1.4.14.2: Product

- Last updated

- Save as PDF

- Page ID

- 58590

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)What you’ll learn to do: explain common product marketing strategies and how organizations use them

Often when we hear the word marketing, we think about promotion or perhaps only advertising, but product is the core of the marketing mix. Product defines what will be priced, promoted, and distributed. If you are able to create and deliver a product that provides exceptional value to your target customer, the rest of the marketing mix is easier to manage. A successful product makes every aspect of a marketer’s job easier—and more fun.

Learning Objectives

- Explain the elements and benefits of branding

- Describe the product life cycle

- Explain the stages of the new-product development process

Consumer Product Categories

A product is a bundle of attributes (features, functions, benefits, and uses) that a person receives in an exchange. In essence, the term “product” refers to anything offered by a firm to provide customer satisfaction, tangible or intangible. Thus, a product may be an idea (recycling), a physical good (a pair of sneakers), a service (banking), or any combination of the three.[1]

Broadly speaking, products fall into one of two categories: consumer products and business products (also called industrial products and B2B products). Consumer products are purchased by the final consumer. Business products are purchased by other industries or firms and can be classified as production goods—i.e., raw materials or component parts used in the production of the final product—or support goods—such as machinery, fixed equipment, software systems, and tools that assist in the production process.[2] Some products, like computers, for instance, may be both consumer products and business products, depending on who purchases and uses them.

The product fills an important role in the marketing mix because it is the core of the exchange. Does the product provide the features, functions, benefits, and uses that the target customer expects and desires? Throughout our discussion of product we will focus on the target customer. Often companies become excited about their capabilities, technologies, and ideas and forget the perspective of the customer. This leads to investments in product enhancements or new products that don’t provide value to the customer—and, as a result, are unsuccessful.

Consumer products are often classified into four groups related to different kinds of buying decisions: convenience, shopping, specialty, and unsought products. These are described below.

Convenience Products

A convenience product is an inexpensive product that requires a minimum amount of effort on the part of the consumer in order to select and purchase it. Examples of convenience products are bread, soft drinks, pain reliever, and coffee. They also include headphones, power cords, and other items that are easily misplaced.

A convenience product is an inexpensive product that requires a minimum amount of effort on the part of the consumer in order to select and purchase it. Examples of convenience products are bread, soft drinks, pain reliever, and coffee. They also include headphones, power cords, and other items that are easily misplaced.

From the consumer’s perspective, little time, planning, or effort go into buying convenience products. Often product purchases are made on impulse, so availability is important. Consumers have come to expect a wide variety of products to be conveniently located at their local supermarkets. They also expect easy online purchase options and low-cost, quick shipping for those purchases. Convenience items are also found in vending machines and kiosks.

For convenience products, the primary marketing strategy is extensive distribution. The product must be available in every conceivable outlet and must be easily accessible in these outlets. These products are usually of low unit value, and they are highly standardized. Marketers must establish a high level of brand awareness and recognition. This is accomplished through extensive mass advertising, sales promotion devices such as coupons and point-of-purchase displays, and effective packaging. Yet, the key is to convince resellers (wholesalers and retailers) to carry the product. If the product is not available when, where, and in a form the consumer desires, the convenience product will fail.

Shopping Products

In contrast, consumers want to be able to compare products categorized as shopping products. Shopping products are usually more expensive and are purchased occasionally. The consumer is more likely to compare a number of options to assess quality, cost, and features.

Although many shopping goods are nationally advertised, in the marketing strategy it is often the ability of the retailer to differentiate itself that generates the sale. If you decide to buy a TV at BestBuy, then you are more likely to evaluate the range of options and prices that BestBuy has to offer. It becomes important for BestBuy to provide a knowledgeable and effective sales person and have the right pricing discounts to offer you a competitive deal. BestBuy might also offer you an extended warranty package or in-store service options. While shopping in BestBuy, consumers can easily check prices and options for online retailers, which places even greater pressure on BestBuy to provide the best total value to the shopper. If the retailer can’t make the sale, product turnover is slower, and the retailer will have a great deal of their capital tied up in inventory.

There is a distinction between heterogeneous and homogeneous shopping products. Heterogeneous shopping products are unique. Think about shopping for clothing or furniture. There are many stylistic differences, and the shopper is trying to find the best stylistic match at the right price. The purchase decision with heterogeneous shopping products is more likely to be based on finding the right fit than on price alone.

In contrast, homogeneous shopping products are very similar. Take, for example, refrigerators. Each model has certain features that are available at different price points, but the basic functions of all of the models are very similar. A typical shopper will look for the lowest price available for the features that they desire.

Specialty Products

Specialty goods represent the third product classification. From the consumer’s perspective, these products are so unique that it’s worth it to go to great lengths to find and purchase them. Almost without exception, price is not the principle factor affecting the sales of specialty goods. Although these products may be custom-made or one-of-a-kind, it is also possible that the marketer has been very successful in differentiating the product in the mind of the consumer.

