4.3: Resource-Based View

- Page ID

- 53970

According to resource-based theory, organizations that own “strategic resources” have important competitive advantages over organizations that do not. Some resources, such as cash and trucks, are not considered to be strategic resources because an organization’s competitors can readily acquire them. Instead, a resource is strategic to the extent that it is valuable, rare, difficult to imitate, and organized to capture value.

Consider how Southwest Airlines’s organizational culture serves as a strategic resource.

| Strategic Resources | Expansion |

| VALUABLE resources aid in improving the organization’s effectiveness and efficiency while neutralizing the opportunities and threats of competitors. | Although the airline industry is extremely competitive, Southwest Airlines’s turns a profit virtually every year. One key reason for their success is a legendary organizational culture that inspires employees to do their very best. |

| RARE resources are those held by few or no other competitors. | Southwest Airlines’s culture provides the firm with uniquely strong employee relations in an industry where strikes, layoffs, and poor morale are common. |

| DIFFICULT-TO-IMITATE resources often involve legally protected intellectual property such as trademarks, patents, or copyrights. Other difficult-to-imitate resources, such as brand names, usually need time to develop fully. | Southwest’s culture arose from its very humble beginnings and has evolved across decades. Because of this unusual history, other airlines could not replicate Southwest’s culture, regardless of how hard they might try. |

| ORGANIZED TO CAPTURE VALUE: Having in place the organizational systems, processes, and structure to capitalize on the potential of the resources and capabilities of the firm to provide a competitive advantage. | The influence of Southwest’s organizational culture extends to how customers are treated by employees. Executives strongly encourage flight attendants to entertain passengers, like hiding in an overhead compartment. Processes related to passengers are infused with customer service attention and actions. |

Important Points to Remember:

- Resources such as Southwest’s culture that reflect all four qualities—valuable, rare, difficult to imitate, and organized to capture value—are ideal because they can create sustained competitive advantages. A resource that has three or less of the qualities can provide an edge in the short term, but competitors can overcome such an advantage eventually.

- Firms often bundle together multiple resources and strategies (that may not be unique in and of themselves) to create uniquely powerful combinations. Southwest’s culture is complemented by approaches that individually could be copied—the airline’s emphasis on direct flights, its reliance on one type of plane, and its unique system for passenger boarding—in order to create a unique business model in which effectiveness and efficiency is the envy of competitors.

- Satisfying only one or two of the valuable, rare, difficult-to-imitate, organized to capture value criteria will likely only lead to competitive parity or a temporary advantage.

Resources and capabilities are the basic building blocks that organizations use to create strategies. These two building blocks are tightly linked—capabilities from using resources over time.

Resources can be divided into two main types: tangible and intangible. While resources refer to what an organization owns, capabilities refer to what the organization can do. More specifically, capabilities refer to the firm’s ability to bundle, manage, or otherwise exploit resources in a manner that provides added value and, hopefully, advantage over competitors.

| Resources |

| Tangible resources are resources that can be readily seen, touched, and quantified. Physical assets such as a firm’s property, plant, and equipment are considered to be tangible resources, as is cash. |

| Intangible resources are quite difficult to see, touch, or quantify. Intangible resources include, for example, the knowledge and skills of employees, a firm’s reputation, and a firm’s culture. In a nod to Southwest Airlines’ outstanding reputation, the firm ranks eighth in Fortune magazine’s 2018 list of the “World’s Most Admired Companies.” |

| Capabilities |

| A dynamic capability exists when a firm is skilled at continually updating its array of capabilities to keep pace with changes in its environment. Coca-Cola, for example, has an uncanny knack for building new brands and products as the soft drink market evolves. Not surprisingly, this firm ranks among the top twelve in Fortune’s “World’s Most Admired Companies” for 2020. |

Resources and Capabilities

The tangibility of a firm’s resources is an important consideration within resource-based theory. Tangible resources are resources that can be readily seen, touched, and quantified. Physical assets such as a firm’s property, plant, and equipment, as well as cash, are considered to be tangible resources. In contrast, intangible resources are quite difficult to see, to touch, or to quantify. Intangible resources include, for example, the knowledge and skills of employees, a firm’s reputation, brand name, exclusive rights to intellectual property, leadership traits of executives, and a firm’s culture. In comparing the two types of resources, intangible resources are more likely to meet the criteria for strategic resources (i.e., valuable, rare, difficult-to-imitate, and organized to capture value) than are tangible resources. Executives who wish to achieve long-term competitive advantages should therefore place a premium on trying to nurture and develop their firms’ intangible resources.

