2.7: Exercises

- Page ID

- 98081

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)EXERCISE 2–1 (LO1) Accounts

Below is a list of various accounts:

| a. | b. | ||||

| Unearned consulting fees | Vehicles | ||||

| Prepaid insurance | Depreciation expense | ||||

| Office supplies | Interest income | ||||

| Notes receivable | Interest expense | ||||

| Insurance fee revenue | Furniture | ||||

| Unearned insurance fee revenue | Utilities payable | ||||

| Salary and benefits expense | Unearned rent revenue | ||||

| Small tools and supplies | Retained earnings | ||||

| Service fees earned | Salaries and benefits payable | ||||

| Service fees revenue | Compensation expense | ||||

| Notes payable | Interest earned | ||||

| Buildings | Meals and mileage expense | ||||

| Rent payable | Unearned service fees | ||||

| Share capital | Equipment |

Required:

- Identify each account as either an asset (A), liability (L), equity (E), revenue (R), or expense (E).

- Identify whether the normal balance of each account is a debit (DR) or credit (CR).

EXERCISE 2–2 (LO1) Accounts

Required: Using the list from EXERCISE 2–1, identify if a debit or credit is needed to decrease the normal balance of each account.

EXERCISE 2–3 (LO2)

Required: Record the debit and credit for each of the following transactions (transaction 1 is done for you):

| Assets | Liabilities | Equity | ||||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| (increase) | (decrease) | (decrease) | (increase) | (decrease) | (increase) | |

| 1. Purchased a $10,000 truck on credit. | 10,000 | 10,000 | ||||

| 2. Borrowed $5,000 cash from the bank. | ||||||

| 3. Paid $2,000 of the bank loan in cash. | ||||||

| 4. Paid $600 in advance for a one-year insurance policy. | ||||||

| 5. Received $500 in advance from a renter for next month's rental of office space. | ||||||

EXERCISE 2–4 (LO2)

Required: Record the debit and credit in the appropriate account for each of the following transactions (transaction 1 is done for you):

| Debit | Credit | |

| 1. Issued share capital for cash. | Cash | Share Capital |

| 2. Purchased equipment on credit. | ||

| 3. Paid for a one-year insurance policy. | ||

| 4. Billed a customer for repairs completed today. | ||

| 5. Paid this month's rent. | ||

| 6. Collected the amount billed in transaction 4 above. | ||

| 7. Collected cash for repairs completed today. | ||

| 8. Paid for the equipment purchased in transaction 2 above. | ||

| 9. Signed a union contract. | ||

| 10. Collected cash for repairs to be made for customers next month. | ||

| 11. Transferred this month's portion of prepaid insurance that was | ||

| used to Insurance Expense. |

EXERCISE 2–5 (LO2) Using T-accounts

Below are various transactions for the month of August, 2016, for BOLA Co. This is their first month of operations.

- Issued share capital in exchange for $3,000 cash.

- Received an invoice from the utilities company for electricity in the amount of $200.

- Bank approved a loan and deposited $10,000 into the company's bank account.

- Paid employee salaries in the amount of $2,000.

- Received repair services worth $5,000 from a supplier in exchange for a note due in thirty days.

- Completed service work for a European customer. Invoiced $8,000 EURO (European funds). The Canadian currency equivalent is $12,000 CAD. (hint: Recall the monetary unit principle.)

- Completed $7,000 of service work for a customer on account.

- Purchased $1,000 of equipment, paying cash.

- Received $8,000 EURO ($12,000 CAD) cash for service work done regarding item (6).

- Rent of $5,000 cash was paid for the current month's rent.

- Made a payment of $1,500 cash as a loan payment regarding item (3). The payment covered $150 for interest expense and the balance of the cash payment was to reduce the loan balance owing.

- Reimbursed $25 in cash to an employee for use of his personal vehicle for company business for a business trip earlier that day.

- Received a cash of $5,000 regarding the service work for item (7).

- Vehicle worth $30,000 purchased in exchange for $10,000 cash and $20,000 note due in six months.

- Paid the full amount of the utilities invoice regarding item (2).

- Purchased $3,000 of furniture on account.

- Completed $2,000 of service work for a customer and collected cash.