Blizzcon attendees, 2014

Blizzcon attendees, 2014

For example, some consumers feel a strong attachment to their hair stylist or barber. They are more likely to wait for an appointment than schedule time with a different stylist.

Another example is the annual Blizzcon event produced by Blizzard Entertainment. The $200 tickets sell out minutes after they are released, and they are resold at a premium. At the event, attendees get the chance to learn about new video games and play games that have not yet been released. They can also purchase limited-edition promotional items. From a marketer’s perspective, in Blizzcon the company has succeeded in creating a specialty product that has incredibly high demand. Moreover, Blizzard’s customers are paying for the opportunity to be part of a massive marketing event.

It is generally desirable for a marketer to lift her product from the shopping to the specialty class—and keep it there. With the exception of price-cutting, the entire range of marketing activities is needed to accomplish this.

Unsought Products

Unsought products are those the consumer never plans or hopes to buy. These are either products that the customer is unaware of or products the consumer hopes not to need. For example, most consumers hope never to purchase pest control services and try to avoid purchasing funeral plots. Unsought products have a tendency to draw aggressive sales techniques, as it is difficult to get the attention of a buyer who is not seeking the product.

Elements and Benefits of Branding

What Is a Brand?

As we start our exploration of brand and its role in marketing, take a few minutes to watch the following video about Coca-Cola, which is perhaps one of the most iconic brands of all time. As you watch this video, look and listen for the all the different elements that contribute to the thing we call a “brand.”

Click here to read a transcript of the video.

Brands are interesting, powerful concoctions of the marketplace that create tremendous value for organizations and for individuals. Because brands serve several functions, we can define the term “brand” in the following ways:

- A brand is an identifier: a name, sign, symbol, design, term, or some combination of these things that identifies an offering and helps simplify choice for the consumer.

- A brand is a promise: the promise of what a company or offering will provide to the people who interact with it.

- A brand is an asset: a reputation in the marketplace that can drive price premiums and customer preference for goods from a particular provider.

- A brand is a set of perceptions: the sum total of everything individuals believe, think, see, know, feel, hear, and experience about a product, service, or organization.

- A brand is “mind share”: the unique position a company or offering holds in the customer’s mind, based on their past experiences and what they expect in the future.

A brand consists of all the features that distinguish the goods and services of one seller from another: name, term, design, style, symbols, customer touch points, etc. Together, all elements of the brand work as a psychological trigger or stimulus that causes an association to all other thoughts one has had about this brand.

Brands are a combination of tangible and intangible elements, such as the following:

- Visual design elements (i.e., logo, color, typography, images, tagline, packaging, etc.)

- Distinctive product features (i.e. quality, design sensibility, personality, etc.)

- Intangible aspects of customers’ experience with a product or company (i.e. reputation, customer experience, etc.)

Branding–the act of creating or building a brand–may take place at multiple levels: company brands, individual product brands, or branded product lines. Any entity that works to build consumer loyalty can also be considered a brand, such as celebrities (Lady Gaga, e.g.), events (Susan G. Komen Race for the Cure, e.g.), and places (Las Vegas, e.g.).

Brands Create Market Perceptions

A successful brand is much more than just a name or logo. As suggested in one of the definitions above, brand is the sum of perceptions about a company or product in the minds of consumers. Effective brand building can create and sustain a strong, positive, and lasting impression that is difficult to displace. Brands provide external cues to taste, design, performance, quality, value, or other desired attributes if they are developed and managed properly. Brands convey positive or negative messages about a company, product, or service. Brand perceptions are a direct result of past advertising, promotion, product reputation, and customer experience.

A brand can convey multiple levels of meaning, including the following:

As an automobile brand, the Mercedes-Benz logo suggests high prestige.

As an automobile brand, the Mercedes-Benz logo suggests high prestige.

- Attributes: specific product features. The Mercedes-Benz brand, for example, suggests expensive, well-built, well-engineered, durable vehicles.

- Benefits: attributes translate into functional and emotional benefits. Mercedes automobiles suggest prestige, luxury, wealth, reliability, self-esteem.

- Values: company values and operational principles. The Mercedes brand evokes company values around excellence, high performance, power.

- Culture: cultural elements of the company and brand. Mercedes represents German precision, discipline, efficiency, quality.

- Personality: strong brands often project a distinctive personality. The Mercedes brand personality combines luxury and efficiency, precision and prestige.

- User: brands may suggest the types of consumers who buy and use the product. Mercedes drivers might be perceived and classified differently than, for example, the drivers of Cadillacs, Corvettes, or BMWs.

Brands Create an Experience

Effective branding encompasses everything that shapes the perception of a company or product in the minds of customers. Names, logos, brand marks, trade characters, and trademarks are commonly associated with brand, but these are just part of the picture. Branding also addresses virtually every aspect of a customer’s experience with a company or product: visual design, quality, distinctiveness, purchasing experience, customer service, and so forth. Branding requires a deep knowledge of customers and how they experience the company or product. Brand-building requires long-term investment in communicating about and delivering the unique value embodied in a company’s “brand,” but this effort can bring long-term rewards.

