1: What Is Managerial Accounting?

- Page ID

- 51389

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Dana Matthews is the president of Sportswear Company, a producer of hats and jerseys for fans of several professional sports teams. Imagine you are the accountant in charge of all accounting functions at Sportswear. Dana just reviewed the financial statements for the most recent fiscal year for the first time and has the following conversation with you:

President (Dana):

I just reviewed our most recent financial statements, and I noticed we did not do as well as we had planned. I would like to look more closely at the profitability of each of our products to determine exactly what happened, but I don’t have this information in the financial statements. Is there a reason we don’t include this in the financial statements?

Accountant:

Yes, the financial statements are prepared following U.S. Generally Accepted Accounting Principles (U.S. GAAP) and are intended for outside users, such as owners, banks, and suppliers. U.S. GAAP does not require us to disclose profitability by product, and we prefer not to make this information public. Product profitability information stays in-house and is prepared by our managerial accountant, Dave Hicks.

President:

That makes sense. Can you have Dave pull together product profitability information for the past year so we can take a close look at which products are doing well and which are not?

Accountant:

You bet. We’ll have the information for you early next week.

1.1 Characteristics of Managerial Accounting

Learning Objectives

- Compare characteristics of financial and managerial accounting.

Question: The issue facing the president at Sportswear is a common one. Companies prefer not to disclose more information than is required by U.S. GAAP, but they would like to have more detailed information for internal decision-making and performance-evaluation purposes. This is why it is important to distinguish between financial and managerial accounting. What is the difference between information prepared by financial accountants and information prepared by managerial accountants?

Answer: Financial accounting provides historical financial information to external users. focuses on providing historical financial information to external users. External users are those outside the company, including owners (e.g., shareholders) and creditors (e.g., banks or bondholders). Financial accountants reporting to external users are required to follow U.S. Generally Accepted Accounting Principles (U.S. GAAP). A set of accounting rules that must be followed to provide consistency in reporting financial information to external users., a set of accounting rules that requires consistency in recording and reporting financial information. This information typically summarizes overall company results and does not provide detailed information.

Managerial accounting focuses on internal users, including executives, product managers, sales managers, and any other personnel in the organization who use accounting information for decision making. focuses on internal users—executives, product managers, sales managers, and any other personnel within the organization who use accounting information to make important decisions. Managerial accounting information need not conform with U.S. GAAP. In fact, conformance with U.S. GAAP may be a deterrent to getting useful information for internal decision-making purposes. For example, when establishing an inventory cost for one or more units of product (each jersey or hat produced at Sportswear Company), U.S. GAAP requires that production overhead costs, such as factory rent and factory utility costs, be included. However, for internal decision-making purposes, it might make more sense to include non-production costs that are directly linked to the product, such as sales commissions and exclude some overhead costs not so directly linked.

Question: It’s clear that financial accounting focuses on reporting to outside users while managerial accounting focuses on reporting to inside users. What specific characteristics would we expect to see in managerial accounting information?

Answer: Managerial accounting often focuses on making future projections for segments of a company. Suppose Sportswear Company is considering introducing a new line of coffee mugs with team logos on each mug. Management would certainly need detailed financial projections for sales, costs, and the resulting profits (or losses). Although historical financial accounting data from other product lines would be useful, preparing projections for the new line of mugs would be a managerial accounting function.

Another characteristic of managerial accounting data is its high level of detail. As noted in the opening dialogue between the president and accountant at Sportswear Company, the financial information in the annual report provides a general overview of the company’s financial results but does not provide any detailed information about each product. Information, such as product profitability, would come from the managerial accounting function.

Finally, managerial accounting information often takes the form of non-financial measures. For example, Sportswear Company might measure the percentage of defective products produced or the percentage of on-time deliveries to customers. This kind of non-financial information comes from the managerial accounting function.

Table 1.1 Comparison of Financial and Managerial Accounting

| Managerial Accounting | Financial Accounting | |

|---|---|---|

| Users | Inside the organization | Outside the organization |

| Accounting rules | None | U.S. Generally Accepted Accounting Principles (U.S. GAAP) |

| Time horizon | Future projections (sometimes historical if in detail) | Historical information |

| Level of detail | Often presents segments of an organization (e.g., products, divisions, departments) | Presents overall company information in accordance with U.S. GAAP |

| Performance measures | Financial and non-financial | Primarily financial |

Follow-Up at Sportswear Company

Question: What did the president at Sportswear Company learn about product profitability from the information provided by the managerial accountant?

Answer: The president at Sportswear, Dana Matthews, learned that the hats product line was much more profitable than expected, accounting for 55 percent of the company’s profits even though initial estimates were that the hat segment would account for 40 percent of company profits. Conversely, the jerseys product line was much less profitable than expected, accounting for 45 percent of the company’s profits.

There are many issues associated with analyzing product profitability including how to predict cost behavior and how to allocate costs that are not easily traced to each product and whether the product revenue and cost information is accurate enough to make important managerial decisions. Those issues most likely to be considered by management will be discussed in this text while much of the detailed accounting for cost flows will be covered in Principles of Managerial Accounting 2.

Key Takeaway

- Financial accounting provides historical financial information for external users in accordance with U.S. GAAP. Managerial accounting provides detailed financial and non-financial information for internal users who use the information for decision making, planning, and control purposes.

Check Yourself

-

Suppose you are the co-owner and manager of a retail store that sells and repairs mountain bikes. Provide one example of a financial accounting report that would be useful to you and your co-owner. Provide two examples of managerial accounting reports that would be useful to you as the manager.

- Provide two examples of non-financial measures used by a pizza eatery that serves food in the restaurant and offers delivery services.

-

For each report listed in the following, indicate whether it relates to financial or managerial accounting. Explain the reasoning behind your answer for each item.

- Projected net income for next quarter by division

- Defective goods produced as a percentage of all goods produced

- Income statement for the most current year, prepared in accordance with U.S. GAAP

- Monthly sales broken down by geographic region

- Production department budget for the next quarter

- Balance sheet at the end of the current year, prepared in accordance with U.S. GAAP

Solution

- Financial accounting reports provided to owners typically include the income statement, statement of owners’ equity, balance sheet, and statement of cash flows. All are prepared in accordance with U.S. GAAP. Managerial accounting reports prepared for managers might include a quarterly budget for revenues and expenses for each segment of the business (e.g., bike sales and bike repairs), returns for defective merchandise as a percent of total monthly sales, income projections to be used in deciding whether to open a new store, and projected sales for each bike model. (There are many correct answers to this problem. Use Table 1.1 “Comparison of Financial and Managerial Accounting” as a guide in determining the accuracy of your answer.)

- Examples of non-financial measures include percentage of on-time deliveries, percentage of burned pizzas, average time required to prepare pizza for restaurant customers (from taking a customer’s order to providing the pizza at the customer’s table), and results of customer satisfaction surveys. (These are just a few examples. There are many correct answers to this problem.)

-

The answers appear as follows. Be sure you explained your answers.

- Managerial accounting—information is for future projections and involves segments of the company

- Managerial accounting—nonfinancial detailed measure of defective products

- Financial accounting—historical information prepared in accordance with U.S. GAAP

- Managerial accounting—detailed information provided monthly

- Managerial accounting—information is for future projections and involves a segment of the company

- Financial accounting—historical information prepared in accordance with U.S. GAAP

1.2 Planning and Control Functions Performed by Managers

Learning Objectives

- Describe the planning and control functions performed by managers.

Question: Managers of most organizations continually plan for the future, and after the plan is implemented, managers assess whether they achieved their goals. What are the two functions that enable management to go through the process of continually planning and evaluating?

Answer: The two important functions that enable management to continually plan for the future and assess implementation are called planning and control. Planning is the process of establishing goals and communicating these goals to employees of the organization. Controlling is the process of evaluating whether the organization’s plans were effectively implemented – comparing the plan to what actually happened.

Planning

Question: Continually planning for the future is an important quality of many successful organizations, such as Southwest Airlines (discussed in Note 1.11 “Business in Action 1.1”). How do organizations formalize their strategic plans?

