual OCI Assets Defined Pension Benefit Expense Balance Opening balance 0 CR 0 DR 0 CR Service cost 389,000 CR 389,000 DR Interest: DBO 0 CR 0 DR Interest: assets 0 DR 0 CR Contribution 348,000 DR 348,000 CR Benefits paid 0 DR 0 CR Remeasurement 2,000 DR 2,000 CR gain: assets Remeasurement 27,000 DR 27,000 CR gain: DBO Journal entry 12,000 CR 348,000 CR 389,000 DR 29,000 CR Closing balance 362,000 CR 350,000 DR 12,000 CR Remeasurement gains are derived by working backwards from the ending balances of the DBO and plan assets. No interest is calculated as the opening balances were zero and it is assumed that transactions occur at the end of the period.

2021:

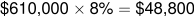

Pension Plan Company Accounting Records DBO Plan Net Cash Annual OCI Assets Defined Pension Benefit Expense Balance Opening balance 362,000 CR 350,000 DR 12,000 CR Service cost 395,000 CR 395,000 DR Interest: DBO* 25,340 CR 25,340 DR Interest: assets** 24,500 DR 24,500 CR Contribution 301,000 DR 301,000 CR Benefits paid 50,000 DR 50,000 CR Remeasurement 15,500 CR 15,500 DR loss: assets*** Remeasurement 0 CR 0 DR loss: DBO Journal entry 110,340 CR 301,000 CR 395,840 DR 15,500 DR Closing balance 732,340 CR 610,000 DR 122,340 CR *

**

*** (Work backwards from the ending balance to determine the balancing figure.)

(Work backwards from the ending balance to determine the balancing figure.) 2022:

Pension Plan Company Accounting Records DBO Plan Net Cash Annual OCI Assets Defined Pension Benefit Expense Balance Opening balance 732,340 CR 610,000 DR 122,340 CR Service cost 410,000 CR 410,000 DR Interest: DBO* 58,587 CR 58,587 DR Interest: assets** 48,800 DR 48,800 CR Contribution 265,000 DR 265,000 CR Benefits paid 54,000 DR 54,000 CR Remeasurement 15,000 CR 15,000 DR loss: assets Remeasurement 42,000 CR 42,000 DR loss: DBO Journal entry 211,787 CR 265,000 CR 419,787 DR 57,000 DR Closing balance 1,188,927 CR 854,800 DR 334,127 CR *

**

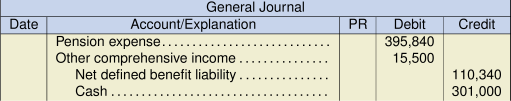

- 2020:

2021:

2022:

- 2020:

Non-Current Liabilities: Net defined benefit liability (underfunded) $ 12,000 Accumulated Other Comprehensive Income: Net remeasurement gains on defined benefit liability $ 29,000 2021:

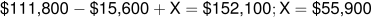

Non-Current Liabilities: Net defined benefit liability (underfunded) $ 122,340 Accumulated Other Comprehensive Income: Net remeasurement gains on defined benefit liability $ 13,500* * Note:

2022:

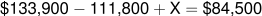

Non-Current Liabilities: Net defined benefit liability (underfunded) $ 334,127 Accumulated Other Comprehensive Income: Net remeasurement losses on defined benefit liability $ (43,500)* * Note:

-

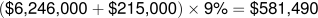

Pension Plan Company Accounting Records DBO Plan Net Cash Annual Assets Defined Pension Benefit Expense Balance Opening balance 6,246,000 CR 6,871,000 DR 625,000 DR Past service cost 215,000 CR 215,000 DR Service cost 510,000 CR 510,000 DR Interest: 581,490 CR 581,490 DR Health Benefit Obligation* Interest: assets** 618,390 DR 618,390 CR Contribution 430,000 DR 430,000 CR Benefits paid 850,000 DR 850,000 CR Journal entry 258,100 CR 430,000 CR 688,100 DR Closing balance 6,702,490 CR 7,069,390 DR 366,900 DR *

**

The post-employment health benefit expense will be $688,100 for the year. Note that the interest on the health benefit obligation is calculated after taking the past service adjustment into account. This is necessary as the past service adjustment was made on January 1.