In consumer and business-to-business markets, branding can influence whether consumers will buy the product and how much they are willing to pay. Branding can also help in new product introduction by creating meaning, market perceptions, and differentiation where nothing existed previously. When companies introduce a new product using an existing brand name (a brand extension or a branded product line), they can build on consumers’ positive perceptions of the established brand to create greater receptivity for the new offering.

Brands Create Value

The Dunkin’ Donuts logo, which includes an image of a DD cup of coffee, makes it easy to spot anywhere. The coffee is known for being a good value at a great price.

The Dunkin’ Donuts logo, which includes an image of a DD cup of coffee, makes it easy to spot anywhere. The coffee is known for being a good value at a great price.

Brands create value for consumers and organizations in a variety of ways.

Value of Branding for the Consumer

Brands help simplify consumer choices. Brands help create trust, so that a person knows what to expect from a branded company, product, or service. Effective branding enables the consumer to easily identify a desirable company or product because the features and benefits have been communicated effectively. Positive, well-established brand associations increase the likelihood that consumers will select, purchase, and consume the product. Dunkin’ Donuts, for example, has an established logo and imagery familiar to many U.S. consumers. The vivid colors and image of a DD cup are easily recognized and distinguished from competitors, and many associate this brand with tasty donuts, good coffee, and great prices.

Value of Branding for Product and Service Providers

The Starbucks brand is associated with premium, high-priced coffee.

The Starbucks brand is associated with premium, high-priced coffee.

For companies and other organizations that produce goods, branding helps create loyalty. It decreases the risk of losing market share to the competition by establishing a competitive advantage customers can count on. Strong brands often command premium pricing from consumers who are willing to pay more for a product they know, trust, and perceive as offering good value. Branding can be a great vehicle for effectively reaching target audiences and positioning a company relative to the competition. Working in conjunction with positioning, brand is the ultimate touchstone to guide choices around messaging, visual design, packaging, marketing, communications, and product strategy.

For example, Starbucks’ loyal fan base values and pays premium prices for its coffee. Starbucks’ choices about beverage products, neighborhood shops, the buying experience, and corporate social responsibility all help build the Starbucks brand and communicate its value to a global customer base.

Value of Branding for the Retailer

Retailers such as Target, Safeway, and Walmart create brands of their own to create a loyal base of customers. Branding enables these retailers to differentiate themselves from one another and build customer loyalty around the unique experiences they provide. Retailer brand building may focus around the in-store or online shopping environment, product selection, prices, convenience, personal service, customer promotions, product display, etc.

Retailers also benefit from carrying the branded products customers want. Brand-marketing support from retailers or manufacturers can help attract more customers (ideally ones who normally don’t frequent an establishment). For example, a customer who truly values organic brands might decide to visit a Babies R Us to shop for organic household cleaners that are safe to use around babies. This customer might have learned that a company called BabyGanics, which brands itself as making “safe, effective, natural household solutions,” was only available at this particular retailer.

Common Branding Strategies

Managing Brands As Strategic Assets

As organizations establish and build strong brands, they can pursue a number of strategies to continue developing them and extending their value to stakeholders (customers, retailers, supply chain and distribution partners, and of course the organization itself).

Brand Ownership

Steve Jobs, co-founder and CEO of Apple

Who “owns” the brand? The legal owner of a brand is generally the individual or entity in whose name the legal registration has been filed. Operationally speaking, brand ownership should be the responsibility of an organization’s management and employees. Brand ownership is about building and maintaining a brand that reflects your principles and values. Brand building is about effectively persuading customers to believe in and purchase your product or service. Iconic brands, such as Apple and Disney, often have a history of visionary leaders who champion the brand, evangelize about it, and build it into the organizational culture and operations.

Branding Strategies

A branding strategy helps establish a product within the market and to build a brand that will grow and mature. Making smart branding decisions up front is crucial since a company may have to live with their decisions for a long time. The following are commonly used branding strategies:

“Branded House” Strategy

A “branded house” strategy (sometimes called a “house brand”) uses a strong brand—typically the company name—as the identifying brand name for a range of products (for example, Mercedes Benz or Black & Decker) or a range of subsidiary brands (such as Cadbury Dairy Milk or Cadbury Fingers). Because the primary focus and investment is in a single, dominant “house” brand, this approach can be simpler and more cost effective in the long run when it is well aligned with broader corporate strategy.

“House of Brands” Strategy

Kool-Aid Man

Kool-Aid Man

With the “house of brands” strategy, a company invests in building out a variety of individual, product-level brands. Each of these brands has a separate name and may not be associated with the parent company name at all. These brands may even be in de facto competition with other brands from the same company. For example, Kool-Aid and Tang are two powdered beverage products, both owned by Kraft Foods. The “house of brands” strategy is well suited to companies that operate across many product categories at the same time. It allows greater flexibility to introduce a variety of different products, of differing quality, to be sold without confusing the consumer’s perception of what business the company is in or diluting brand perceptions about products that target different tiers or types of consumers within the same product category.