Answer: Organizations formalize their plans by creating a budget. A series of reports used to quantify an organization’s plan for the future., which is a series of reports used to quantify an organization’s plans for the future. For example, Ernst & Young, an international accounting firm, plans for the future by establishing a budget indicating the labor hours required to perform specific services for each client. The process of creating a budget for each client enables the firm to plan for future staffing needs and communicate these needs to employees of the company. Rather than simply hoping it all works out in the end, Ernst & Young projects the labor hours required in the future, hires accounting staff based on these projections, and schedules the staff required for each client.

A budget can take a variety of forms. A budgeted income statement indicates a profit plan for the future. A capital budget shows the long-term investments planned for the future. A cash flow budget outlines cash inflows and outflows for the future. We provide more information about how budgets can be used for planning purposes in chapter 5 and 6.

Business in Action 1.1

Plans for the Future

Review the annual report or 10K for just about any company, and you are likely to find information regarding plans for the future. Here are some examples:

- Southwest Airlines. “We expect to take delivery of 28 MAX 8 aircraft this year, and plan to end 2021 with 69 MAX 8 aircraft and 729 total aircraft. We reached agreement with The Boeing Company (Boeing) to extend our order book through 2031, and selected the MAX 7 aircraft as the successor to the 737-700 model—reaching agreement on 100 firm orders for MAX 7 aircraft. This agreement with Boeing underscores our commitment to the continued modernization of the fleet with more fuel-efficient and climate-friendly aircraft, and it also positions Southwest to capitalize on growth opportunities, when they arise. We are expanding the number of airports served and pursuing new revenue streams"

- Disney “In November 2019, the Company launched Disney+, a subscription-based DTC video streaming service with Disney, Pixar, Marvel, Star Wars and National Geographic branded content in the U.S. and four other countries and has expanded to select Western European countries in the Spring of 2020. In April, our Hotstar service in India was converted to Disney+Hotstar, and in June 2020, current subscribers of the Disney Deluxe service in Japan were converted to Disney+. In September 2020, Disney+ was launched in additional European countries and Disney+Hotstar was launched in Indonesia. In November 2020, Disney+ was launched in Latin America. Additional launches are planned for various Asia-Pacific territories in calendar 2021.

- Tesla We also intend to bring additional all-electric vehicles to market in the future, including Model Y, the Tesla Semi truck, a pickup truck and a new version of the Tesla Roadster. The production of fully electric vehicles that meet consumers’ range and performance expectations requires substantial design, engineering, and integration work on almost every system of our vehicles. Our design and vehicle engineering capabilities, combined with the technical advancements of our powertrain system, have enabled us to design and develop electric vehicles that we believe overcome the design, styling, and performance issues that have historically limited broad adoption of electric vehicles.

As these companies go through the process of making decisions about the future, developing plans based on their decisions, and controlling the implementation of their plans, managerial accounting information will play a key role in all phases of the process.

Control

Question: Although planning for the future is important, plans are only effective if implemented properly. How do organizations assess the implementation of their plans?

Answer: The control function evaluates whether an organization’s plans were implemented effectively and often leads to recommendations for the future. Many organizations compare actual results with the initial plan (or budget) to evaluate performance of employees, departments, or the entire organization.

For example, assume Ernst & Young creates a budget indicating the labor hours needed to perform tax services for a particular client (this is the planning function). After the work is performed, actual labor hours used to complete the work are compared to budgeted labor hours. This analysis is then used to evaluate whether employees were able to complete the work within the budgeted time and often results in recommendations for the future. Recommendations might include the need for adding more labor hours to the budget or obtaining better support documents from the client.

Planning and controlling operations are critical functions within most organizations. In today’s business environment, effective planning and control by managers can be the key to survival.

Key Takeaway

- Managers continually plan and control operations within organizations. Planning involves establishing goals and communicating these goals to employees of the organization. The control function assesses whether goals were achieved and is often used to evaluate the performance of employees, departments, and the organization as a whole.

Check Yourself

Assume you are preparing a personal budget of all income and expenses for next month.

- Describe the planning and control functions of this process.

- What benefits might be derived from performing the planning and control functions for a personal budget?

Solution to Check Yourself

-

The planning function would involve establishing income and expense goals for next month. Possible sources of income include wages, scholarships, or student loans. Expenses might include rent, textbooks, tuition, food, entertainment, and transportation.

The control function occurs after the end of the month and involves comparing actual income and expenses with budgeted income and expenses. This allows for the evaluation of whether income and expense goals were achieved.

-

There are several benefits to using a planning and control process. The planning function establishes income and expense goals and helps to identify any deviations from these goals. For example, planned expenditures are clearly outlined in the budget and provide guidelines for making expenditure decisions throughout the month. Without clear guidelines, money might be spent on items that are not needed.

The control function allows for an evaluation of how well you met the goals established in the planning process. Perhaps some goals were achieved (e.g., food expenditures were close to what was budgeted) while other goals were not (e.g., transportation expenditures were higher than what was budgeted). The control function identifies these areas and leads to refined goals in the future. For example, the decision might be made to carpool next month to save on transportation costs or to earn more income to pay for transportation by working additional hours.

1.3 Key Finance and Accounting Personnel

Learning Objectives

- Describe the functions of key finance and accounting personnel.

Question: From the previous discussion, we know that planning and control functions are often designed to evaluate the performance of employees and departments of an organization. This often includes employees overseeing financial information. Thus it is important to understand how most large companies organize their accounting and finance personnel. What are the accounting and finance positions within a typical large company, and what functions do they perform?

Answer: Let’s look at an example to answer this question. Suppose you are the president of Sportswear Company, mentioned earlier in the chapter, which produces hats and jerseys for fans of professional sports teams. Assume this is a large public company. (The term public company – A company whose shares of stock are publicly traded—that is, the general investing public can purchase and sell ownership in the company.) As president of Sportswear, you ask the following questions:

- How much will we owe the government in income taxes for the year?

- What was total net income for the last fiscal year?

- Should we expand into new geographic markets?

- If we do decide to expand into new markets, should we obtain financing by issuing bonds, obtaining a loan from a bank, or issuing common stock?

- How profitable is each segment of our business (hats and jerseys)?

- How effective are our internal controls over cash?

The challenge is to determine who within Sportswear would be best suited to answer each of these questions. An organization chart will help in finding a solution.