- Received a cheque in the amount of $2,000 from a customer for service work to be done in two months.

- Purchased office supplies for $3,000 on account.

- Completed a project for a customer and billed them $8,000 for the service work.

- Purchased a laptop computer for $2,500 in exchange for a note payable.

- September rent of $5,000 was paid two weeks in advance, on August 15.

Required: Create a separate T-account for each asset, liability, equity, revenue and expense account affected by the transactions above. Record the various transactions debits and credits into the applicable T-account (similar to the two T-accounts shown in Section 2.1, under the heading T-accounts, for Cash and Accounts payable). Calculate and record the ending balance for each T-account. (Hint: Include the reference to the transaction number for each item in the T-accounts, to make it easier to review later, if the accounts contain any errors.)

EXERCISE 2–6 (LO3) Preparing a Trial Balance

Required: Using the T-accounts prepared in EXERCISE 2–5, prepare an August 31, 2024, trial balance for the company based on the balances in the T-accounts.

EXERCISE 2–7 (LO3) Preparing Financial Statements

Required: Using the trial balance in EXERCISE 2–6, prepare the August 31, 2024, income statement, statement of changes in equity and the balance sheet for the company based on the balances in the T-accounts.

EXERCISE 2–8 (LO2)

Required: Post the following transactions to the appropriate accounts:

- Issued share capital for $5,000 cash (posted as an example).

- Paid $900 in advance for three months' rent, $300 for each month.

- Billed $1,500 to customers for repairs completed today.

- Purchased on credit $2,000 of supplies to be used next month.

- Borrowed $7,500 from the bank.

- Collected $500 for the amount billed in transaction (3).

- Received a $200 bill for electricity used to date (the bill will be paid next month).

- Repaid $2,500 of the bank loan.

- Used $800 of the supplies purchased in transaction (4).

- Paid $2,000 for the supplies purchased in transaction (4).

- Recorded the use of one month of the rent paid for in transaction (2).

| Cash | Bank Loan | Share Capital | Repair Revenue | ||||

| (1) 5,000 | (1) 5,000 | ||||||

| Accounts Receivable | Accounts Payable | Electricity Expense | |||||

| Prepaid Expense | Rent Expense | ||||||

| Unused Supplies | Supplies Expense | ||||||

EXERCISE 2–9 (LO3)

The following Trial Balance was prepared from the books of Cross Corporation at its year-end, December 31, 2023. After the company's bookkeeper left, the office staff was unable to balance the accounts or place them in their proper order. Individual account balances are correct, but debits may be incorrectly recorded as credits and vice-versa.

| Account Title | Account Balances | |

| Debits | Credits | |

| Cash | $120,400 | |

| Commissions Earned | 5,000 | |

| Share Capital | $170,000 | |

| Accounts Payable | 30,000 | |

| Insurance Expense | 100 | |

| Land | 8,000 | |

| Building | 120,000 | |

| Rent Expense | 1,000 | |

| Accounts Receivable | 26,000 | |

| Unused Supplies | 6,000 | |

| Supplies Expense | 300 | |

| Loan Payable | 80,000 | |

| Salaries Expense | 3,000 | |

| Telephone Expense | 200 | |

| Totals | $161,700 | $408,300 |

Required: Prepare a corrected Trial Balance showing the accounts in proper order and balances in the correct column. List expenses in alphabetical order. Total the columns and ensure total debits equal total credits.

EXERCISE 2–10 (LO4)

Required: Prepare journal entries for each of the following transactions:

- Issued share capital for $3,000 cash.

- Purchased $2,000 of equipment on credit.

- Paid $400 cash for this month's rent.

- Purchased on credit $4,000 of supplies to be used next month.

- Billed $2,500 to customers for repairs made to date.

- Paid cash for one-half of the amount owing in transaction (d).

- Collected $500 of the amount billed in transaction (e).

- Sold one-half of the equipment purchased in transaction 2 above for $1,000 in cash.