Private-Label or Store Branding

Also called store branding, private-label branding has become increasingly popular. In cases where the retailer has a particularly strong identity, the private label may be able to compete against even the strongest brand leaders and may outperform those products that are not otherwise strongly branded. The northeastern U.S. grocery chain Wegman’s offers many grocery products that carry the Wegman’s brand name. Meanwhile national grocery chain Safeway offers several different private label “store” brands: Safeway Select, Organics, Signature Cafe, and Primo Taglio, among others.[3]

“No-Brand” Branding

A number of companies successfully pursue “no-brand” strategies by creating packaging that imitates generic-brand simplicity. “No brand” branding can be considered a type of branding since the product is made conspicuous by the absence of a brand name. “Tapa Amarilla” or “Yellow Cap” in Venezuela during the 1980s is a prime example of no-brand strategy. It was recognized simply by the color of the cap of this cleaning products company.

Personal and Organizational Brands

Personal and organizational branding are strategies for developing a brand image and marketing engine around individual people or groups. Personal branding treats persons and their careers as products to be branded and sold to target audiences. Organizational branding promotes the mission, goals, and/or work of the group being branded. The music and entertainment industries provide many examples of personal and organizational branding. From Justin Bieber to George Clooney to Kim Kardashian, virtually any celebrity today is a personal brand. Likewise, bands, orchestras, and other artistic groups typically cultivate an organizational (or group) brand. Faith branding is a variant of this brand strategy, which treats religious figures and organizations as brands seeking to increase their following. Mission-driven organizations such the Girl Scouts of America, the Sierra Club, the National Rifle Association (among millions of others) pursue organizational branding to expand their membership, resources, and impact.

Personal and organizational branding are strategies for developing a brand image and marketing engine around individual people or groups. Personal branding treats persons and their careers as products to be branded and sold to target audiences. Organizational branding promotes the mission, goals, and/or work of the group being branded. The music and entertainment industries provide many examples of personal and organizational branding. From Justin Bieber to George Clooney to Kim Kardashian, virtually any celebrity today is a personal brand. Likewise, bands, orchestras, and other artistic groups typically cultivate an organizational (or group) brand. Faith branding is a variant of this brand strategy, which treats religious figures and organizations as brands seeking to increase their following. Mission-driven organizations such the Girl Scouts of America, the Sierra Club, the National Rifle Association (among millions of others) pursue organizational branding to expand their membership, resources, and impact.

Place Branding

The developing fields of place branding and nation branding work on the assumption that places compete with other places to win over people, investment, tourism, economic development, and other resources. With this in mind, public administrators, civic leaders, and business groups may team up to “brand” and promote their city, region, or nation among target audiences. Depending on the goals they are trying to achieve, targets for these marketing initiatives may be real-estate developers, employers and business investors, tourists and tour/travel operators, and so forth. While place branding may focus on any given geographic area or destination, nation branding aims to measure, build, and manage the reputation of countries.

The city-state Singapore is an early, successful example of nation branding. The edgy Las Vegas “What Happens Here, Stays Here” campaign, shown in in the following video, is a well-known example of place branding.

Co-Branding

Co-branding is an arrangement in which two established brands collaborate to offer a single product or service that carries both brand names. In these relationships, generally both parties contribute something of value to the new offering that neither would have been able to achieve independently. Effective co-branding builds on the complementary strengths of the existing brands. It can also allow each brand an entry point into markets in which they would not otherwise be credible players.

The following are some examples of co-branded offerings:

- Delta Airlines and American Express offer an entire family of co-branded credit cards; other airlines offer similar co-branded cards that offer customer rewards in terms of frequent flyer points and special offers.

Fiat 500 “Barbie”

Fiat 500 “Barbie”

- Home furnishings company Pottery Barn and the paint manufacturer Benjamin Moore co-brand seasonal color palettes for home interior paints

- Fashion designer Liz Lange designs a ready-to-wear clothing line co-branded with and sold exclusively at Target stores

- Auto maker Fiat and toy maker Mattel teamed up to celebrate Barbie’s fiftieth anniversary with the nail-polish-pink Fiat 500 Barbie car.

Co-branding is a common brand-building strategy, but it can present difficulties. There is always risk around how well the market will receive new offerings, and sometimes, despite the best-laid plans, co-branded offerings fall flat. Also, these arrangements often involve complex legal agreements that are difficult to implement. Co-branding relationships may be unevenly matched, with the partners having different visions for their collaboration, placing different priority on the importance of the co-branded venture, or one partner holding significantly more power than the other in determining how they work together. Because co-branding impacts the existing brands, the partners may struggle with how to protect their current brands while introducing something new and possibly risky.