- The company will report a non-current asset of $366,900, subject to any adjustment required as a result of the asset ceiling test.

-

Pension Plan Company Accounting Records DBO Plan Net Cash Annual Assets Defined Pension Benefit Expense Balance Opening balance 6,300,000 CR 5,950,000 DR 350,000 CR Service cost 575,000 CR 575,000 DR Interest: DBO 441,000 CR 441,000 DR Interest: assets 416,500 DR 416,500 CR Contribution 682,000 DR 682,000 CR Benefits paid 186,000 DR 186,000 CR Remeasurement 20,500 DR 20,500 CR gain: assets Journal entry 103,000 DR 682,000 CR 579,000 DR Closing balance 7,130,000 CR 6,883,000 DR 247,000 CR -

- The company will report a non-current liability of $247,000 on December 31, 2021.

-

Pension Plan Company Accounting Records DBO Plan Net Cash Annual Assets Defined Pension Benefit Expense Balance Opening balance 4,400,000 CR 4,550,000 DR 150,000 DR Service cost 565,000 CR 565,000 DR Interest: DBO 352,000 CR 352,000 DR Interest: assets 364,000 DR 364,000 CR Contribution 422,000 DR 422,000 CR Benefits paid 166,000 DR 166,000 CR Remeasurement 52,000 CR 52,000 DR loss: assets Remeasurement 176,000 CR 176,000 DR loss: DBO Journal entry 359,000 CR 422,000 CR 781,000 DR Closing balance 5,327,000 CR 5,118,000 DR 209,000 CR -

-

Non-Current Liabilities: Net defined benefit liability $ 209,000 No accumulated other comprehensive income is reported. The remeasurement losses would simply be included in retained earnings through the closing of the pension expense account at the end of the year.

Chapter 17 Exercises

- Lessee analysis (ASPE):

- Does ownership title pass? No, title remains with the lessor.

- Is there a BPO or a bargain renewal option? Yes

- Is the lease term 75% or more of the asset's estimated economic or useful life? No 6 years/10 years = 60%, which does not meet the 75% threshold

- Does the present value of the minimum lease payments exceed 90% of the leased asset's fair value? Yes, as calculated below.

Present value of minimum lease payments:

PV = (25,100 PMT/AD, 7 I/Y, 6 N, 3,000 FV) = $130,014 (rounded)

ASPE interest rate used must be the lower of the two rates, since both are known.

The present value compared to the fair value of $130,000 exceeds the 90% numeric threshold. Note that the leased asset and obligation cannot exceed fair value, so $130,000 will be the amount used as the valuation in the journal entries below.

Any one of the criteria met will result in a classification of a capital lease. In this case, the lease agreement has met two criteria: a bargain purchase option, and a present value of the minimum lease payments that exceeds 90% of the fair value of the asset.

Lessor Analysis (ASPE)

The lease agreement meets the capitalization criteria for the lessee above. Additionally, there are no uncertainties regarding the collectability of the lease payments and the costs yet to be incurred by the lessor (both must be met). This would, therefore, be classified as a capital lease for the lessor. The initial amount of net investment (fair value) of $130,000 exceeds the lessor's cost of $90,000, making the lease a sales-type lease to the lessor.

- Gross investment (lease receivable) for the lessor:

The minimum lease payments regarding this lease are:

Calculation:

= $ 150,600 BPO + 3,000 Gross investment at inception $ 153,600 Net investment for the lessor:

The $130,000 fair value in this case (or the present value if it does not exceed the fair value).

-

Lessee and Lessor Lease Amortization Schedule Annual Lease Reduction Balance Payment Interest of Lease Lease Date Plus BPO @ 7% Obligation Obligation Jul 1, 2021 $ 25,100 $ 130,000 Jul 1, 2021 25,100 $ 25,100 104,900 Jul 1, 2022 25,100 $ 7,343 17,757 87,143 Jul 1, 2023 25,100 6,100 19,000 68,143 Jul 1, 2024 25,100 4,770 20,330 47,813 Jul 1, 2025 25,100 3,347 21,753 26,060 Jul 1, 2026 25,100 1,824 23,276 2,784 Jun 30, 2027 3,000 216* 2,784 0 $ 153,600 $ 23,600 $ 130,000 * Note: The lease valuation is limited to its fair value of $130,000 instead of the present value of $130,014. The difference ($14) is insignificant, thus a new interest rate is not required for the amortization schedule above. Had the present value been significantly higher than the fair value, a new effective interest rate would be required and calculated using the following methodology.