EXERCISE 2–11 (LO2,4)

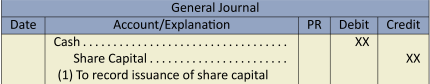

Required: Prepare the journal entries and likely descriptions of the eleven transactions that were posted to the following General Ledger accounts for the month ended January 31, 2023. Do not include amounts. For instance, the first entry would be:

| Cash | Bank Loan | Share Capital | Repair Revenue | ||||

| 1 | 2 | 11 | 1 | 3 | |||

| 3 | 5 | 4 | |||||

| 8 | 10 | ||||||

| 11 | |||||||

| Accounts Receivable | Accounts Payable | Electricity Expense | |||||

| 4 | 10 | 2 | 9 | ||||

| 6 | |||||||

| 7 | |||||||

| Prepaid Expense | Rent Expense | ||||||

| 5 | 9 | 7 | |||||

| Unused Supplies | Supplies Expense | ||||||

| 2 | 8 | 6 | |||||

EXERCISE 2–12 (LO2,3,4)

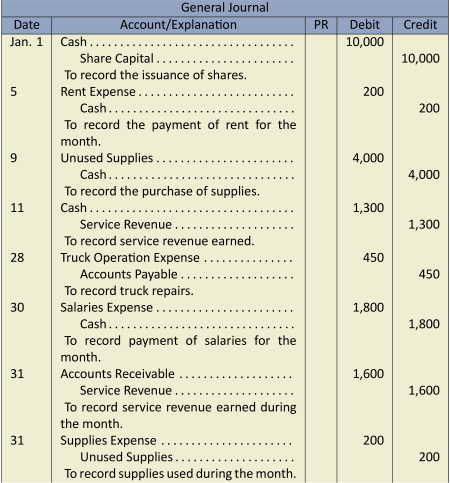

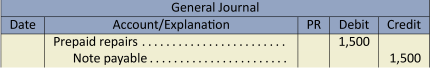

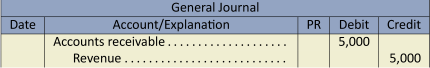

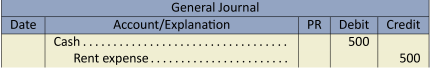

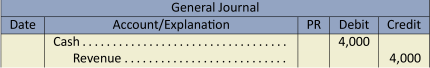

The following journal entries were prepared for Elgert Corporation for its first month of operation, January 2023.

Required:

- Prepare necessary General Ledger T-accounts and post the transactions.

- Prepare a Trial Balance at January 31, 2023.

- Prepare an Income Statement and Statement of Changes in Equity for the month ended January 31, 2023 and a Balance Sheet at January 31, 2023.

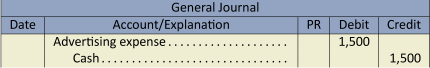

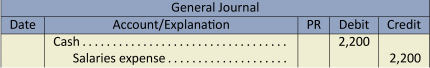

EXERCISE 2–13 (LO4) Correcting Errors in Journal Entries

Below are transactions that contain errors in the journal entry.

- Received an invoice from a supplier for advertising in the amount of $150.

- Paid employee salaries in the amount of $2,200.

- Received repair services worth $1,500 from a supplier in exchange for a note due in sixty days.

- Completed service work for a British customer. Invoiced $5,000 GBP (British pounds Sterling funds). The Canadian currency equivalent is $8,400 CAD. (Hint: Recall the monetary unit principle.)

- Rent of $5,000 cash was paid for the current month's rent.

- Received a cheque in the amount of $4,000 from a customer for service work to be started in three months.

- Completed a project for a customer and billed them $8,000 for the service work.

- Rent of $10,000 for the next six months was paid in advance.

Required: Record the correcting journal entries. (Hint: One method is to reverse the incorrect entry and record the correct entry and a second method is to record the correcting amounts to the applicable accounts only.)

Problems

PROBLEM 2–1 (LO3)

The following account balances are taken from the records of Fox Creek Service Limited at October 31, 2015 after its first year of operation:

| Accounts Payable | $9,000 | Insurance Expense | $ 500 | |

| Accounts Receivable | 6,000 | Repair Revenue | 19,000 | |

| Advertising Expense | 2,200 | Supplies Expense | 800 | |

| Bank Loan | 5,000 | Telephone Expense | 250 | |

| Cash | 1,000 | Truck | 9,000 | |

| Share Capital | 2,000 | Truck Operation | ||

| Commissions Expense | 4,500 | Expense | 1,250 | |

| Equipment | 7,000 | Wages Expense | 4,000 | |

| Wages Payable | 1,500 |

Required:

- Prepare a Trial Balance at October 31, 2023.