Brand Licensing

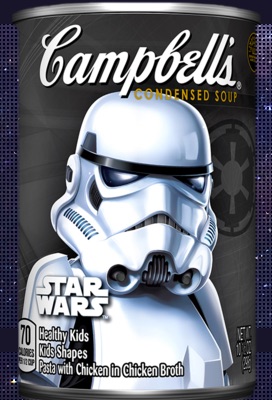

Campbell’s “Star Wars” Soup. Source: http://www.campbells.com/star-wars/

Campbell’s “Star Wars” Soup. Source: http://www.campbells.com/star-wars/

Brand licensing is the process of leasing or renting the right to use a brand in association with a product or set of products for a defined period and within a defined market, geography, or territory. Through a licensing agreement, a firm (licensor) provides some tangible or intangible asset to another firm (licensee) and grants that firm the right to use the licensor’s brand name and related brand assets in return for some payment. The licensee obtains a competitive advantage in this arrangement, while the licensor obtains inexpensive access to the market in question.

Licensing can be extremely lucrative for the owner of the brand, as other organizations pay for permission to produce products carrying a licensed name. The Walt Disney Company was an early pioneer in brand licensing, and it remains a leader in this area with its wildly popular entertainment and toy brands: Star Wars, Disney Princesses, Toy Story, Mickey Mouse, and so on. Toy manufacturers, for example, pay millions of dollars and vie for the rights to produce and sell products affiliated with these “super-brands.”

Line Extensions and Brand Extensions

Organizations use line extensions and brand extensions to leverage and increase brand equity.

Diet Coke is a line extension of the Coke brand.

Diet Coke is a line extension of the Coke brand.

A company creates a line extension when it introduces a new variety of offering within the same product category. To illustrate with the food industry, a company might add new flavors, package sizes, nutritional content, or products containing special additives in line extensions. Line extensions aim to provide more variety and hopefully capture more of the market within a given category. More than half of all new products introduced each year are line extensions. For example, M&M candy varieties such as peanut, pretzel, peanut butter, and dark chocolate are all line extensions of the M&M brand. Diet Coke™ is a line extension of the parent brand Coke ™. While the products have distinct differences, they are in the same product category.

A brand extension moves an existing brand name into a new product category, with a new or somehow modified product. In this scenario, a company uses the strength of an established product to launch a product in a different category, hoping the popularity of the original brand will increase receptivity of the new product. An example of a brand extension is the offering of Jell-O pudding pops in addition to the original product, Jell-O gelatin. This strategy increases awareness of the brand name and increases profitability from offerings in more than one product category.

Line extensions and brand extensions are important tools for companies because they reduce financial risk associated with new-product development by leveraging the equity in the parent brand name to enhance consumers’ perceptions and receptivity towards new products. Due to the established success of the parent brand, consumers will have instant recognition of the product name and be more likely to try the new line extension.

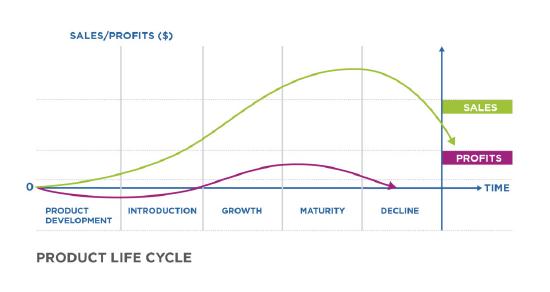

Stages of the Product Life Cycle

A company has to be good at both developing new products and managing them in the face of changing tastes, technologies, and competition. Products generally go through a life cycle with predictable sales and profits. Marketers use the product life cycle to follow this progression and identify strategies to influence it. The product life cycle (PLC) starts with the product’s development and introduction, then moves toward withdrawal or eventual demise. This progression is shown in the graph, below.

The five stages of the PLC are:

- Product development

- Market introduction

- Growth

- Maturity

- Decline

The table below shows common characteristics of each stage.

| Common Characteristics | |

|---|---|

| 0. Product development stage |

|

| 1. Market introduction stage |

|

| 2. Growth stage |

|

| 3. Maturity stage |

|

| 4. Decline stage |

|

Using the Product Life Cycle

The product life cycle can be a useful tool in planning for the life of the product, but it has a number of limitations.

Not all products follow a smooth and predictable growth path. Some products are tied to specific business cycles or have seasonal factors that impact growth. For example, enrollment in higher education tracks closely with economic trends. When there is an economic downturn, more people lose jobs and enroll in college to improve their job prospects. When the economy improves and more people are fully employed, college enrollments drop. This does not necessarily mean that education is in decline, only that it is in a down cycle.

Furthermore, evidence suggests that the PLC framework holds true for industry segments but not necessarily for individual brands or projects, which are likely to experience greater variability.[4]

Of course, changes in other elements of the marketing mix can also affect the performance of the product during its life cycle. Change in the competitive situation during each of these stages may have a much greater impact on the marketing approach than the PLC itself. An effective promotional program or a dramatic lowering of price may improve the sales picture in the decline period, at least temporarily. Usually the improvements brought about by non-product tactics are relatively short-lived, and basic alterations to product offerings provide longer benefits.