Capabilities are another key concept within resource-based theory. An effective way to distinguish resources and capabilities is this: resources refer to what an organization owns, capabilities refer to what the organization can do (Table 4.2). Capabilities tend to arise over time as a firm takes actions that build on its strategic resources. Southwest Airlines, for example, has developed the capability of providing excellent customer service by building on its strong organizational culture. Capabilities are important in part because they are how organizations capture the potential value that resources offer. Customers do not simply send money to an organization because it owns strategic resources. Instead, capabilities are needed to bundle, to manage, and otherwise to exploit resources in a manner that provides value added to customers and creates advantages over competitors.

Some firms develop a dynamic capability. This means that a firm has a unique ability to create new capabilities. Said differently, a firm that enjoys a dynamic capability is skilled at continually updating its array of capabilities to keep pace with changes in its environment. Coca-Cola has an uncanny knack for building new brands and products as the soft-drink market evolves. Not surprisingly, Coca-Cola ranks among the top twelve in Fortune’s “World’s Most Admired Companies” for 2020.

VRIO: Four Characteristics of Strategic Resources

Resource-based theory can be confusing because the term resources is used in many different ways within everyday common language. It is important to distinguish strategic resources from other resources. To most individuals, cash is an important resource. Tangible goods such as one’s car and home are also vital resources. When analyzing organizations, however, common resources such as cash and vehicles are not considered to be strategic resources. Resources such as cash and vehicles are valuable, of course, but an organization’s competitors can readily acquire them. Thus an organization cannot hope to create an enduring competitive advantage around common resources.

Southwest Airlines provides an illustration of resource-based theory in action. Resource-based theory contends that the possession of strategic resources provides an organization with a golden opportunity to develop competitive advantages over its rivals (Table 4.1). These competitive advantages in turn can help the organization enjoy strong profits (Barney, 1991; Wernerfelt, 1981).

A strategic resource is an asset that is valuable, rare, difficult to imitate, and organized to capture value (Barney, 1991; Chi, 1994). A resource is valuable to the extent that it helps a firm create strategies that capitalize on opportunities and ward off threats. Southwest Airlines’ culture fits this standard well. Most airlines struggle to be profitable, but Southwest makes money virtually every year. One key reason is a legendary organizational culture that inspires employees to do their very best. This culture is also rare in that strikes, layoffs, and poor morale are common within the airline industry. Southwest embraces a culture of fun for both its customers and employees. Most other airlines do not have this philosophy.

Competitors have a hard time duplicating resources that are difficult to imitate. Some difficult to imitate resources are protected by various legal means, including trademarks, patents, and copyrights. Other resources are hard to copy because they evolve over time and they reflect unique aspects of the firm. Southwest’s culture arose from its very humble beginnings. The airline had so little money that at times it had to temporarily “borrow” luggage carts from other airlines and put magnets with the Southwest logo on top of the rivals’ logo. Southwest is a “rags to riches” story that has evolved across several decades. Other airlines could not replicate Southwest’s culture, regardless of how hard they might try, because of Southwest’s unusual history.

A resource is organized to capture value when the firm has organizational systems, processes, and structure in place to capitalize on the resource for a competitive advantage. This may provide bargaining power for the firm in the marketplace. A key benefit of Southwest’s culture is that it leads employees to treat customers well, which in turn creates loyalty to Southwest among passengers. This customer loyalty is why many passengers choose Southwest over other airlines.