Organizational Structure

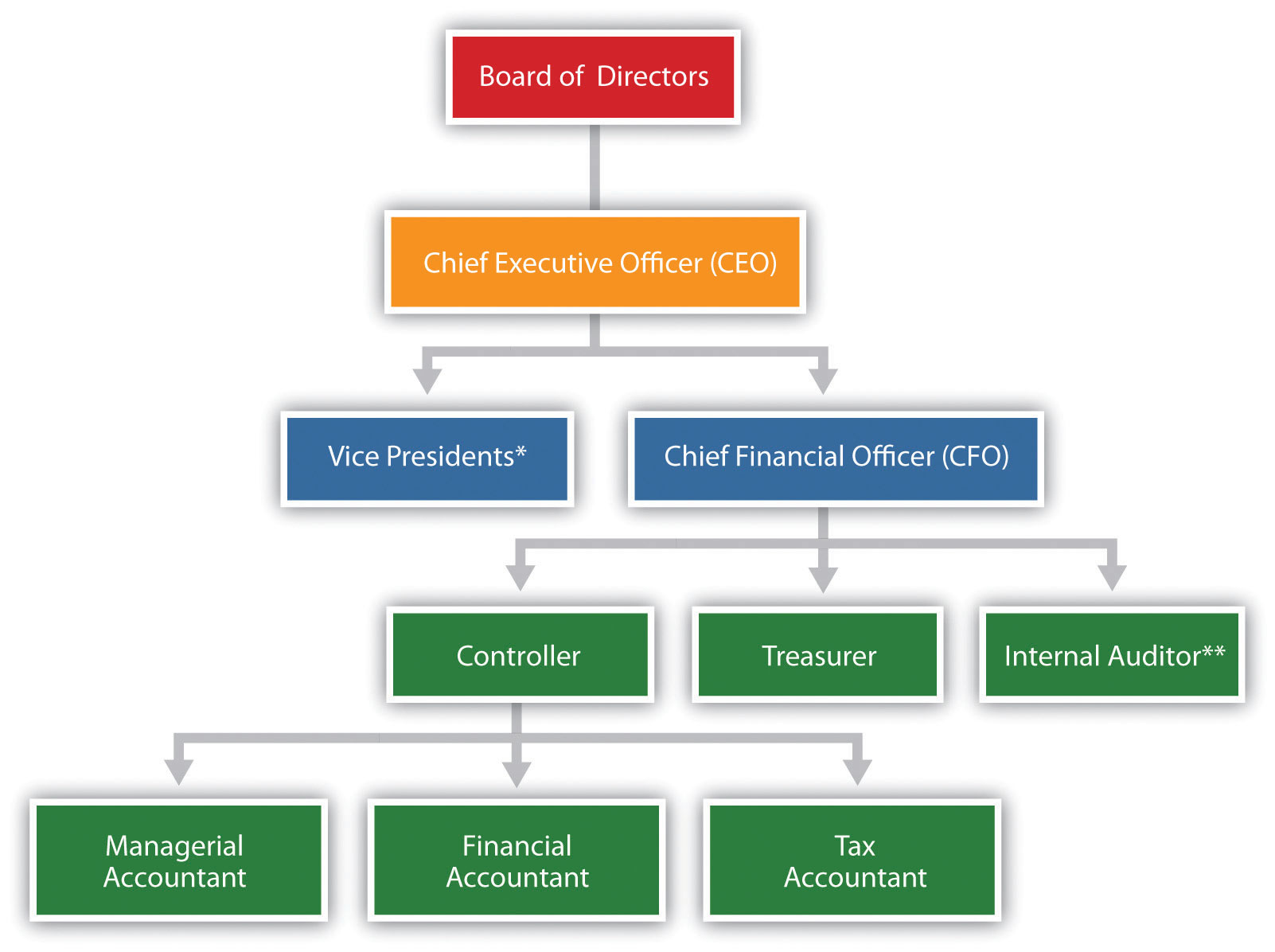

Figure 1.1 “A Typical Organization Chart” is a typical organization chart; it shows how accounting and finance personnel fit within most companies. The personnel at the bottom of the chart report to those above them. For example, the managerial accountant reports to the controller. At the top of the chart are those who control the company, typically the board of directors (who are elected by the owners or shareholders). Review Figure 1.1 “A Typical Organization Chart” before moving on to the detailed discussion of each important finance and accounting position.

Figure 1.1 A Typical Organization Chart

*Represents vice presidents of various departments outside of accounting and finance such as production, personnel, and research and development.

**In addition to reporting to the chief financial officer, the internal auditor typically reports independently to the board of directors and/or the audit committee (made up of select members of the board of directors).

Chief Financial Officer

The chief financial officer (CFO) is the person in charge of all finance and accounting functions within the organization and typically reports to the chief executive officer.

Controller

The controller is the person responsible for managing the accounting staff that provides managerial accounting information used for internal decision making, financial accounting information for external reporting purposes, and tax accounting information to meet tax filing requirements. The three accountants the controller manages are as follows:

- Managerial accountant. The managerial accountant is the person who assists in preparing information used for decision making within the organization, reports directly to the controller and assists in preparing information used for decision making within the organization. Reports prepared by managerial accountants include operational budgets, cost estimates for existing products, budgets for new product lines, and profit and loss reports by division. (Note that some people use the term cost accountant interchangeably with managerial accountant. Others consider cost accounting a specific function of managerial accounting that focuses on measuring costs. In this text, we use the term managerial accountant and assume that cost accountants focus on measuring costs.)

- Financial accountant. The financial accountant is the person who assists in preparing financial information in accordance with U.S. GAAP for external users. reports directly to the controller and assists in preparing financial information in accordance with U.S. GAAP, for those outside the company. Reports prepared by financial accountants include a quarterly report filed with the Securities and Exchange Commission (SEC) that is called a 10Q and an annual report filed with the SEC that is called a 10K.

- Tax accountant. The tax accountant is the person who assists in preparing tax reports for governmental agencies. reports directly to the controller and assists in preparing tax reports for governmental agencies, including the Internal Revenue Service.

Treasurer

The treasurer is the person responsible for obtaining financing, projecting cash flow needs, and managing cash and short-term investments for the organization. reports directly to the CFO. A treasurer’s primary duties include obtaining sources of financing for the organization (e.g., from banks and shareholders), projecting cash flow needs, and managing cash and short-term investments.

Internal Auditor

An internal auditor is the person responsible for confirming that controls within the company are effective in ensuring accurate financial data. reports to the CFO and is responsible for confirming that the company has controls that ensure accurate financial data. The internal auditor often verifies the financial information provided by the managerial, financial, and tax accountants (all of whom report to the controller and ultimately to the CFO). If conflicts arise with the CFO, an internal auditor can report directly to the board of directors or to the audit committee, which consists of select board members.

Not All Organizations Are Alike!

Question: The organization chart in Figure 1.1 “A Typical Organization Chart” is intended to serve as a guide. However, all organizations are not the same, particularly smaller organizations. How might the organizational structure differ for a small organization?

Answer: Smaller organizations tend to have only one or two key finance and accounting personnel who perform the functions described previously. For example, one accountant might perform the financial and managerial accounting duties while another takes care of the tax work (or the tax work might be contracted out to a tax firm). Instead of employing its own internal auditor, an organization might hire one from an outside consulting firm. Some organizations may not have a CFO, or they may have a CFO but not a controller. An organization’s structure depends on many different factors, including its size and reporting requirements, as indicated below:

Business in Action 1.2

The Organizational Structure of a Not-for-Profit Symphony

Financial limitations prevent a small not-for-profit symphony in California from hiring full-time finance and accounting employees. In spite of having annual revenues approaching $200,000, all financial transactions are processed and recorded by a part-time bookkeeper hired by the symphony. The bookkeeper also inputs budget information and provides monthly financial reports to the treasurer. The treasurer, a volunteer member of the board of directors, is responsible for establishing the annual budget and providing monthly financial reports to the board of directors. An outside firm prepares and processes all tax filings, assembles annual financial statements, and performs a review of the accounting operations at the end of each fiscal year.

Notice how the symphony does not have any of the formal positions identified in Figure 1.1 “A Typical Organization Chart”, with the exception of the treasurer. This illustrates how financial constraints and reporting requirements may require an organization to be creative in establishing its organizational structure.

Key Takeaway

- It is important to understand the key accounting and finance positions within a typical company and how each position fits into the organizational structure. The chief financial officer (CFO) oversees all accounting and finance personnel, including the controller, treasurer, and internal auditor. The controller is responsible for the managerial, financial, and tax accounting staff.

Check Yourself

For each of the six questions listed at the beginning of this section for Sportswear Company, determine who within the company would be responsible for providing the appropriate information. Assume Sportswear has the same organizational structure as the one shown in Figure 1.1 “A Typical Organization Chart”.

Solution:

- The tax accountant is responsible for determining the income taxes to be paid to various government agencies.

- The financial accountant prepares the annual report, which includes the income statement where net income can be found.

- Although several personnel would likely be involved, the managerial accountant is responsible for providing financial projections. However, the financial accountant might provide historical information for existing geographic segments, which would form the basis for the managerial accountant’s estimates.

- The treasurer handles financing decisions.

- Detailed financial information that goes beyond what is required by U.S. GAAP may be provided by the managerial accountants.

- The internal auditors are responsible for evaluating the effectiveness of internal controls.

1.4 Ethical Issues Facing the Accounting Industry

Learning Objective

- Use standards of ethical conduct to resolve ethical conflicts facing accountants.

Imagine you are the accountant for Drive Write, a company that produces computer disk drives, and you are in charge of all accounting functions within the company. The president has informed you that if the company’s profits grow by 20 percent this year, you will receive a $20,000 bonus, and she will receive a $50,000 bonus. No bonuses will be awarded if profit growth is less than 20 percent. Because the company’s profits have grown 20 percent annually for the last 10 years, investors have come to expect significant growth from one year to the next. Near the end of this fiscal year, the president and you have the following conversation:

President:

We are awfully close to hitting our numbers and getting to the 20 percent target. With two weeks remaining, projections show we will come in at 18 percent for the year. What can we do on the accounting side to increase current year profits?

Accountant:

Well, I’m not sure there is anything we can do. Our accounting is squeaky clean, as confirmed by our independent auditors. Perhaps our sales will improve next year.