- Prepare an Income Statement and Statement of Changes in Equity for the year ended October 31, 2023.

- Prepare a Balance Sheet at October 31, 2023.

PROBLEM 2–2 (LO1,2,3,4)

The following ledger accounts were prepared for Davidson Tool Rentals Corporation during the first month of operation ending May 31, 2023. No journal entries were prepared in support of the amounts recorded in the ledger accounts.

| Cash | 101 | Accounts Payable | 210 | Share Capital | 320 | Service Revenue | 470 | |||||||||||

| May 1 | 5,000 | May 11 | 1,000 | May 22 | 600 | May 11 | 1,000 | May 1 | 5,000 | May 5 | 3,000 | |||||||

| 6 | 2,000 | 16 | 500 | 23 | 150 | 6 | 2,000 | |||||||||||

| 10 | 1,500 | 20 | 300 | 24 | 1,100 | 18 | 2,500 | |||||||||||

| 15 | 1,200 | 22 | 600 | |||||||||||||||

| 21 | 800 | 28 | 400 | Advertising Expense | 610 | |||||||||||||

| 29 | 3,500 | May 31 | 250 | |||||||||||||||

| Accounts Receivable | 110 | Commissions Expense | 615 | |||||||||||||||

| May 5 | 3,000 | May 10 | 1,500 | May 24 | 1,100 | |||||||||||||

| 18 | 2,500 | 15 | 1,200 | |||||||||||||||

| Rent Expense | 654 | |||||||||||||||||

| Prepaid Advertising | 160 | May 28 | 400 | |||||||||||||||

| May 16 | 500 | May 31 | 250 | |||||||||||||||

| Salaries Expense | 656 | |||||||||||||||||

| Unused Supplies | 173 | May 29 | 3,500 | |||||||||||||||

| May 20 | 300 | May 30 | 100 | |||||||||||||||

| Supplies Expense | 668 | |||||||||||||||||

| Equipment | 183 | May 30 | 100 | |||||||||||||||

| May 11 | 2,000 | May 21 | 800 | |||||||||||||||

| Telephone Expense | 669 | |||||||||||||||||

| May 23 | 150 | |||||||||||||||||

Required:

- Reconstruct the transactions that occurred during the month and prepare journal entries to record these transactions, including appropriate descriptions. Include accounts numbers (Folio) using the Chart of Accounts provided. Calculate the balance in each account.

- Total the transactions in each T-account above. Prepare a Trial Balance in proper order (list assets, liabilities, equity, revenue, then expenses) at May 31, 2015.

PROBLEM 2–3 (LO1,2,4)

The following balances appeared in the General Ledger of Fenton Table Rentals Corporation at April 1, 2023.

| Cash | $1,400 | Accounts Payable | $2,000 |

| Accounts Receivable | 3,600 | Share Capital | 4,350 |

| Prepaid Rent | 1,000 | ||

| Unused Supplies | 350 |

The following transactions occurred during April:

- Collected $2,000 cash owed by a customer.

- Billed $3,000 to customers for tables rented to date.

- Paid the following expenses: advertising, $300; salaries, $2,000; telephone, $100.

- Paid half of the accounts payable owing at April 1.

- Received a $500 bill for April truck repair expenses.

- Collected $2,500 owed by a customer.

- Billed $1,500 to customers for tables rented to date.

- Transferred $500 of prepaid rent to rent expense.

- Counted $200 of supplies on hand at April 30; recorded the amount used as an expense.

Required: Prepare journal entries to record the April transactions.