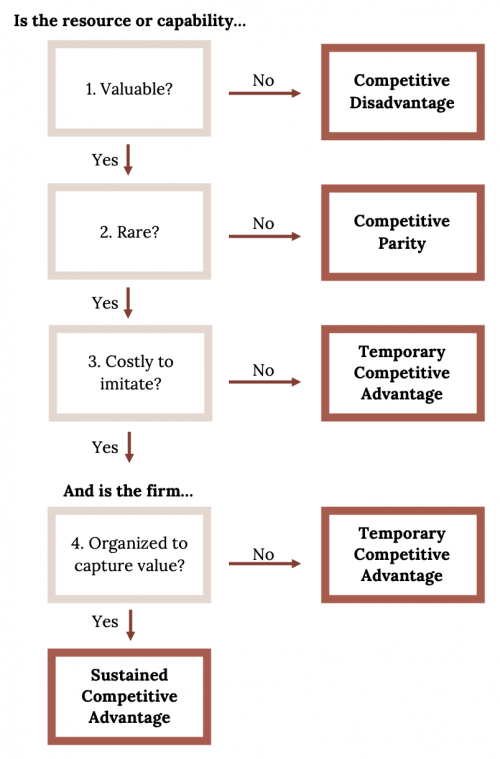

The key to using the Resource Based View is to evaluate a firm’s resources and capabilities using the VRIO framework decision tree.

Note that the decision tree is used to assess resources and capabilities, NOT a firm’s products, services, or the firm itself. The evaluation occurs within the industry of the firm being evaluated. Using Southwest Airlines culture as the resource to evaluate with VRIO:

- Is Southwest’s culture valuable? If not, all the effort to develop it is a waste of resources and a competitive disadvantage. If yes, go to number 2.

- Is Southwest’s culture rare within the airline industry? If not, then this resource only provides Southwest competitive parity. It does not help or hurt Southwest competitively. If yes, go to number 3.

- In the airline industry, is Southwest’s culture hard to imitate? If not then culture provides Southwest with a temporary competitive advantage over its rivals, but competitors can imitate it. If yes, go to number 4.

- Has Southwest organized this resource of culture to capture value? If not, then it still only provides a temporary competitive advantage. If yes, then Southwest’s culture is providing a sustained competitive advantage.

For the company culture resource of Southwest Airlines, a yes can be answered for each of the four steps, providing a sustained competitive advantage for this organization. As can be seen from its exceptional organizational performance over many years when compared to other airlines, VRIO shows that company culture is one reason why it is more successful than its competitors.

| Valuable? | Rare? | Difficult to imitate? | Organized to capture value? | Competitive Advantage |

| Yes | Yes | Yes | Yes | Sustained Competitive Advantage |

As another example, what about Southwest Airlines’ capability to arrive on time at a much higher rate than the industry average? What kind of competitive advantage, if any, does this capability provide?

Capability: High on-time arrival

| Valuable? | Rare? | Difficult to Imitate? | Organized to Capture Value? | Competitive Advantage? |

| Yes | Yes | No | Temporary Competitive Advantage |

In the case of on-time arrival capability, Southwest Airline enjoys a temporary competitive advantage (the third line), but it is not that difficult for rivals to imitate this ability. In working through the decision tree, once a no is obtained, there is no need to continue through the tree.

Ideally, a firm will its own resources, like Southwest’s culture, that embrace the four VRIO qualities shown in Table 4.1. If so, these resources can provide not only a competitive advantage but also a sustained competitive advantage—one that will endure over time and help the firm stay successful far into the future. Resources that do not have all four qualities can still be very useful, but they are unlikely to provide long-term advantages. A resource that is valuable and rare but that can be imitated, for example, might provide an edge in the short term, but competitors can eventually overcome such an advantage.

| Resource or Capability | Valuable? | Rare? | Costly to Imitate? | Organized to capture value? | Competitive Implication |

Resource-based theory also stresses the merit of an old saying: the whole is greater than the sum of its parts. Specifically, it is important to recognize that strategic resources can be created by taking several strategies and resources that each could be copied and bundling them together in a way that cannot be copied. For example, Southwest’s culture is complemented by approaches that individually could be copied—the airline’s emphasis on direct flights, its reliance on one type of plane, and its unique system for passenger boarding—to create a unique business model whose performance is without peer in the industry.