President:

There has to be something we can do—I could sure use the bonus money, and our investors would appreciate an increase in their investment! I know we have a large customer order to be filled the first week of next year. Why not include that sale in this year’s numbers?

Accountant:

I’m not comfortable recording sales in the wrong fiscal year.

President:

We’re only talking about moving sales by a few days! I would like you to consider this carefully. If you can’t do this, I may have to find an accountant who can! Let’s talk about our options later this week.

Question: The situation at Drive Write creates a serious ethical dilemma. (The Drive Write example is based on a real company called MiniScribe Corporation , subsequently purchased by a competitor.) Companies are constantly under pressure to meet sales and profit goals. Employees who succeed in meeting these goals often reap huge monetary rewards; those who fail may be penalized with lower pay or may even lose their jobs. What would you do if asked to record information in a way that distorts the company’s financial results?

Answer: As the accountant for Drive Write, your response to the president’s request would likely affect your reputation as a professional and your future as an accountant. The unethical behavior at corporations like Satyam, Enron, and WorldCom in recent years makes it imperative that we know both how to act ethically and how to resolve ethical conflicts.

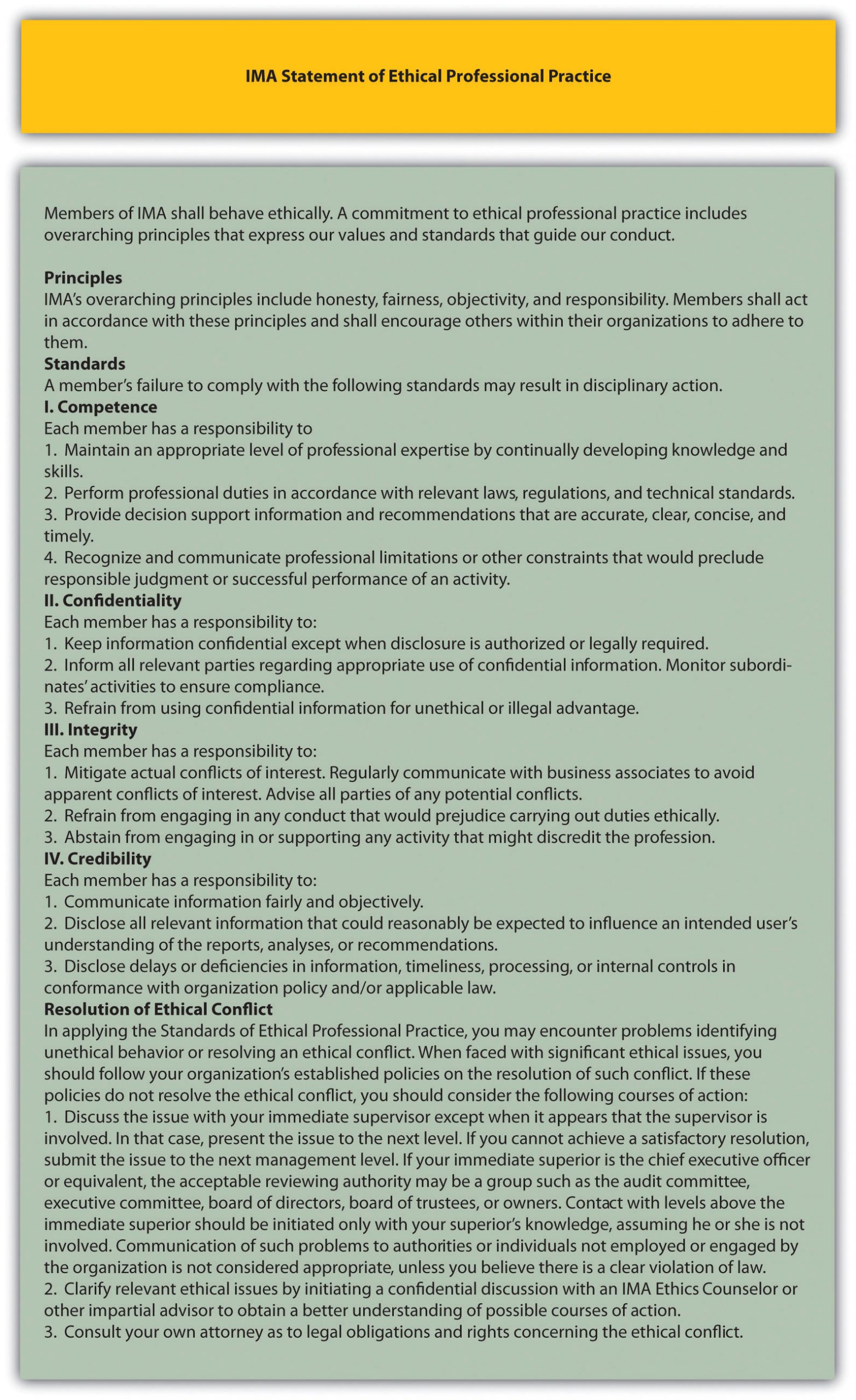

To help guide accounting professionals through ethical dilemmas like the one at Drive Write, the Institute of Management Accountants (IMA) has established a Statement of Ethical Professional Practice, which appears in Figure 1.2 “IMA Statement of Ethical Professional Practice”. The standards outlined in this statement are guidelines that can help accountants choose an ethically acceptable course of action. As you review Figure 1.2 “IMA Statement of Ethical Professional Practice”, notice that the IMA specifies four core responsibilities (competence, confidentiality, integrity, and credibility) as well as guidelines on how to resolve ethical conflicts. The “Resolution of Ethical Conflict” section provides specific guidance on how to resolve the conflict at Drive Write.

Figure 1.2 IMA Statement of Ethical Professional Practice

Source: Adapted from the Institute of Management Accountants, http://www.imanet.org.

Question: The IMA is just one of many professional accounting organizations. Do other professional accounting organizations also provide guidance regarding ethics in accounting?

Answer: Yes, other professional organizations do provide ethical guidance. Several are listed as follows:

- The American Institute for Certified Public Accountants (AICPA) has a Code of Professional Conduct (see http://www.aicpa.org).

- Financial Executives International provides a Model Code of Ethical Conduct for Financial Managers (see http://www.financialexecutives.org).

- The International Federation of Accountants has a Code of Ethics and Statement of Policy Implementation & Enforcement of Ethical Requirements (see http://www.ifac.org).

- The Securities and Exchange Commission (SEC), in compliance with the Sarbanes-Oxley Act of 2002, requires a company to disclose whether it has adopted a code of ethics (see http://www.sec.gov).

- The Institute of Management Accountants even provides an ethics help line to give financial professionals a resource to provide guidance in making the right decisions (see http://www.imanet.org).

Because of alleged wrongdoing, such as that reported in the “Business in Action 1.3”, improving ethics is a top priority for most businesses as shown in the “Business in Action 1.4”. As a result, professional organizations like those we have cited have become instrumental in providing ethical guidelines.

Business in Action 1.3

Production Firm Employees Charged with Fraud

The Securities and Exchange Commission (SEC) filed three actions against Diebold, Inc., a manufacturer and seller of automated teller machines, for improperly inflating earnings over a five-year period. Three former employees—the CFO, controller, and director of accounting—were accused of improperly inflating revenue on factory orders, improperly recognizing revenue on a lease transaction, manipulating reserves and accruals, improperly capitalizing expenses, and improperly increasing the value of inventory. These actions allegedly resulted in over 40 misstated annual, quarterly, and other reports filed with the SEC, along with numerous inaccurate press releases.

The company agreed to pay a $25,000,000 civil penalty, and the three former employees remain in litigation. Although the CEO was not accused of wrongdoing, he settled with the SEC and agreed to pay back cash bonuses, stock, and stock options received during the periods when the financial fraud was committed.

Source: Securities and Exchange Commission, “SEC Charges Diebold and Former Executives with Accounting Fraud,” news release, June 2, 2010.

Business in Action 1.4

The Code of Ethics at Home Depot and Hewlett-Packard

Ethics policies are becoming increasingly important to organizations. Home Depot, Inc., has an ethics code that states “ All associates are expected to act with honesty and integrity. Adhering to the highest ethical standards and doing the right thing are the driving forces behind The Home Depot’s success and have been a core component of how we have done business since the beginning.”