I/Y = (+/- 130,000 PV, 25,100 PMT/AD, 6 N, 3,000 FV) = 7.004876% or 7%

As can be seen, the 7% rate for the lessor has not significantly changed, so 7% will be the rate used in the amortization schedule above.

- Lessee journal entries:

Year-end adjusting entries:

* Note: Because there is a bargain purchase option, the leased asset is depreciated over its economic life rather than over the lease term. This is because the BPO, much less than the market price at that time, will be exercised by the lessee and the asset will be used beyond the lease term.

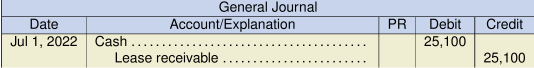

- Lessor entries

Year-end adjusting entry:

2022 payment:

Year-end adjusting entry:

Note: The lessor could record six months of interest income in July, and six months of interest income on December 31 to match the lessee interest entries. However, the minimum reporting requirement would be to recognize interest income each reporting date (December 31). If the lessor also had interim reporting every six months within the fiscal year, interest income would be accrued every six months to ensure that both the interim and year-end financial statements were complete.

- For the lessee:

Rather than using quantitative factors, such as the 75% and the 90% hurdles, the IFRS (IAS 17) criteria use qualitative factors to establish whether the risks and rewards of ownership have transferred to the lessee, which supports the classification as a capitalized lease:

- There is reasonable assurance that the lessee will obtain ownership of the leased property by the end of the lease term. If there is a bargain purchase option in the lease, it is assumed that the lessee will exercise it and obtain ownership of the asset (same as with ASPE).

- The lease term is long enough that the lessee will receive substantially all of the economic benefits that are expected to be derived from using the leased property over its life (equivalent to the 75% numeric threshold for ASPE).

- The lease allows the lessor to recover substantially all of its investment in the leased property and to earn a return on the investment. Evidence of this is provided if the present value of the minimum lease payments is close to the fair value of the leased asset (equivalent to the 90% numeric threshold for ASPE).

- The leased assets are so specialized that, without major modification, they are of use only to the lessee (IFRS (IAS 17) only).

If the lease is deemed as a lease subject to capitalization, the accounting treatment of the lease by the lessee would be the same as ASPE, although it would be referred to as a finance lease, rather than a capital, direct financing lease.

The treatment of the lease by the lessor would be the same as the lessee above, using qualitative criteria rather than numeric thresholds used for ASPE. (The criteria will not include the two-revenue recognition-based tests for uncertainty regarding collectability of lease payments and estimated un-reimbursable costs for the lessor.) The lease would be referred to as a finance lease, manufacturer or dealer rather than a sales-type lease.

- If the lease agreement included an unguaranteed residual, the leased asset would be physically returned to the lessor at the end of the lease term. The depreciation charge would, therefore, be over the lease term and not the asset's economic life, which is the case when a bargain purchase is involved. As well, the depreciation calculation would not include a residual value.

- Lessee analysis (IFRS, IAS 17)

- Does ownership title pass? No, title remains with the lessor.

- Is there a BPO or a bargain renewal option? No

- Is the lease term covering the majority of the asset's estimated economic or useful life? Consider that the lease term is eight years and the economic life is ten years, so this constitutes a major part of the economic life of the asset. Yes, capitalize leased asset.

- The leased asset is a specialized piece of landscaping machinery, so it will only benefit the lessee without major modifications. Yes, capitalize leased asset.

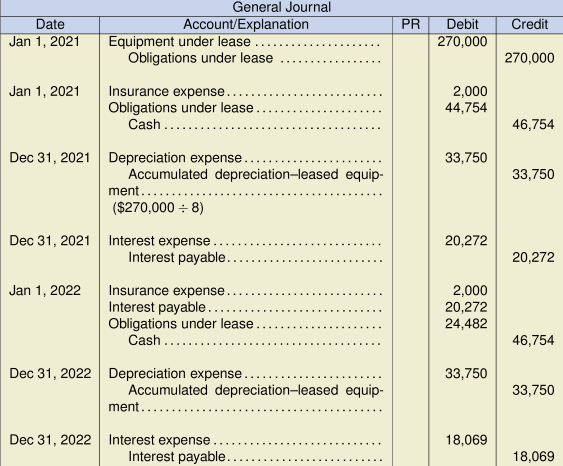

- Does the present value of the minimum lease payments allow the lessor to recover substantially all of the leased asset's fair value as well as realizing a return on the investment? Consider that the present value of the minimum lease payments shown below is nearly equal to the fair value of $270,000, so it appears that the lessor will be reimbursed for all of the leased investment, including a return on investment. Yes, capitalize leased asset.