Whether one accepts the S-shaped curve as a valid sales pattern or as a pattern that holds only for some products (but not for others), the PLC concept can still be very useful. It offers a framework for dealing systematically with product marketing issues and activities. The marketer needs to be aware of the generalizations that apply to a given product as it moves through the various stages.

Marketing through the Product Cycle

There are some common marketing considerations associated with each stage of the PLC. How marketers think about the marketing mix and the blend of promotional activities–also known as the promotion mix–should reflect a product’s life-cycle stage and progress toward market adoption. These considerations cannot be used as a formula to guarantee success, but they can function as guidelines for thinking about budget, objectives, strategies, tactics, and potential opportunities and threats.

Keep in mind that we will discuss the new-product development process next, so it is not covered here.

Market Introduction Stage

Think of the market introduction stage as the product launch. This phase of the PLC requires a significant marketing budget. The market is not yet aware of the product or its benefits. Introducing a product involves convincing consumers that they have a problem or need which the new offering can uniquely address. At its core, messaging should convey, “This product is a great idea! You want this!” Usually a promotional budget is needed to create broad awareness and educate the market about the new product. To achieve these goals, often a product launch includes promotional elements such as a new Web site (or significant update to the existing site), a press release and press campaign, and a social media campaign.

There is also a need to invest in the development of the distribution channels and related marketing support. For a B2B product, this often requires training the sales force and developing sales tools and materials for direct and personal selling. In a B2C market, it might include training and incentivizing retail partners to stock and promote the product.

Pricing strategies in the introduction phase are generally set fairly high, as there are fewer competitors in the market. This is often offset by early discounts and promotional pricing.

Google Glass

Google Glass

It is worth noting that the launch will look different depending on how new the product is. If the product is a completely new innovation that the market has not seen before, then there is a need to both educate the market about the new offering and build awareness of it. In 2013 when Google launched Google Glass—an optical head-mounted computer display—it had not only to get the word out about the product but also help prospective buyers understand what it was and how it might be used. Google initially targeted tech-savvy audiences most interested in novelty and innovation (more about them later when we discuss diffusion of innovation). By offering the new product with a lot of media fanfare and limited availability, Google’s promotional strategy ignited demand among these segments. Tech bloggers and insiders blogged and tweeted about their Google Glass adventures, and word-of-mouth sharing about the new product spread rapidly. You can imagine that this was very different from the launch of Wheat Thins Spicy Buffalo crackers, an extension of an existing product line, targeting a different audiences (retailers, consumers) with promotional activities that fit the product’s marketing and distribution channels. The Google Glass situation was also different from the launch of Tesla’s home battery. In that case Tesla offered a new line of home products from a company that had previously only offered automobiles. Breaking into new product categories and markets is challenging even for a well-regarded company like Tesla. As you might expect, the greater the difference in new products from a company’s existing offerings, the greater the complexity and expense of the introduction stage.

One other consideration is the maturity of the product. Sometimes marketers will choose to be conservative during the marketing introduction stage when the product is not yet fully developed or proven, or when the distribution channels are not well established. This might mean initially introducing the product to only one segment of the market, doing less promotion, or limiting distribution (as with Google Glass). This approach allows for early customer feedback but reduces the risk of product issues during the launch.

While we often think of an introduction or launch as a single event, this phase can last several years. Generally a product moves out of the introduction stage when it begins to see rapid growth, though what counts as “rapid growth” varies significantly based on the product and the market.

Growth Stage

Once rapid growth begins, the product or industry has entered the growth stage. When a product category begins to demonstrate significant growth, the market usually responds: new competitors enter the market, and larger companies acquire high-growth companies and products.

These emerging competitive threats drive new marketing tactics. Marketers who have been seeking to build broad market awareness through the introduction phase must now differentiate their products from competitors, emphasizing unique features that appeal to target customers. The central thrust of market messaging and promotion during this stage is “This brand is the best!” Pricing also becomes more competitive and must be adjusted to align with the differentiation strategy.

Often in the growth phase the marketer must pay significant attention to distribution. With a growing number of customers seeking the product, more distribution channels are needed. Mass marketing and other promotional strategies to reach more customers and segments start to make sense for consumer-focused markets during the growth stage. In business-to-business markets, personal selling and sales promotions often help open doors to broader growth. Marketers often must develop and support new distribution channels to meet demand. Through the growth phase, distribution partners will become more experienced selling the product and may require less support over time.

The primary challenges during the growth phase are to identify a differentiated position in the market that allows the product to capture a significant portion of the demand and to manage distribution to meet the demand.

Maturity Stage

When growth begins to plateau, the product has reached the maturity phase. In order to achieve strong business results through the maturity stage, the company must take advantage of economies of scale. This is usually a period in which marketers manage budget carefully, often redirecting resources toward products that are earlier in their life cycle and have higher revenue potential.