Hewlett-Packard Company is “Guided by the Integrity at HP (formerly HP’s Standards of Business Conduct), program, we apply strong ethics and anti-corruption principles within our operations, across our value chain, and in the communities where we live, work, and do business.”

Sources: Home Depot, “Home Page,” http://www.homedepot.com; Hewlett-Packard, “Home Page,” http://www.hp.com.

Key Takeaway

- Should you encounter ethical conflicts during your career, use the resources provided by internal company policies, by professional organizations such as the IMA and AICPA, and by governmental organizations such as the SEC as a guide to ethical behavior and the resolution of ethical conflicts.

Check Yourself

- Describe the four key standards of ethical conduct for IMA members outlined in Figure 1.2 “IMA Statement of Ethical Professional Practice”.

- What steps does the IMA recommend for resolving ethical conflicts?

- Using Figure 1.2 “IMA Statement of Ethical Professional Practice” as a guide, discuss your options as the accountant at Drive Write.

Solution:

-

The four key standards shown in Figure 1.2 “IMA Statement of Ethical Professional Practice” are outlined as follows:

- Competence. Members of the IMA must maintain an adequate level of skill to perform duties in an accurate and professional manner.

- Confidentiality. Members of the IMA must not disclose confidential information for any reason unless legally obligated to do so.

- Integrity. Members of the IMA must avoid any actual or apparent conflict of interest, including receiving gifts or favors, and must not engage in any activity that would discredit the profession.

- Credibility. Members of the IMA must disclose all relevant information fairly and objectively.

-

Several options exist for resolving ethical conflicts. The IMA suggests the following courses of action:

- Follow the policies of the organization involving the resolution of ethical conflicts.

- If following the organization’s policies does not effectively resolve the conflict, discuss the problem with your immediate supervisor unless the supervisor is involved.

- If the immediate superior cannot reach a satisfactory resolution, the problem should be presented to the next higher managerial level.

- If all higher levels of management do not reach a satisfactory resolution, an acceptable reviewing authority may be a group, such as the audit committee, executive committee, board of directors, board of trustees, or owners.

- Another option includes consulting an objective advisor (e.g., IMA ethics counseling service or an attorney).

- Several options are available. The IMA suggests first following the organization’s policies with regard to resolving ethical conflicts. If Drive Write does not have policies in place or if following the organization’s policies does not resolve the conflict, the next step is to discuss the conflict with the immediate supervisor. However, the president of Drive Write (the immediate supervisor) is involved in the conflict, so approaching the president’s superiors would be best. This could be the audit committee, executive committee, board of directors, or owners. If after pursuing these different courses of action the ethical conflict still exists, it may be appropriate to consult an objective advisor (e.g., the IMA helpline) and perhaps consult an attorney as to legal obligations and rights concerning the ethical conflict. (Many would argue that regardless of the outcome, one would not want to work for a company where this type of unethical behavior occurs at the top, or anywhere within the organization, and that resigning is the best course of action.)

1.5 Computerized Accounting Systems

Learning Objective

- Understand how accounting systems can help organizations.

Question: Many companies today are growing out of their accounting systems. In the old days, accounting systems were designed primarily to track daily transactions and provide reports to external users on a monthly, quarterly, or annual basis. But times have changed, and companies now need more information internally to make good decisions. Accounting systems are currently used for both external reporting (financial accounting) and internal reporting (managerial accounting). Even relatively small accounting packages, such as QuickBooks and Sage, provide features that are important for managerial accounting. However, most agree that no single accounting system will meet the needs of every organization and that two important factors must be considered when choosing a system. What are the two factors that must be considered when deciding on an accounting system?

Answer: The two factors are (1) the size of the organization and (2) the information needs of the organization. Each factor is discussed next.

How Big Is Your Company?

Accounting software is designed to serve different-sized companies. The size of a company is commonly measured in sales revenue. Experts express varying opinions on what constitutes a small, mid-sized, or large company. Some believe that small companies have sales up to $10,000,000, mid-sized companies have sales up to $100,000,000, and large companies have sales greater than $100,000,000. Others prefer different amounts. Regardless of the number used, the goal is to find an accounting system that best meets the needs of the organization, and the size of the organization plays a big part in finding the best-fitting system.

What Information Is Needed?

Before selecting an accounting system, an organization must determine its accounting needs. Some organizations simply need the equivalent of a check register, which provides easy tracking of expense codes as checks are issued and makes bank reconciliations a snap. Other organizations require more than a check register; they may demand a system that can create invoices, process payroll, and track inventory. More complex organizations will want the ability to perform more advanced functions. Such organizations might need to customize reports (e.g., create an income statement by division or customer), modify input screens, send financial reports via e-mail, export reports to spreadsheet software such as Excel, and create reports with graphics (e.g., tables, pie charts, and line charts).

Enterprise Resource Planning System

Question: Clearly the size and information needs of a company will drive the selection of an accounting system for the company. As the need for accounting data has become more complex, accounting systems have been developed that perform a wide variety of tasks. These systems are called enterprise resource planning systems. What is an enterprise resource planning system, and how does this system help companies utilize accounting data?

Answer: Enterprise resource planning (ERP) A system designed to record and share information across functional and geographical areas to meet the needs of internal and external users. systems are designed to record and share information across functional areas (e.g., accounting, marketing, human resources, and shipping) and across geographical areas (e.g., from a sales office in California to headquarters in Hong Kong). ERP systems continually update information to provide real-time data to all users, and the data can be organized in different formats to meet the needs of internal and external users. For example, in his book Onward, Howard Schultz describes how as CEO of Starbucks he reviews comparative financial data for Starbucks stores daily. This information comes from the ERP system at Starbucks.

The idea behind ERP software, and a central theme in managerial accounting, is that accurate and up-to-date financial information will help organizations make better decisions. Better decisions typically lead to improvements in profitability, efficiency, and customer satisfaction.

ERP systems are expensive. Annual costs for large organizations can easily exceed $10,000,000. However, smaller systems for mid-sized companies are available at a much lower cost. Most ERP software is offered in modules for functional accounting areas, such as accounts receivable, accounts payable, payroll, inventory, and job costing. The more modules included, the higher the cost will be. Popular makers of ERP systems include Microsoft, Oracle, and SAP Corporation.

In deciding whether to upgrade to an ERP system, organizations must be sure that the benefits of using the data from a new system outweigh the costs of implementing the system. If management does not intend to use the information to improve planning and decision making, then going with a less sophisticated accounting system may be the better approach.

Using Spreadsheet Software

Question: ERP systems commonly provide a means to download data to spreadsheets for further analysis. How can spreadsheet software help us to analyze financial information?

Answer: Since managers make extensive use of spreadsheets to organize and analyze data, most computerized accounting systems are designed to export data to spreadsheet software programs such as Excel. For example, Figure 1.3 “Excel Spreadsheet for Southwest Airlines” shows how a spreadsheet was used to import data directly from Southwest Airlines’ 2020 annual report. This allows the user to analyze the data more easily. Notice that in Figure 1.3 “Excel Spreadsheet for Southwest Airlines” the total operating revenue increased from 2018 to 2019 before dropping significantly in 2020 due to the pandemic. We could use Excel to quickly determine the exact percentage change from 2018 to 2019 and from 2019 to 2020.

Figure 1.3 Excel Spreadsheet for Southwest Airlines

| Year ended December 31, | |||

| 2020 | 2019 | 2018 | |

| OPERATING REVENUES: | |||

| Passenger | $ 7,665 | $ 20,776 | $ 20,455 |

| Freight | 161 | 172 | 175 |

| Other | 1,222 | 1,480 | 1,335 |

| Total operating revenues | 9,048 | 22,428 | 21,965 |

| OPERATING EXPENSES: | |||

| Salaries, wages, and benefits | 6,811 | 8,293 | 7,649 |

| Payroll support and voluntary Employee programs, net | (967) | - | - |

| Fuel and oil | 1,849 | 4,347 | 4,616 |

| Maintenance materials and repairs | 750 | 1,223 | 1,107 |

| Landing fees and airport rentals | 1,240 | 1,363 | 1,334 |

| Depreciation and amortization | 1,255 | 1,219 | 1,201 |

| Other operating expenses | 1,926 | 3,026 | 2,852 |

| Total operating expenses, net | 12,864 | 19,471 | 18,759 |

| OPERATING INCOME (LOSS) | (3,816) | 2,957 | 3,206 |

| OTHER EXPENSES (INCOME): | |||

| Interest expense | 349 | 118 | 131 |

| Capitalized interest | (35) | (36) | (38) |

| Interest income | (32) | (90) | (69) |

| Other (gains) losses, net | 158 | 8 | 18 |

| Total other expenses (income) | 440 | - | 42 |

| INCOME (LOSS) BEFORE INCOME TAXES | (4,256) | 2,957 | 3,164 |

| PROVISION (BENEFIT) FOR INCOME TAXES | (1,182) | 657 | 699 |

| NET INCOME (LOSS) | $ (3,074) | $ 2,300 | $ 2,465 |

Question: Let’s assume you are asked to prepare an income statement showing revenue and expense projections for next year. How might you use Excel to prepare your projections?