Yearly payment $ 46,754 Less: Executory costs 2,000 Minimum annual lease payment $ 44,754 Present value of minimum lease payments:

PV = (44,754 PMT/AD, 9 I/Y, 8 N, 0 FV) = $269,999 (which is virtually 100% of the fair value of $270,000)

Under IFRS (IAS 17), the lessee will classify this lease as a finance lease since the lease term covers substantially all of the asset's useful life, the present value of the minimum lease payments allows the lessor to recover almost all of the leased asset's fair value (as well as realizing a return on the investment), and the machinery is highly specialized. Three of the criteria considered were met so it is reasonable to assume that the lessee will capitalize the lease.

The treatment of the lease by the lessor would be the same as the lessee above, using the qualitative criteria rather than numeric thresholds used for ASPE. Except the lessor classification criteria will not include the two-revenue recognition-based tests for uncertainty regarding collectability of lease payments and estimated un-reimbursable costs for the lessor. Again, since three criteria were met, it is reasonable to assume that the lease would be classified as a finance lease.

- IFRS (IAS 17) states that the rate implicit in the lease is to be used wherever it is reasonably determinable. Using the fair value of $270,000, the implicit rate can be calculated:

I/Y = (+/- 270,000 PV, 44,754 PMT/AD, 8 N) = 9% (rounded) which is the same rate as the lessee's

Mercy Ltd. Lease Amortization Schedule (Lessee) Annual Lease Payment Reduction Balance Excluding Interest of Lease Lease Date Executory Costs) @ 9% Obligation Obligation $ 270,000 Jan 1, 2021 $ 44,754 $ 44,754 225,246 Jan 1, 2022 44,754 $ 20,272 24,482 200,764 Jan 1, 2023 44,754 18,069 26,685 174,079 Jan 1, 2024 44,754 15,667 29,087 144,992 Jan 1, 2025 44,754 13,049 31,705 113,287 Jan 1, 2026 44,754 10,196 34,558 78,729 Jan 1, 2027 44,754 7,086 37,668 41,061 Jan 1, 2028 44,754 3,693* 41,061 0 $ 358,032 $ 88,032 $ 270,000 * rounded -

| Mercy Ltd. | |||

| Statement of Financial Position | |||

| December 31, 2022 | |||

| Non-current assets | |||

| Equipment under lease | $ | 270,000 | |

| Accumulated depreciation | (67,500) | ||

| 202,500 | |||

| Current liabilities | |||

| Interest payable | 18,069 | ||

| Current portion of long-term lease obligation* | 26,685 | ||

| Non-current liabilities | |||

|

Long-term lease obligation ( |

$ | 174,079 | |

* The principal portion of the lease payment over the next 12 months after the reporting date of December 31, 2022. Refer to the amortization schedule above.

Required disclosure in the notes:

The following is a schedule of future minimum lease payments under the finance lease, expiring December 31, 2028, together with the balance of the obligation under finance lease.

| Year ending December 31 | |||

| 2023 | $ | 46,754 | |

| 2024 | 46,754 | ||

| 2025 | 46,754 | ||

| 2026 | 46,754 | ||

| 2027 | 46,754 | ||

| 2028 | 46,754 | ||

| 280,524 | |||

| Less amount representing executory costs | 12,000 | ||

| Total minimum lease payments | 268,524 | ||

| Less amount representing interest at 9%* | 67,760 | ||

| Balance of the obligation, December 31, 2022 | $ | 200,764 | |

* ![]()

Note: Additional disclosures would also be required about material lease arrangements, including contingent rents, sub-lease payments, and lease-imposed restrictions. These do not apply in this case.