PROBLEM 2–4 (LO1,2,4)

The following transactions occurred in Thorn Accounting Services Inc. during August 2023, its first month of operation.

| Aug. 1 | Issued share capital for $3,000 cash. |

| 1 | Borrowed $10,000 cash from the bank. |

| 1 | Paid $8,000 cash for a used truck. |

| 4 | Paid $600 for a one-year truck insurance policy effective August 1. |

| 5 | Collected $2,000 fees in cash from a client for work performed today (recorded as Feeds Earned). |

| 7 | Billed $5,000 fees to clients for services performed to date (recorded as Fees Earned). |

| 9 | Paid $250 for supplies used to date. |

| 12 | Purchased $500 of supplies on credit (recorded as Unused Supplies). |

| 15 | Collected $1,000 of the amount billed on August 7. |

| 16 | Paid $200 for advertising in The News during the first two weeks of August. |

| 20 | Paid half of the amount owing for the supplies purchased on August 12. |

| 25 | Paid cash for the following expenses: rent for August, $350; salaries, $2,150; telephone, $50; truck repairs, $250. |

| 28 | Called clients for payment of the balance owing from August 7. |

| 29 | Billed $6,000 of fees to clients for services performed to date (recorded as Fees Earned). |

| 31 | Transferred the amount of August's truck insurance ($50) to Insurance Expense. |

| 31 | Counted $100 of supplies still on hand (recorded the amount used as Supplies Expense). |

Required: Prepare journal entries to record the August transactions.

PROBLEM 2–5 (LO4) Challenge Question – Errors in the Trial Balance

Below is the trial balance for Cushio Corp. which contains a number of errors:

| Cushio Corp. | ||

| Trial Balance | ||

| At August 31, 2023 | ||

| Incorrect | ||

| Debit | Credit | |

| Cash | $102,000 | |

| Accounts receivable | 59,730 | |

| Prepaid expenses | 2,000 | |

| Office supplies inventory | 5,500 | |

| Equipment | 115,000 | |

| Accounts payable | $74,500 | |

| Unearned revenue | 50,000 | |

| Share capital | 25,000 | |

| Retained earnings | 50,500 | |

| Revenue | 245,000 | |

| Repairs expense | 1,000 | |

| Rent expense | 25,000 | |

| Advertising expense | 24,500 | |

| Salaries expense | 115,000 | |

| $449,730 | $445,000 | |

The following errors were discovered:

- Cushio collected $5,000 from a customer and posted a debit to Cash but did not post a credit entry to accounts receivable.

- Cushio completed service work for a customer for $5,000 and debited accounts receivable but credited unearned revenue.

- Cushio received cash of $583 from a customer as payment on account and debited cash for $583, but incorrectly credited accounts receivable for $853.

- Cushio did not post an invoice of $500 received for repairs.

- Cushio purchased equipment for $5,000 on account and posted the transaction as a debit to accounts payable and a credit to equipment.

- Cushio purchased advertising services for cash of $6,000 that will be published in the newspapers over the next six months. This transaction was posted as a debit to advertising expense and a credit to cash for $6,000.

Required: Prepare a corrected trial balance. (Hint: Using T-accounts would be helpful.)

PROBLEM 2–6 (LO4) Challenge Question – Transactions, Trial Balance, and Financial Statements

Stellar Services Ltd. is an engineering firm that provides electrical engineering consulting services to various clients. Below are the account balances in its General Ledger as at December 31, 2023 which is its first month of operations. All accounts have normal balances as explained in the text.

| Stellar Services Ltd. | |

| Trial Balance | |

| At December 31, 2023 | |

| Accounts payable | $115,000 |

| Accounts receivable | 85,000 |

| Cash | 150,000 |

| Building/warehouse | – |

| Equipment | 45,000 |

| Furniture | 15,000 |

| Land | – |

| Notes payable | 20,000 |

| Office equipment | – |

| Office supplies | 7,000 |

| Prepaid expenses | – |

| Repairs expense | 500 |

| Retained earnings | 90,000 |

| Salaries expense | 32,000 |

| Service revenue | 25,000 |

| Share capital | 108,000 |

| Unearned service revenue | – |

| Utilities expense | 4,500 |

| Vehicle | 19,000 |

Listed below are activities for Stellar Services Ltd. for the month of January, 2023:

- Stellar ordered $3,500 in new software from a software supplier. It will be paid when it is ready to install in three weeks.

- Paid $12,000 for a two-year insurance policy to begin January 1, 2024.