Answer: You could start by exporting this year’s results from the accounting system to an Excel spreadsheet. Then you could set up a new column to show estimates for next year. You would likely discuss different aspects of the income statement with various personnel in the organization—making changes as you go—before finalizing your projections.

Imagine the work involved if you did not use a computer but instead had to write the information down by hand. If there were any changes to the information, you would have to make time-consuming calculations, and once the data were finalized, you would be faced with the manual preparation of formal reports. With the relatively recent advances in business technology, the days of preparing information manually are over. Most organizations require their accounting and finance personnel to have advanced computer spreadsheet skills. Our goal is to provide you with an opportunity to use spreadsheets in a way that mirrors the real world.

Key Takeaway

- Throughout this text, you will learn about different methods of recording, sorting, analyzing, and reporting financial information for internal users. Before deciding to implement one of these methods, ask yourself the following question: Will the benefits derived from a new system, such as an ERP system, exceed the costs of putting the system in place? If the answer is “yes,” then go for it! If the answer is “no,” consider other alternatives.

Check Yourself

Assume you are the CFO for an electronics consulting firm with annual revenues of $30,000,000 and annual profit of $5,000,000. The current accounting system is used for basic functions, such as issuing checks, creating invoices, and processing payroll. The company is considering upgrading its accounting system by purchasing an ERP system. Describe the factors to be considered by the company in making this decision.

Solution:

This company is a mid-sized company with $30,000,000 in revenues, although some would argue that this is a small company. Going to an ERP system is probably not appropriate if management is simply looking for a few reports beyond what most financial accounting systems can provide.

If management has a need for more detailed and complex financial information—other than processing checks, invoices, and payroll—then a low-end ERP system might be appropriate. However, the benefits derived from such a system must outweigh the costs.

1.6 Cost Terminology

Learning Objective

- Understand the terms used for costing purposes.

Question: Much of what we discuss in this book relates to companies that manufacture products, such as Nike and Apple , and terminology is a key component of accounting for manufacturing companies. The challenge is in classifying costs correctly for items such as production materials, production labor, marketing department labor, rent for production facilities, and rent for the administrative services facilities. These costs must be classified accurately so that they appear correctly in company financial reports. The starting point for learning how to classify costs correctly is in understanding two broad categories of costs. What are the two broad terms used to categorize cost information in a manufacturing setting?

Answer: The two broad categories of costs are manufacturing costs and nonmanufacturing costs. Each category is described in detail as follows.

Manufacturing Costs

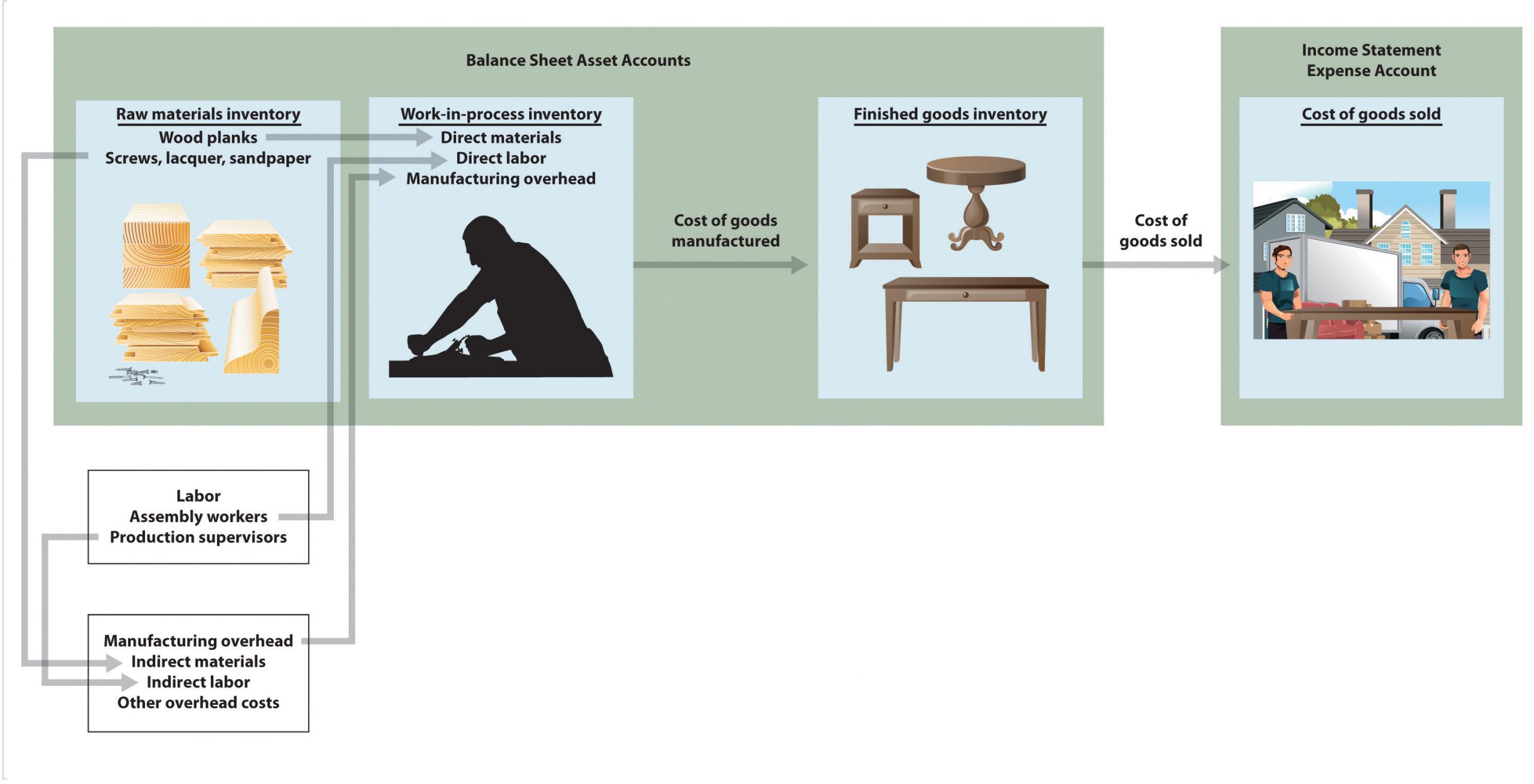

All costs related to the production of goods are called manufacturing costs. All costs related to the production of goods are also called product costs. A manufacturer purchases materials, employs workers who use the materials to assemble the goods, provides a building where the materials are stored and goods are assembled, and sells the goods. We classify the costs associated with these activities into three categories: direct materials, direct labor, and manufacturing overhead.

To help clarify which costs are included in these three categories, let’s look at a furniture company that specializes in building custom wood tables called Custom Furniture Company. Each table is unique and built to customer specifications for use in homes (coffee tables and dining room tables) and offices (boardroom and meeting room tables). The sales price of each table varies significantly, from $1,000 to more than $30,000. Figure 1.4 “Direct Materials, Direct Labor, and Manufacturing Overhead at Custom Furniture Company” shows examples of production activities at Custom Furniture Company for each of the three categories.

Direct Materials

Question: Raw materials used in the production process that are easily traced to the product are called direct materials. Raw materials used in the production process that are easily traced to the product. What materials used in the production process at Custom Furniture would be classified as direct materials?

Answer: The wood used to build tables and the hardware used to attach table legs would be considered direct materials. Small, inexpensive items like glue, nails, and masking tape are typically not included in direct materials because the cost of tracing these items to the product outweighs the benefit of having accurate cost data. These minor types of materials, often called supplies or indirect materials, are included in manufacturing overhead, which we define later.