At this stage, organizations are trying to extract as much value from an established product as they can, typically in a very competitive field. Marketing messages and promotions seek to remind customers about a great product, differentiate from competitors, and reinforce brand loyalty: “Remember why this brand is the best.” As mentioned in the previous section, this late in the life cycle, promotional tactics and pricing discounts are likely to provide only short-term benefits. Changes to product have a better chance of yielding more sustained results.

In the maturity stage, marketers often focus on niche markets, using promotional strategies, messaging, and tactics designed to capture new share in these markets. Since there is no new growth, the emphasis shifts from drawing new customers to the market to winning more of the existing market. The company may extend a product line, adding new models that have greater appeal to a smaller segment of the market.

Often, distribution partners will reduce their emphasis on mature products. A sales force will shift its focus to new products with more growth potential. A retailer will reallocate shelf space. When this happens the manufacturer may need to take on a stronger role in driving demand.

We have repeatedly seen this tactic in the soft drink industry. As the market has matured, the number of different flavors of large brands like Coke and Pepsi has grown significantly. We will look at other product tactics to extend the growth phase and manage the maturity phase in the next section.

Decline Stage

Once a product or industry has entered decline, the focus shifts almost entirely to eliminating costs. Little if any marketing spending goes into products in this life stage, because the marketing investment is better spent on other priorities. For goods, distributors will seek to eliminate inventory by cutting prices. For services, companies will reallocate staff to ensure that delivery costs are in check. Where possible, companies may initiate a planned obsolescence process. Commonly technology companies will announce to customers that they will not continue to support a product after a set obsolescence date.

Often a primary focus for marketers during this stage is to transition customers to newer products that are earlier in the product life cycle and have more favorable economics. Promotional activities and marketing communications, if any, typically focus on making this transition successful among brand-loyal segments who still want the old product. A typical theme of marketing activity is “This familiar brand is still here, but now there’s something even better.”

The New-Product Development Process

There are probably as many varieties of new-product development systems as there are types of companies, but most of them share the same basic steps or stages—they are just executed in different ways. Below, we have divided the process into eight stages, grouped into three phases. Many of the activities are performed repeatedly throughout the process, but they become more concrete as the product idea is refined and additional data are gathered. For example, at each stage of the process, the product team is asking, “Is this a viable product concept?” but the answers change as the product is refined and more market perspectives can be added to the evaluation.

There are probably as many varieties of new-product development systems as there are types of companies, but most of them share the same basic steps or stages—they are just executed in different ways. Below, we have divided the process into eight stages, grouped into three phases. Many of the activities are performed repeatedly throughout the process, but they become more concrete as the product idea is refined and additional data are gathered. For example, at each stage of the process, the product team is asking, “Is this a viable product concept?” but the answers change as the product is refined and more market perspectives can be added to the evaluation.

| Phase I: Generating and Screening Ideas | Phase II: Developing New Products | Phase III: Commercializing New Products |

|---|---|---|

| Stage 1: Generating New Product Ideas | Stage 4: Business Case Analysis | Stage 6: Test Marketing |

| Stage 2: Screening Product Ideas | Stage 5: Technical and Marketing Development | Stage 7: Launch |

| Stage 3: Concept Development and Testing |

Stage 1: Generating New Product Ideas

Generating new product ideas is a creative task that requires a particular way of thinking. Coming up with ideas is easy, but generating good ideas is another story. Companies use a range of internal and external sources to identify new product ideas. A SWOT analysis might suggest strengths in existing products that could be the basis for new products or market opportunities. Research might identify market and customer trends. A competitive analysis might expose a hole in the company’s product portfolio. Customer focus groups or the sales team might identify unmet customer needs. Many amazing products are also the result of lucky mistakes—product experiments that don’t meet the intended goal but have an unintended and interesting application. For example, 3M scientist Dr. Spencer Silver invented Post-It Notes in a failed experiment to create a super-strong adhesive.[5]

Generating new product ideas is a creative task that requires a particular way of thinking. Coming up with ideas is easy, but generating good ideas is another story. Companies use a range of internal and external sources to identify new product ideas. A SWOT analysis might suggest strengths in existing products that could be the basis for new products or market opportunities. Research might identify market and customer trends. A competitive analysis might expose a hole in the company’s product portfolio. Customer focus groups or the sales team might identify unmet customer needs. Many amazing products are also the result of lucky mistakes—product experiments that don’t meet the intended goal but have an unintended and interesting application. For example, 3M scientist Dr. Spencer Silver invented Post-It Notes in a failed experiment to create a super-strong adhesive.[5]

The key to the idea generation stage is to explore possibilities, knowing that most will not result in products that go to market.