- Paid one half of the outstanding accounts payable.

- Hired a new employee who will start up January 1, 2024. His salary will be $2,500 every two weeks.

- Received cash of $200,000 from a client for a $1,000,000 consulting contract. Work will commence in March.

- Booked a conference room at a hotel for a presentation to potential customers scheduled for January 15. The $600 rental fee will be paid January 1.

- Met with a client's lawyer about a fire that destroyed a portion of the client's building. The client is planning to sue Stellar for $300,000 based on some previous consulting services Stellar provided to the client.

- Completed four electrical inspections today on credit for $3,000 each.

- Collected from two of the credit customers from item 8.

- Received $20,000 from a client in partial payment for services to be provided next year.

- Borrowed $150,000 from their bank by signing a note payable due on July 31, 2025.

- John Stellar invested $30,000 cash and engineering equipment with a fair value of $10,000 in exchange for capital shares.

- Stellar rented some additional office space and paid $18,000 for the next six month's rent.

- Purchased land and a small warehouse for $50,000 cash and a long-term note payable for the balance. The land was valued at $250,000 and the warehouse at $60,000.

- Signed an agreement with a supplier for equipment rental for a special project to begin on January 23, 2024. A deposit for $300 is to be paid on January 1.

- Completed $30,000 of services for a client which is payable in 30 days.

- Purchased $8,000 of equipment for $5,000 cash and a trade-in of some old equipment that originally was recorded at $3,000.

- Paid $1,000 in cash dividends.

- Refunded the client $2,000 due to a complaint about the consulting services provided in item 16.

- Paid salaries of $35,000.

- Received a bill for water and electricity in the amount of $1,800 for January, which will be paid on February 15.

- Purchased some office equipment for $5,000 and office supplies for $2,000 on account.

- Placed an order with a supplier for $10,000 of drafting supplies to be delivered January 10. This must be paid by January 25.

Required:

- Prepare all required journal entries for December.

- Prepare the income statement and the statement of changes in equity for the month ended December 31, 2023 and the balance sheet as at December 31, 2023. (Hint: Using T-accounts would be helpful.)

PROBLEM 2–7 (LO4) Special Journals and Subledgers

The following are selected transactions from December, 2025 for Readem & Weep Sad Books Co. Ltd., who purchases and sells books for a profit.

Required: Complete the schedule based on the information in Section 2.4, Special Journals and Subledgers from this chapter. If a transaction has no applicable subledger, leave answer blank.

| Journals | |

| Sales | S |

| Purchases | P |

| Cash Receipts | CR |

| Cash Disbursements | CD |

| General Journal | GJ |

| Subledgers | |

| Accounts Receivable | AR |

| Accounts Payable | AP |

| Merchandise Inventory | MI |

| Date | Transaction | Journal | Subledger |

| Dec 1 | Issued shares to the company's founder for cash | ||

| 1 | Issued a cheque for rent to the building owner | ||

| 2 | Purchased 100 books on credit from the publisher | ||

| 4 | Borrowed money from bank (i.e. a note payable) | ||

| 5 | Purchased office furniture on account | ||

| 6 | Return 5 books to the publisher due to missing pages | ||

| 12 | Sold 20 books to Fred's Cigar Store on account (credit) | ||

| 13 | Paid cash for a two-year insurance policy effective immediately | ||

| 15 | Paid cash for some office supplies | ||

| 19 | Issued a cheque to the bank for the note payable interest | ||

| 20 | Hired an employee and paid her first week's salary in cash | ||

| 22 | Sold 10 books for cash | ||

| 27 | Fred's Cigar Store returned five of the books purchased earlier and the amount owing was adjusted (accounts receivable) | ||

| 27 | Received cash from Fred's Cigar Store for amount owing | ||

| 28 | Found an error in the accounting records and recorded a correcting entry | ||

| 29 | Received cash from a customer for 100 books. 50% of the books will be sent immediately and the remained to be sent in January | ||

| 30 | A cheque was issued for rent for January, 2026 | ||

| 30 | Dividends were paid in cash to the company founder |

PROBLEM 2–8 (LO4) Special Journals and Subledgers

Listed below are transactions for the first month of operations for Harmand Ltd., a consulting company who provides engineering consulting services and also sells vintage model airplanes (cost of goods sold ignored for simplicity).