Direct Labor

Question: Workers who convert materials into a finished product and whose time is easily traced to the product are called direct labor. Labor performed by workers who convert materials into a finished product and whose time is easily traced to the product. . Who represents direct labor at Custom Furniture?

Answer: Direct labor would include the workers who use the wood, hardware, glue, lacquer, and other materials to build tables.

Manufacturing Overhead

Question: All costs associated with the production process other than direct material costs and direct labor costs are called manufacturing overhead.Terms synonymous with manufacturing overhead include factory overhead, factory burden, and overhead. What items are included in manufacturing overhead?

Answer: Manufacturing overhead consists of the following:

- Indirect material costs. The costs of materials necessary to manufacture a product that are not easily traced to the product or that are not worth tracing to the product.. The cost of materials necessary to manufacture a product that are not easily traced to the product or not worth tracing to the product.

- Indirect labor costs. The costs of workers who are involved in the production process but whose time cannot easily be traced to the product.. The cost of workers who are involved in the production process but whose time cannot easily be traced to the product. For example, supervisors in the production process who oversee several different products and are responsible for hiring employees, scheduling employees, and ordering materials are considered indirect labor.

- Other manufacturing costs. These are all other costs for items associated with the factory, including equipment maintenance, insurance, utilities, and depreciation. Note that while overhead costs include costs that are indirectly related to the making of our product but they still are at least related to that process.

Table 1.2 Manufacturing Costs at Custom Furniture Company

| Direct Materials |

|

| Direct Labor |

|

| Manufacturing Overhead |

|

“Business in Action 1.5” details the materials, labor, and manufacturing overhead at a company that has been producing boats since 1968.

Business in Action 1.5

Photo courtesy of Brian Miller, http://www.flickr.com/photos/13233728@N00/5155012186/

Manufacturing Costs at MasterCraft

MasterCraft produces boats for water skiers and wake boarders. Each boat produced incurs significant manufacturing costs. MasterCraft records these manufacturing costs as inventory on the balance sheet until the boats are sold, at which time the costs are transferred to cost of goods sold on the income statement.

Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform. Examples of indirect materials (part of manufacturing overhead) include glue, paint, and screws. Direct labor includes the production workers who assemble the boats and test them before they are shipped out. Indirect labor (part of manufacturing overhead) includes the production supervisors who oversee production for several different boats and product lines.

Manufacturing overhead includes the indirect materials and indirect labor mentioned previously. Other manufacturing overhead items are factory building rent, maintenance and depreciation for production equipment, factory utilities, and quality control testing.

Source: MasterCraft, “Home Page,” http://www.mastercraft.com.

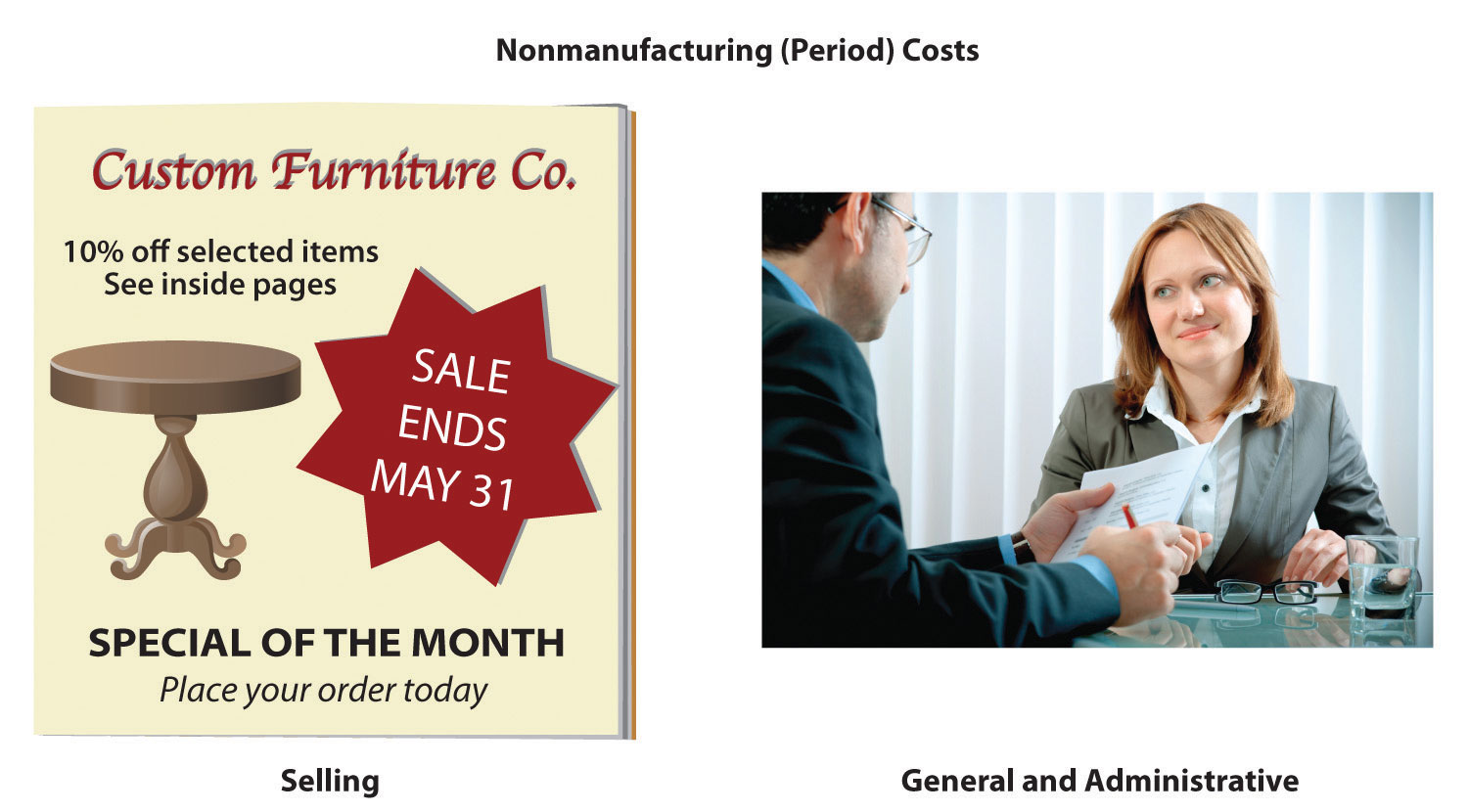

Nonmanufacturing Costs

Costs that are not related to the production of goods are called non-manufacturing costs. These costs have two components—selling costs and general and administrative costs—which are described next. Examples of non-manufacturing costs appear in Figure 1.5 “Examples of Non-manufacturing Costs at Custom Furniture Company”.

Selling Costs

Question: Costs incurred to obtain customer orders and provide customers with a finished product are called selling costs. (They are also often called marketing costs or selling and advertising costs.) What activities would be classified as selling costs at Custom Furniture?

Answer: Examples of selling costs include advertising, sales commissions, salaries for marketing and advertising personnel, office space for marketing and advertising personnel, finished goods storage costs, and shipping costs paid by the seller for products shipped to customers.

General and Administrative Costs

Question: Costs related to the overall management of an organization are called general and administrative costs What activities would be classified as general and administrative costs at Custom Furniture?

Answer: Examples include personnel and support staff in the following areas: accounting, human resources, legal, executive, and information technology. Depreciation of office equipment and buildings associated with these areas would also be included as general and administrative costs. General and administrative costs are often simply called administrative costs.

Figure 1.5 Examples of Nonmanufacturing Costs at Custom Furniture Company

Although selling costs and general and administrative costs are considered non-manufacturing costs, managers often want to assign some of these costs to products for decision-making purposes. For example, sales commissions and shipping costs for a specific product could be assigned to the product. This would be important if one product had a higher commission rate or was very bulky and thus made shipping difficult. This does not comply with U.S. GAAP because, under U.S. GAAP, only product costs can be assigned to products. However, as we noted earlier, managerial accounting information is tailored to meet the needs of the users and need not follow U.S. GAAP.

