17.3: Cash Flows from Operating Activities- The Indirect Method

- Page ID

- 4491

Learning Objectives

At the end of this section, students should be able to meet the following objectives:

- Explain the difference in the start of the operating activities section of the statement of cash flows when the indirect method is used rather than the direct method.

- Demonstrate the removal of noncash items and nonoperating gains and losses in the application of the indirect method.

- Determine the effect caused by the change in the various connector accounts when the indirect method is used to present cash flows from operating activities.

- Identify the reporting classification for interest revenues, dividend revenues, and interest expense in creating a statement of cash flows and describe the controversy that resulted from this handling.

Question: As mentioned, most organizations do not choose to present their operating activity cash flows using the direct method despite preference by FASB. Instead, this information is shown within a statement of cash flows by means of the indirect method. How does the indirect method of reporting operating activity cash flows differ from the direct method?

Answer: The indirect method actually follows the same set of procedures as the direct method except that it begins with net income rather than the business’s entire income statement. After that, the three steps demonstrated previously are followed although the mechanical process here is different.

- Noncash items are removed.

- Nonoperational gains and losses are removed.

- Adjustments are made, based on the change registered in the various connector accounts, to switch remaining revenues and expenses from accrual accounting to cash accounting.

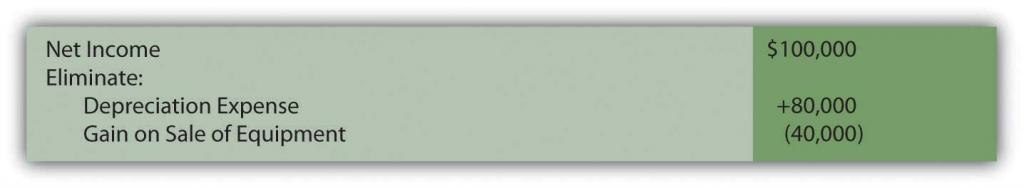

Question: In the income statement presented above for the Liberto Company, net income was reported as $100,000. That included depreciation expense (a noncash item) of $80,000 and a gain on the sale of equipment (an investing activity rather than an operating activity) of $40,000. In applying the indirect method, how are noncash items and nonoperating gains and losses removed from net income?

Answer: Depreciation is an expense and, hence, a negative component of net income. To eliminate a negative, it is offset by a positive. Adding back depreciation serves to remove its impact from the reporting company’s net income.

The gain on sale of equipment also exists within reported income but as a positive figure. It helped increase profits this period. To eliminate this gain, the $40,000 amount must be subtracted. The cash flows resulting from this transaction came from an investing activity and not an operating activity.

In applying the indirect method, a negative is removed by addition; a positive is removed by subtraction.

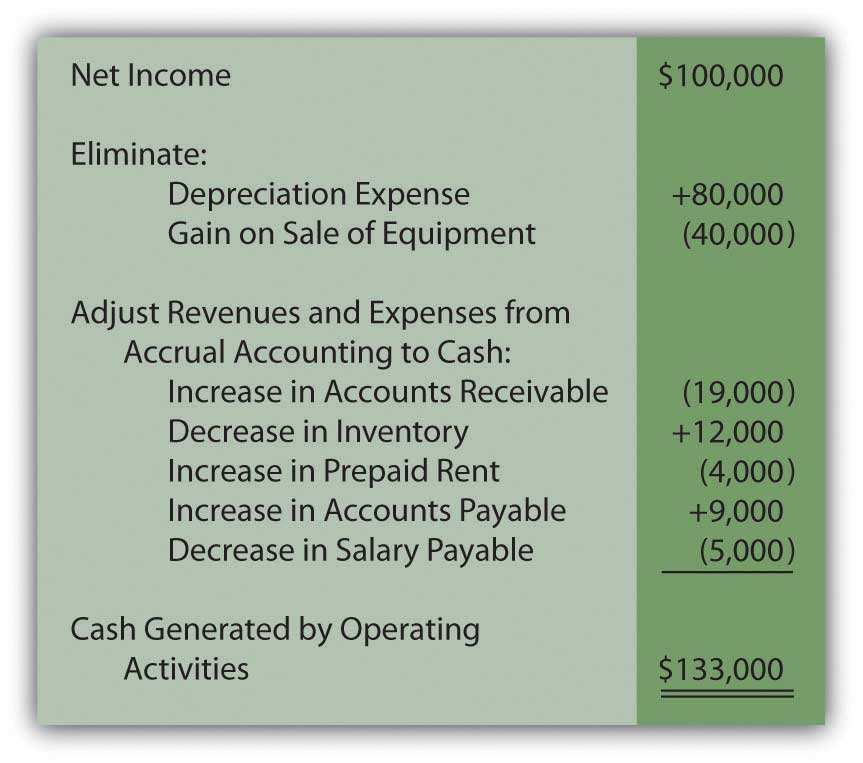

Figure 17.7 Operating Activity Cash Flows, Indirect Method—Elimination of Noncash and Nonoperating Balances

In the direct method, these two amounts were simply omitted in arriving at the individual cash flows from operating activities. In the indirect method, they are both physically removed from income by reversing their effect. The impact is the same in the indirect method as in the direct method.

Question: After all noncash and nonoperating items are removed from net income, only the changes in the balance sheet connector accounts must be utilized to complete the conversion to cash. For Liberto, those balances were shown previously.

- Accounts receivable: up $19,000

- Inventory: down $12,000

- Prepaid rent: up $4,000

- Accounts payable: up $9,000

- Salary payable: down $5,000

Each of these increases and decreases was used in the direct method to turn accrual accounting figures into cash balances. That same process is followed in the indirect method. How are changes in an entity’s connector accounts reflected in the application of the indirect method?

Answer: Although the procedures appear to be different, the same logic is applied in the indirect method as in the direct method. The change in each of these connector accounts has an impact on the cash amount and it can be logically determined. However, note that the effect is measured on the net income as a whole rather than on individual revenue and expense accounts.

Accounts receivable increased by $19,000. This rise in the receivable balance shows that less money was collected than the sales made during the period. Receivables go up because customers are slow to pay. This change results in a lower cash balance. Thus, the $19,000 should be subtracted in arriving at the cash flow amount generated by operating activities. The cash received was actually less than the figure reported for sales within net income. Subtract $19,000.

Inventory decreased by $12,000. A drop in the amount of inventory on hand indicates that less was purchased during the period. Buying less merchandise requires a smaller amount of cash to be paid. That leaves the balance higher. The $12,000 should be added. Add $12,000.

Prepaid rent increased by $4,000. An increase in any prepaid expense shows that more of the asset was acquired during the year than was consumed. This additional purchase requires the use of cash; thus, the balance is lowered. The increase in prepaid rent necessitates a $4,000 subtraction in the operating activity cash flow computation. Subtract $4,000.

Accounts payable increased by $9,000. Any jump in a liability means that Liberto paid less cash during the period than the debts that were incurred. Postponing liability payments is a common method for saving cash and keeping the reported balance high. The $9,000 should be added. Add $9,000.

Salary payable decreased by $5,000. Liability balances fall when additional payments are made. Those cash transactions are reflected in applying the indirect method by a $5,000 subtraction. Subtract $5,000.

Therefore, if Liberto Company uses the indirect method to report its cash flows from operating activities, the information will take the following form.

Figure 17.8 Liberto Company Statement of Cash Flows for Year One, Operating Activities Reported by Indirect Method