Stage 2: Screening Product Ideas

The second stage of the product development process is idea screening. This is the first of many screening points. At this early stage much is not known about the product and its market opportunity. Still, product ideas that do not meet the organization’s objectives should be rejected at this stage. If a poor product idea is allowed to pass the screening stage, it wastes effort and money in later stages until it is abandoned. Even more serious is the possibility of screening out a worthwhile idea and missing a significant market opportunity. For this reason, this early screening stage allows many ideas to move forward that may not eventually go to market.

At this early stage, product ideas may simply be screened through some sort of internal rating process. Employees might rate the product ideas according to a set of criteria, for example; those with low scores are dropped and only the highest ranked products move forward.

Stage 3: Concept Development and Testing

Today, it is increasingly common for companies to run some small concept test in a real marketing setting. The product concept is a synthesis or a description of a product idea that reflects the core element of the proposed product. Marketing tries to have the most accurate and detailed product concept possible in order to get accurate reactions from target buyers. Those reactions can then be used to inform the final product, the marketing mix, and the business analysis.

Today, it is increasingly common for companies to run some small concept test in a real marketing setting. The product concept is a synthesis or a description of a product idea that reflects the core element of the proposed product. Marketing tries to have the most accurate and detailed product concept possible in order to get accurate reactions from target buyers. Those reactions can then be used to inform the final product, the marketing mix, and the business analysis.

New tools for technology and product development are available that support the rapid development of prototypes which can be tested with potential buyers. When concept testing can include an actual product prototype, the early test results are much more reliable. Concept testing helps companies avoid investing in bad ideas and at the same time helps them catch and keep outstanding product ideas.

Stage 4: Business Case Analysis

Before companies make a significant investment in a product’s development, they need to be sure that it will bring a sufficient return.

The company seeks to answer such questions as the following:

- What is the market opportunity for this product?

- What are the costs to bring the product to market?

- What are the costs through the stages of the product life cycle?

- Where does the product fit in the product portfolio and how will it impact existing product sales?

- How does this product impact the brand?

- How does this product impact other corporate objectives such as social responsibility?

The marketing budget and costs are one element of the business analysis, but the full scope of the analysis includes all revenues, costs, and other business impacts of the product.

Stage 5: Technical and Marketing Development

A product that has passed the screening and business analysis stages is ready for technical and marketing development. Technical development processes vary greatly according to the type of product. For a product with a complex manufacturing process, there is a lab phase to create specifications and an equally complex phase to develop the manufacturing process. For a service offering, there may be new processes requiring new employee skills or the delivery of new equipment. These are only two of many possible examples, but in every case the company must define both what the product is and how it will be delivered to many buyers.

A product that has passed the screening and business analysis stages is ready for technical and marketing development. Technical development processes vary greatly according to the type of product. For a product with a complex manufacturing process, there is a lab phase to create specifications and an equally complex phase to develop the manufacturing process. For a service offering, there may be new processes requiring new employee skills or the delivery of new equipment. These are only two of many possible examples, but in every case the company must define both what the product is and how it will be delivered to many buyers.

While the technical development is under way, the marketing department is testing the early product with target customers to find the best possible marketing mix. Ideally, marketing uses product prototypes or early production models to understand and capture customer responses and to identify how best to present the product to the market. Through this process, product marketing must prepare a complete marketing plan—one that starts with a statement of objectives and ends with a coherent picture of product distribution, promotion, and pricing integrated into a plan of marketing action.

Stage 6: Test Marketing and Validation

Test marketing is the final stage before commercialization; the objective is to test all the variables in the marketing plan including elements of the product. Test marketing represents an actual launching of the total marketing program. However, it is done on a limited basis.

Initial product testing and test marketing are not the same. Product testing is totally initiated by the producer: he or she selects the sample of people, provides the consumer with the test product, and offers the consumer some sort of incentive to participate.

Test marketing, on the other hand, is distinguished by the fact that the test group represents the full market, the consumer must make a purchase decision and pay for the product, and the test product must compete with the existing products in the actual marketing environment. For these and other reasons, a market test is an accurate simulation of the broader market and serves as a method for reducing risk. It should enhance the new product’s probability of success and allow for final adjustment in the marketing mix before the product is introduced on a large scale.

Stage 7: Launch

Finally, the product arrives at the commercial launch stage. The marketing mix comes together to introduce the product to the market. This stage marks the beginning of the product life cycle.

Stage 8: Evaluation

The launch does not in any way signal the end of the marketing role for the product. To the contrary, after launch the marketer finally has real market data about how the product performs in the wild, outside the test environment. These market data initiate a new cycle of idea generation about improvements and adjustments that can be made to all elements of the marketing mix.

- www.ama.org/resources/Pages/...tter=P#product ↵

- www.businessdictionary.com/de...ial-goods.html ↵

- http://www.safeway.com/ShopStores/Br...ur-Brands.page ↵

- Mullor-Sebastian, Alicia. “The Product Life Cycle Theory: Empirical Evidence.” Journal of International Business Studies 14.3 (1983): 95–105. ↵

- https://en.Wikipedia.org/wiki/Post-it_note ↵