Lessee Analysis (IFRS, IAS 17)

- Does the ownership title pass? No, title remains with the lessor.

- Is there a BPO or a bargain renewal option? No

- Does the lease term cover the majority of the asset's estimated economic or useful life? Consider that the lease term is eight years, and the economic life is twelve years, the lease covers a major part of the economic life of the asset. Yes, capitalize leased asset.

- As the leased asset is a specialized piece of landscaping machinery, it will only benefit the lessee without major modifications. Yes, capitalize leased asset.

- Does the present value of the minimum lease payments allow the lessor to recover substantially all of the leased asset's fair value, as well as realizing a return on the investment? Consider that the present value of the minimum lease payments is $288,960, compared to the fair value of $300,000, making the minimum lease payments nearly equal to the fair value at that date. As such, the lessor will recover substantially all of the leased asset's fair value, as well as a return of 9% on the investment. Yes, as calculated below.

Yearly payment $ 50,397 Less: Executory costs 2,500 Minimum annual lease payment $ 47,897 Present value of minimum lease payments:

PV = (47,897 PMT/AD, 9 I/Y, 8 N, 0 FV) = 288,960 (which is substantially most of the fair value of $300,000)Consider the following criteria: The lease term covers substantially all of the asset's useful life, the present value of the minimum lease payments recovers substantially most of the leased asset's fair value (as well as realizing a return on the investment), and the machinery is highly specialized for the lessee. As these three factors have been met, it is reasonable to assume that the lease will be classified as a finance lease for the lessee under IFRS (IAS 17).

- This is a finance lease to Oberton Ltd. The IFRS (IAS 17) criteria use qualitative factors to establish whether the risks and rewards of ownership are transferred to the lessee, and supports classification as a finance lease:

- There is reasonable assurance that the lessee will obtain ownership of the leased property by the end of the lease term. If there is a bargain purchase option in the lease, it is assumed that the lessee will exercise it and obtain ownership of the asset. No

- The lease term is long enough that the lessee will receive substantially all of the economic benefits that are expected to be derived from using the leased property over its life (as evidenced by a four-year lease compared to a six-year estimated economic life). Yes, this represents a major part of the economic life of the asset.

- The lease allows the lessor to recover substantially all of its investment in the leased property and to earn a return on the investment. Evidence of this is provided if the present value of the minimum lease payments is close to the fair value of the leased asset. Yes

Compared to a fair value of $18,000 = 100% recovery of investment + an 8% return on investment.

- The leased assets are so specialized that, without major modification and/or significant cost to the lessor, they are of use only to the lessee. No

The standard also states that these indicators are not always conclusive. The decision has to be made on the substance of each specific transaction. If the lessee determines that the risks and benefits of ownership have not been transferred to it, the lease is classified as an operating lease. In this case, two factors have been met so it would be reasonable to classify this lease as a finance lease for the lessee.

For Black Ltd. (the lessor) under IFRS (IAS 17), the lease would receive the same treatment as for the lessee using the qualitative factors. Black Ltd. reasonably meets the factors, and is not a manufacturer or dealer, and so this is a finance lease.

- Calculation of annual rental payment:

PMT = +/- 18,000 PV, 8 I/Y, 4 N, 3,500 FV =

= $4,333 lease payment, including executory costs of $20.

= $4,333 lease payment, including executory costs of $20.This confirms that the interest rate used to calculate the lease payment was 8% per annum.

-

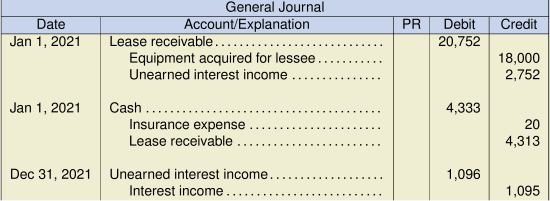

Lease Amortization Schedule Lease Payment Reduction Balance Excluding Interest of Lease Lease Date Executive Costs) @ 8% Obligation Obligation $ 18,000 Jan. 1, 2021 $ 4,313 $ 4,313 13,687 Jan. 1, 2022 4,313 $ 1,095 3,218 10,469 Jan. 1, 2023 4,313 838 3,475 6,994 Jan. 1, 2024 4,313 560 3,753 3,241 Jan. 1, 2025 3,500 259 3,241 0 $ 20,752 $ 2,752 $ 18,000 -

-

Oberton Ltd. Statement of Financial Position December 31, 2021 Non-current assets Property, plant, and equipment Vehicles under lease $ 18,000 Less accumulated depreciation 3,625 14,375 Current liabilities Interest payable 1,095 Obligations under lease (Note 1) 3,218 Non-current liabilities Obligations under lease (Note 1) $ 10,469 Note 1: The following is a schedule of future minimum payments under finance lease expiring January 1, 2025, together with the present balance of the obligation under the lease.