On occasion, events in the environment can turn a common resource into a strategic resource. Consider, for example, a very generic commodity: water. Humans simply cannot live without water, so water has inherent value. Also, water cannot be imitated (at least not on a large scale), and no other substance can substitute for the life-sustaining properties of water. Despite having three of the four properties of strategic resources, water in the United States has remained cheap; however, this may be changing. Major cities in hot climates such as Las Vegas, Los Angeles, and Atlanta are confronted by dramatically shrinking water supplies. As water becomes more and more rare, landowners in Maine stand to benefit. Maine has been described as “the Saudi Arabia of water” because its borders contain so much drinkable water. It is not hard to imagine a day when companies in Maine make huge profits by sending giant trucks filled with water south and west or even by building water pipelines to service arid regions.

Strategy at the Movies

That Thing You Do! [02:48]

How can the members of an organization reach success “doing that thing they do”? According to resource-based theory, one possible road to riches is creating—on purpose or by accident—a unique combination of resources. In the 1996 movie That Thing You Do!, unwittingly assembling a unique bundle of resources leads a 1960s band called The Wonders to rise from small-town obscurity to the top of the music charts. One resource is lead singer Jimmy Mattingly, who possesses immense musical talent. Another is guitarist Lenny Haise, whose fun attitude reigns in the enigmatic Mattingly. Although not a formal band member, Mattingly’s girlfriend Faye provides emotional support to the group and even suggests the group’s name. When the band’s usual drummer has to miss a gig due to injury, the door is opened for charismatic drummer Guy Patterson, whose energy proves to be the final piece of the puzzle for The Wonders.

Despite Mattingly’s objections, Guy spontaneously adds an up-tempo beat to a sleepy ballad called “That Thing You Do!” during a local talent contest. When the talent show audience goes crazy in response, it marks the beginning of a meteoric rise for both the song and the band. Before long, The Wonders perform on television and “That Thing You Do!” is a top-ten hit record. The band’s magic vanishes as quickly as it appeared, however. After their bass player joins the Marines, Lenny elopes on a whim, and Jimmy’s diva attitude runs amok, the band is finished and Guy is left to “wonder” what might have been. That Thing You Do! illustrates that while bundling resources in a unique way can create immense success, preserving and managing these resources over time can be very difficult.

The Wonders- That Thing You Do!

This video is the song “That Thing You Do!” by the Wonders.

You can view this video here: https://youtu.be/BJn-Jl2ZeQU.

Key Takeaway

- Resource-based theory suggests that tangible or intangible resources that are valuable, rare, difficult to imitate, and organized to capture value best position a firm for long-term success. These strategic resources can provide the foundation to develop firm capabilities that can lead to superior performance over time. Capabilities are needed to bundle, to manage, and otherwise to exploit resources in a manner that provides added value to customers and creates advantages over competitors. The VRIO tool can be used to determine if resources or capabilities are valuable, rare, difficult-to-imitate, and organized to capture value, and thereby understand what type of competitive advantage they offer to a firm.

Exercises

- What tangible and intangible resources does your favorite restaurant have that might give it a competitive advantage?

- Do any of the resources or capabilities of your favorite restaurant have the four qualities of resources (VRIO) that lead to success as articulated by resource-based theory?

References

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

Chi, T. (1994). Trading in strategic resources: Necessary conditions, transaction cost problems, and choice of exchange structure. Strategic Management Journal, 15(4), 271–290.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5, 171–180.

Image Credits

Figure 4.2: Planephotoman. ” Southwest Airlines Boeing 737 Lonestar One (N352SW) at LAS in November 2005.” CC BY 2.0. Cropped. Retrieved from https://commons.wikimedia.org/wiki/File:Southwest_737_Lonestar_One.jpg.

Figure 4.3: Kindred Grey (2020). “The VRIO Framework with numbers.” CC BY-SA 4.0. Retrieved from https://commons.wikimedia.org/wiki/File:The_VRIO_Framework_with_numbers.png.

Video Credits

LegacyRecordingsVEVO. (2020, April 24). The Wonders-That Thing You Do! [Video]. YouTube. https://youtu.be/BJn-Jl2ZeQU.