| June 1 | Purchased equipment on credit from Bradley & Co., $12,000. |

| 2 | Billed consulting services completed for Cooper Co., Invoice #17001 for $8,000. |

| 3 | Issued cheque #601 to LRS Properties Ltd., for office rent for June, $3,500. |

| 4 | Purchased office supplies from Office Supplies Ltd., cheque #602 for $1,240. |

| 6 | Sold five vintage model airplanes to Mr. F. Scott on account, Invoice #17002 for $2,500 each. |

| 7 | Sold one vintage model airplane as a cash sale, $2,000. |

| 8 | Received cash from Cooper Co., for Invoice #17001 for $7,920. Cooper was entitled to an early payment discount of $80 because they paid their account within 10 days of being billed. |

| 9 | Paid salary for one employee, cheque #603 for $1,400. |

| 10 | Received an invoice from the Daily Gazette for advertising, payable in 30 days; $1,200. |

| 10 | Paid 20% of the June 1 equipment purchase; cheque #604. |

| 11 | Received a cheque for $5,000 from Fort Robbins Bridge Builders Ltd., for consulting work that will begin July 1; |

| 14 | Borrowed $10,000 from the bank as a loan. |

| 18 | Issued a receipt for $5,000 for cash payment from F. Scott as a partial payment of their account. |

| 22 | Issued 500 additional shares to owner and shareholder for $5,000 cash. |

| 23 | Paid utilities bill from last month to HTC Power Corp., cheque #605 for $350. |

| 25 | Billed $35,000 of consulting services rendered to Boyzee Villages Corp. Invoice #17003. |

| 28 | Paid Daily Gazette amount owing early and received a discount of $12, reducing payment to $1,188, cheque #606. |

| 29 | Paid $200 in dividends to Bill Sloan, owner and sole shareholder, cheque #607. |

| 30 | Paid $1,000 to pay the interest owing to date of $30 (interest expense) and reduce the bank loan for the balance, cheque #608. |

| 30 | Paid salary for employee up to date, cheque #609 for $1,600. |

| 30 | Corrected an error in the payment to the bank. Interest expense should be $35 and $965 to reduce the bank loan. |

Required:

- Prepare a sales journal, purchases journal, cash receipts journal, cash disbursements journal, and general journal as shown below. Record the June transactions into these journals. (Ignore GST and account codes for simplicity.)

Credit Sales Journal S1 Consulting Vintage Accounts Services Model Date Billing # Customer Ref Receivable Revenue Plane Sales Other Desc Debit Credit Credit Totals Credit Purchases Journal P1 Accounts Equipment Advertising Other Date Invoice # Creditor Ref Payable Purchases Expense Purchases Desc Credit Debit Debit Debit Totals Cash Receipts Journal CR1 Sales Accounts Cash Date Billing # Customer Ref Cash Discount Receivable Sales Other Desc Debit Debit Credit Credit Credit Totals Cash Disbursements Journal CD1 Purchase Accounts Other Date Chq # Payee Ref Cash Discount Payable Disbursements Desc Credit Credit Debit Debit Totals General Journal GJ1 Date Account/Explanation PR Debit Credit Totals - Prepare an accounts receivable subledger, accounts payable subledger, and a general ledger as shown below. Post the journals from part 1 to the subledgers and general ledger as shown in Section 2.4 of this chapter. You will need to create multiple Accounts Receivable and Accounts Payable subledgers, as well as general ledgers.

Accounts Receivable Subledger Name: Date Ref Debit Credit Balance Accounts Payable Subledger Name: Date Ref Debit Credit Balance General Ledger Name: Date Ref Debit Credit Balance - Prepare a trial balance from the general ledger accounts. Use the format shown in Section 2.3 of this chapter. Ensure that the trial balance debits equal the credits and that the subledgers balance to their respective accounts receivable and accounts payable control accounts.

- Prepare an income statement, statement of changes in equity and a balance sheet as at June 30, 20XX. Use the format shown in Section 2.3 of this chapter.