Year ending December 31, 2021 2022 $ 4,333 2023 4,333 2024 4,333 2025 3,500 16,499 Amount representing executory costs (60) Amount representing interest (2,752) Balance of obligation December 31, 2021 $ 13,687 Oberton Ltd. Statement of Income For the Year Ended December 31, 2021 Administrative expense Depreciation expense $ 3,625 Insurance expense 20 Other expenses Interest expense 1,095 * from lease amortization schedule part (c)

-

- Entries for Black Ltd.:

-

Black Ltd. Income Statement For the Year Ended December 31, 2021 Revenue Interest income (leases)* $ 1,095 * from lease amortization schedule part (c)

Note: The insurance recovery of $20 per year would offset the original insurance expense incurred by Black Ltd.

- Lessor Analysis (ASPE)

-

*

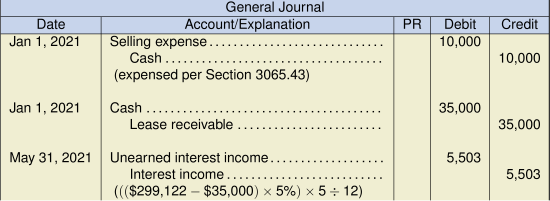

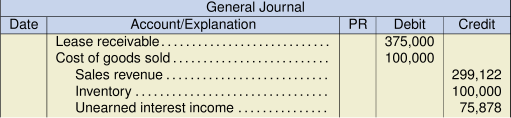

Note: The unguaranteed residual value is included in the lessor's gross investment even though the lessee does not guarantee it. From the lessor's perspective, it anticipates receiving $25,000 from a third party at the end of the lease term and it does not matter who they receive it from. ** The residual value is unguaranteed, so its present value must be removed from the sale price to the lessee. Present value of the minimum lease payments = (35,000 PMT/AD, 5 I/Y, 10 N, 25,000 FV) = $299,122 Sales price

Note: The unguaranteed residual value is included in the lessor's gross investment even though the lessee does not guarantee it. From the lessor's perspective, it anticipates receiving $25,000 from a third party at the end of the lease term and it does not matter who they receive it from. ** The residual value is unguaranteed, so its present value must be removed from the sale price to the lessee. Present value of the minimum lease payments = (35,000 PMT/AD, 5 I/Y, 10 N, 25,000 FV) = $299,122 Sales price  OR remove the $25,000 residual value from the present value calculation above. PV = (35,000 PMT/AD, 5 I/Y, 10 N) = $283,774 *** The unearned interest income of $75,878 is calculated as the lease receivable (gross investment) less the present value of the minimum lease payments (

OR remove the $25,000 residual value from the present value calculation above. PV = (35,000 PMT/AD, 5 I/Y, 10 N) = $283,774 *** The unearned interest income of $75,878 is calculated as the lease receivable (gross investment) less the present value of the minimum lease payments ( ).

).

- Assuming the $25,000 residual value was guaranteed by the lessee, this would change the initial entry for the sale as follows:

The sales revenue and cost of goods sold would not need to be reduced by the present value of the estimated residual value ($15,348) calculated in part (b). The sales revenue would, therefore, be the amount equalling the present value of the minimum lease payments.

- Lease payment PMT/AD = (299,122 PV, 5 I/Y, 12 N, 40,000 FV) = $29,748 (rounded)

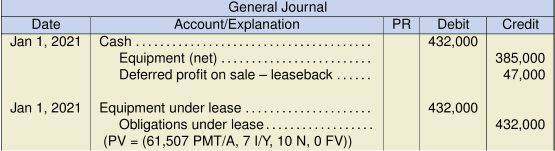

- Lessee Analysis (ASPE)

- Does ownership title pass? Yes, legal title passes to the lessee at the end of the lease term.

