A $550 Million Loaf of Bread?

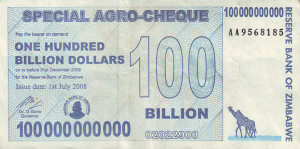

If you were born within the last three decades in the United States, Canada, or many other countries in the developed world, you probably have no real experience with a high rate of inflation. Inflation is when most prices in an entire economy are rising. But there is an extreme form of inflation called hyperinflation. This occurred in Germany between 1921 and 1928, and more recently in Zimbabwe between 2008 and 2009. In November of 2008, Zimbabwe had an inflation rate of 79.6 billion percent. In contrast, in 2012, the United States had an average annual rate of inflation of 2.1%.

Zimbabwe’s inflation rate was so high it is difficult to comprehend. So, let’s put it into context. It is equivalent to price increases of 98% per day. This means that, from one day to the next, prices essentially double. What is life like in an economy afflicted with hyperinflation? Not like anything you are familiar with. Prices for commodities in Zimbabwean dollars were adjusted several times each day. There was no desire to hold on to currency since it lost value by the minute. The people there spent a great deal of time getting rid of any cash they acquired by purchasing whatever food or other commodities they could find. At one point, a loaf of bread cost 550 million Zimbabwean dollars. Teachers were paid in the trillions a month; however this was equivalent to only one U.S. dollar a day. At its height, it took 621,984,228 Zimbabwean dollars to purchase one U.S. dollar.

Government agencies had no money to pay their workers so they started printing money to pay their bills rather than raising taxes. Rising prices caused the government to enact price controls on private businesses, which led to shortages and the emergence of black markets. In 2009, the country abandoned its currency and allowed foreign currencies to be used for purchases.

An interactive or media element has been excluded from this version of the text. You can view it online here: http://pb.libretexts.org/mlum/?p=319

How does this happen? How can both government and the economy fail to function at the most basic level? Before we consider these extreme cases of hyperinflation, let’s first look at inflation itself.

Inflation has consequences for economic agents throughout the economy. Lenders and borrowers, wage-earners, taxpayers, and consumers may all be affected. But before we get into the details, we first need to understand how inflation is measured.

Tracking Inflation

Dinner table conversations where you might have heard about inflation usually entail reminiscing about when “everything seemed to cost so much less. You used to be able to buy three gallons of gasoline for a dollar and then go see an afternoon movie for another dollar.” Table 1 compares some prices of common goods in 1970 and 2014. Of course, the average prices shown in this table may not reflect the prices where you live. The cost of living in New York City is much higher than in Houston, Texas, for example. In addition, many products have improved over recent decades. A new car in 2014, loaded with antipollution equipment, safety gear, computerized engine controls, and many other technological advances, is a more advanced machine (and more fuel efficient) than your typical 1970s car, so older and more recent products are not completely comparable. However, put details like these to one side for the moment, and look at the overall pattern. The primary reason behind the price rises in Table 1—and all the price increases for the other products in the economy—is not specific to the market for housing or cars or gasoline or movie tickets. Instead, it is part of a general rise in the level of all prices. In 2014, $1 had about the same purchasing power in overall terms of goods and services as 18 cents did in 1972, because of the amount of inflation that has occurred over that time period.

| Table 1. Price Comparisons, 1970 and 2014 | ||

|---|---|---|

| Items | 1970 | 2014 |

| Pound of ground beef | $0.66 | $4.16 |

| Pound of butter | $0.87 | $2.93 |

| Movie ticket | $1.55 | $8.17 |

| Sales price of new home (median) | $22,000 | $280,000 |

| New car | $3,000 | $32,531 |

| Gallon of gasoline | $0.36 | $3.36 |

| Average hourly wage for a manufacturing worker | $3.23 | $19.55 |

| Per capita GDP | $5,069 | $53,041.98 |

Moreover, the power of inflation does not affect just goods and services, but wages and income levels, too. The second-to-last row of Table 1 shows that the average hourly wage for a manufacturing worker increased nearly six-fold from 1970 to 2012. Sure, the average worker in 2012 was better educated and more productive than the average worker in 1970—but not six times more productive. Sure, per capita GDP increased substantially from 1970 to 2012, but is the average person in the U.S. economy really more than eight times better off in just 42 years? Not likely.

A modern economy has millions of goods and services whose prices are continually quivering in the breezes of supply and demand. How can all of these shifts in price be boiled down to a single inflation rate? As with many problems in economic measurement, the conceptual answer is reasonably straightforward: Prices of a variety of goods and services are combined into a single price level (or price index); the inflation rate is simply the percentage change in the price level. Applying the concept, however, involves some practical difficulties to which we now turn.

Glossary

[glossary-page][glossary-term]hyperinflation: [/glossary-term]

[glossary-definition]an extremely high rate of inflation, in the 100s or 1000s percent per year [/glossary-definition][glossary-term]inflation: [/glossary-term][glossary-definition]a general and ongoing rise in the level of prices in an economy[/glossary-definition][/glossary-page]