- Is there a BPO or a bargain renewal option? N/A, title passes, so BPO is not relevant.

- Is the lease term 75% or more of the asset's estimated economic or useful life? Yes 10 years/10 years = 100% which meets the 75% threshold

- Does the present value of the minimum lease payments exceed 90% of the leased asset's fair value? Yes, as calculated below.

PV = (61,507 PMT/A, 7 I/Y, 10 N, 0 FV) = $432,000 (rounded)

The ASPE interest rate used must be the lower of the two, since both are known.

The present value is equal to the fair value of $432,000, so it exceeds the 90% numeric threshold.

Any one of the criteria met will result in a classification of a capital lease for the lessee. In this case, the lease agreement has met three criteria: legal title passes to the lessee, a lease term that exceeds 75% of the estimated economic life of the leased asset, and a present value of the minimum lease payments that exceeds 90% of the fair value of the asset.

Lessor Analysis (ASPE)

The lease agreement meets the capitalization criteria for the lessee above. In addition, there are no uncertainties regarding the collectability of the lease payments or the costs yet to be incurred by the lessor (both must be met). This would, therefore, be classified as a capital lease for the lessor. Additionally, as the lessor is a financing company this lease would be classified as a direct-financing lease by the lessor.

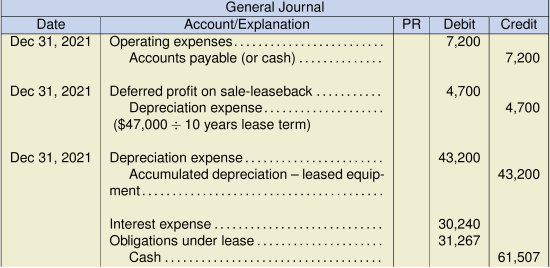

- Kimble Ltd. (lessee) entries

Note: The present value calculation in this case will involve the annual payment (PMT) of an ordinary annuity (paid at the end of each year) for 10 periods at 7%. The interest rate under ASPE is to be the lower of the two rates, if both are known.

Earlier leasing questions involved the annual payment of an annuity due at the beginning of each year over the lease term.

Note: Under ASPE, Kimble Ltd. is to use the lower of the two rates. The deferred profit on the sale-leaseback is to be amortized on the same basis that the asset is being depreciated, which, in this case, is ten years.

Quick Finance Corp. (lessor) entries

Chapter 18 Exercises

| Transaction | Effect |

| Issuance of common shares | NE |

| Share split | NE |

| A revaluation of surplus resulting from a remeasurement of an | |

| available-for-sale asset | NE |

| Declaration of a cash dividend | D |

| Net income earned during the year | I |

| Declaration of a share dividend | D |

| Payment of a cash dividend | NE |

| Issuance of preferred shares | NE |

| Re-acquisition of common shares | D or NE |

| Appropriation of retained earnings for a reserve | D |

| A cumulative, preferred dividend that is unpaid at the end of the year | NE |

Note: The contributed surplus is reduced on a pro-rata basis, as this surplus resulted from a share premium on issue, and not from a previous re-acquisition.

Also, note that the contributed surplus is fully utilized because it resulted from a previous re-acquisition of the same class of shares. As such, we do not need to allocate it on a pro-rata basis.

May 20 – no journal entry required

May 30 – no journal entry required

-

Calculation Preferred Common Total Current year: (  )

)$ 150,000 $ 150,000 Balance of dividends – $ 1,050,000 1,050,000 $ 150,000 $ 1,050,000 $ 1,200,000 -

Calculation Preferred Common Total Arrears: (  )

)$ 300,000 $ 300,000 Current year: (  )

)150,000 150,000 Balance of dividends – $ 750,000 750,000 $ 450,000 $ 750,000 $ 1,200,000 -

Calculation Preferred Common Total Arrears, as before $ 300,000 $ 300,000 Current year year basic dividend 150,000 $ 240,000 390,000 Current year participating dividend 196,146 313,854 510,000 $ 646,146 $ 553,854 $ 1,200,000 Note: The basic preferred dividend is calculated as before. Then, a like amount is allocated to the common shares. The preferred dividend can be expressed as a percentage:

(or

(or  ). Therefore, the common shares are also allocated a basic dividend of (

). Therefore, the common shares are also allocated a basic dividend of ( ) = $240,000. This leaves a remaining dividend of $510,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:

) = $240,000. This leaves a remaining dividend of $510,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:Carrying amounts of each class:

Preferred $ 5,000,000 38.46% Common 8,000,000 61.54% Total $ 13,000,000 100% The participating dividend is therefore:

Preferred:

= $196,146 Common:

= $313,854

- Implied value of the company before the dividend:

50% share dividend would issue an additional

shares

sharesThe ex-dividend price should be

per share

per shareA 3-for-2 share split results in the same number of shares being issued as above, making the share price $8.

- For the 50% share dividend, the dividend amount will be calculated as

Common shares $ 32,500,000 Retained earnings 22,000,000 Total equity $ 54,500,000 A 3-for-2 share split has no effect on the accounts, as it simply increases the number of outstanding shares. Therefore, the equity section will appear as follows:

Common shares $ 12,500,000 Retained earnings 42,000,000 Total equity $ 54,500,000 - Either action will result in the share price dropping to $8 per share from $12. However, the total reported equity will not change as it's just a question of how the deck will be shuffled, so to speak, in the equity section. The decision will depend on both the legal framework in the company's jurisdiction and the corporate objectives of the distribution. There may be legal restrictions and tax implications, with respect to the share dividend, which would make the share split easier to implement. On the other hand, if the directors would like to capitalize some of the retained earnings to potentially reduce future shareholder demands for dividends, then the share dividend would be the better approach. The directors will also have to consider if the shareholder response will be different for each scenario. The directors should also consider if there are any other contracts or agreements, such as loan covenants, that would be affected by the decision.

-

Average issue price =

Preferred dividend:

Common dividend:

-

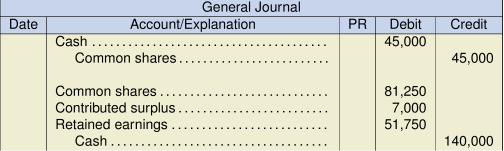

Ocampo Inc. Statement of Changes in Shareholders' Equity Year Ended 31 December 2022 Accumulated Preferred Common Contributed Retained Other Comp. Total Shares Shares Surplus Earnings Income Balance on January 1 $ 1,217,000 $ 225,000 $ 280,000 $ 7,000 $ 590,000 $ 115,000 Comprehensive Income: Net income 120,000 120,000 Revaluation 23,000 23,000 Total comprehensive income 143,000 Shares issued 64,000 19,000 45,000 Shares retired (140,000) (81,250) (7,000) (51,750) Cash dividend – common (33,000) (33,000) Cash dividend – preferred (11,000) (11,000) Share dividend – common – 48,000 (48,000) Balance on December 31 $ 1,240,000 $ 244,000 $ 291,750 – $ 566,250 $ 138,000 Note: Additional details of the transactions and the authorized and issued shares would be contained in the notes to the financial statements.

Note: Treasury shares were acquired at a price of ![]() per share. This is the price used to remove the treasury shares on resale.

per share. This is the price used to remove the treasury shares on resale.

Average issue price = ![]() per share

per share

![]()

Average issue price = ![]() per share

per share

![]()

There is no contributed surplus balance associated with preferred share re-acquisitions, so the full difference is charged to retained earnings.

Common dividend: ![]()

Note: The shares remaining in treasury are excluded from the dividend calculation, as the company cannot pay itself a dividend. The company's issued share capital includes the treasury shares, although they are not outstanding.

Preferred dividend: ![]()

Note: This calculation assumes that the cumulative, unpaid dividend on the retired preferred shares was not paid. Depending on the articles of incorporation and local legislation, the cumulative, unpaid dividend may need to be paid prior to retirement of the shares. This would result in an additional dividend of $50,000 (![]() ) paid on the date of retirement.

) paid on the date of retirement.

Chapter 19 Exercises

- Basic earnings per share calculation:

Step 1: Record the opening balance of shares outstanding and each subsequent event, date, description, and number of shares for the current reporting. An event is where the outstanding number of shares changes.

Step 2: For stock dividends or stock splits, apply the required retroactive restatement factor(s) from the event point when it initially occurs and backwards to the beginning of the fiscal year.