Distinguishing between manufacturing and non-manufacturing costs is not always simple. For example, if legal staff works on an issue associated with production personnel and if human resources staff hires assembly line workers, are the costs involved manufacturing or non-manufacturing costs? It is up to each organization to determine how to handle such costs for product costing purposes. The advantage of managerial accounting over financial accounting is that costs can be organized in any manner that helps managers make decisions there are no standards that must be followed. However, in this chapter, to avoid ambiguity, we follow the definitions that most closely follow U.S. GAAP.

Presentation of Manufacturing and Nonmanufacturing Costs in Financial Statements

Question: At this point, you should be able to distinguish between manufacturing costs and non-manufacturing costs. Why is it important to make this distinction?

Answer: Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements. All manufacturing costs (direct materials, direct labor, and manufacturing overhead) are attached to inventory as an asset on the balance sheet until the goods are sold, at which point the costs are transferred to cost of goods sold on the income statement as an expense. Non-manufacturing costs are also called period costs; that is because they are expensed on the income statement in the time period in which they are incurred.

Table 1.3 “Manufacturing Versus Nonmanufacturing Costs” clarifies the relationship between manufacturing and non-manufacturing costs. It also describes the point at which these costs are recorded as expenses on the income statement. (Remember that the terms manufacturing cost and product cost are generally interchangeable, as are the terms non-manufacturing cost and period cost.)

Table 1.3 Manufacturing Versus Nonmanufacturing Costs

| Manufacturing Costs (Also Called Product Costs) | Nonmanufacturing Costs (Also Called Period Costs) |

|---|---|

|

|

| Timing of expense: Costs are expensed when goods are sold. | Timing of expense: Costs are expensed during the time period incurred. |

“Business in Action 1.6” provides examples of nonmanufacturing costs at PepsiCo, Inc.

Business in Action 1.6

Source: Photo courtesy of JeffBedord, http://www.flickr.com/photos/jeffbedford/6218820224/in/photostream/.

Nonmanufacturing Costs at PepsiCo

PepsiCo, Inc., produces more than 500 products under several different brand names, including Frito-Lay, Pepsi-Cola, Gatorade, Tropicana, and Quaker. Net sales for 2019 totaled $67.2 billion, resulting in operating profits of $10.3 billion. Cost of sales represented the highest cost on the income statement at $30.1 billion. The second highest cost on the income statement—selling and general and administrative expenses—totaled $26.7 billion. These expenses are period costs, meaning they must be expensed in the period in which they are incurred.

Examples of selling costs for PepsiCo include advertising and other marketing activities, reported as selling, general and administrative expenses, totaled

$4.7 billion in 2019, including advertising expenses of $3.0 billion in 2019. Examples of general and administrative costs include salaries and bonuses of top executives and the costs of administrative departments, including personnel, accounting, legal, and information technology.

Source: PepsiCo, “PepsiCo 2019 Annual Report,” http://www.pepsico.com.

Key Takeaways

- All manufacturing costs that are easily traceable to a product are classified as either direct materials or direct labor. All other manufacturing costs are classified as manufacturing overhead. All nonmanufacturing costs are not related to production and are classified as either selling costs or general and administrative costs.

Check Yourself

-

The following manufacturing items are for a construction company working on several custom homes. Identify whether each item should be categorized as direct materials, direct labor, or manufacturing overhead.

- Nails

- Lumber

- Drywall

- Workers building the house frame

- Supervisor responsible for three homes

- Light bulbs

- Cabinets

- Depreciation of construction equipment

-

Identify whether each item in the following should be categorized as a product (manufacturing) cost or as period (nonmanufacturing) cost. Also indicate whether the cost should be recorded as an expense when the cost is incurred or as an expense when the goods are sold.

- Advertising

- Shipping costs for raw materials coming from a supplier

- Shipping costs for goods shipped to a customer

- Chief executive officer’s salary

- Production supervisor’s salary

- Depreciation on production equipment

- Raw materials used in production

- Paper used by the accounting staff

- Commissions paid to salespeople

- Janitorial services provided for production facility

- Supplies used by human resources personnel

- Utility costs for retail store

- Insurance costs for production facility

- Assembly line workers

- Clerical support for chief executive officer

- Maintenance of production equipment

- Identify whether each item listed in item 2 should be categorized as direct materials, direct labor, manufacturing overhead, selling cost, or general and administrative cost.

Solution:

-

- Manufacturing overhead

- Direct materials

- Direct materials

- Direct labor

- Manufacturing overhead

- Manufacturing overhead (You might call this a direct material, but the benefit of tracking this item as a direct material probably does not outweigh the cost.)

- Direct materials

- Manufacturing overhead

- Period cost, expensed when incurred

- Product cost, expensed when goods are sold

- Period cost, expensed when incurred

- Period cost, expensed when incurred

- Product cost, expensed when goods are sold

- Product cost, expensed when goods are sold

- Product cost, expensed when goods are sold

- Period cost, expensed when incurred

- Period cost, expensed when incurred

- Product cost, expensed when goods are sold

- Period cost, expensed when incurred

- Period cost, expensed when incurred

- Product cost, expensed when goods are sold

- Product cost, expensed when goods are sold

- Period cost, expensed when incurred

- Product cost, expensed when goods are sold

- Selling

- Direct materials or manufacturing overhead, depending on if the materials are easily traced to the product (direct) or not (indirect manufacturing overhead)

- Selling

- General and administrative

- Manufacturing overhead

- Manufacturing overhead

- Direct materials or manufacturing overhead, depending on if the materials are easily traced to the product (direct) or not (indirect manufacturing overhead)

- General and administrative

- Selling

- Manufacturing overhead

- General and administrative

- Selling

- Manufacturing overhead

- Direct labor

- General and administrative

- Manufacturing overhead

1.7 How Product Costs Flow through Accounts

Learning Objectives

- Identify how costs flow through the three inventory accounts and cost of goods sold account.

Question: Custom Furniture Company’s direct materials include items such as wood and hardware. Direct labor involves the employees who build the custom tables. Manufacturing overhead includes items such as indirect materials (glue, screws, nails, sandpaper, and stain), indirect labor (production supervisor), and other manufacturing costs, such as factory equipment maintenance and factory utilities. What accounts are used to record the costs associated with these items, and where do these accounts appear in the financial statements?

Answer: All the costs mentioned previously for Custom Furniture are product costs (also called manufacturing costs). Product costs are recorded as an asset on the balance sheet until the products are sold, at which point the costs are recorded as an expense on the income statement. To record product costs as an asset, accountants use one of three inventory accounts: raw materials inventory, work-in-process inventory, or finished goods inventory. The account they use depends on the product’s level of completion. They use one expense account—cost of goods sold—to record the product costs when the goods are sold.

Table 1.4 “Accounts Used to Record Product Costs” summarizes the accounts used to track product costs. Figure 1.6 “Flow of Product Costs through Balance Sheet and Income Statement Accounts” shows how product costs flow through the balance sheet and income statement. Take time to review these items carefully. Your understanding of them will help clarify how product costs flow through the accounts and where product costs appear in the financial statements. The following discussion provides further clarification.

Product Costs on the Balance Sheet

Question: What is the difference between raw materials inventory, work-in-process inventory, and finished goods inventory?

Answer: Each of these accounts is used to record product costs depending on where the product is in the production process, and each account is an asset account on the balance sheet.

Raw Materials

The raw materials inventory. An account used to record the cost of materials not yet put into production. For Custom Furniture Company, this account includes items such as wood, brackets, screws, nails, glue, lacquer, and sandpaper.

Work in Process

The work-in-process (WIP) inventory. An account used to record costs associated with products in the production process that are not yet complete. Suppose Custom Furniture Company has eight tables that are still in production at the end of the year. All manufacturing costs associated with these incomplete eight tables—direct materials, direct labor, and manufacturing overhead—are included in the WIP inventory account.

Once goods in WIP inventory are completed, they are transferred into finished goods inventory. The cost of completed goods that are transferred out of WIP inventory into finished goods inventory is called the cost of goods manufactured.

The finished goods inventory. An account used to record the manufacturing costs associated with products that are completed and ready to sell. Suppose Custom Furniture Company has five completed tables at the end of the year (in addition to the eight partially completed tables in work-in-process inventory). The manufacturing costs of these five tables—direct materials, direct labor, and manufacturing overhead—are included in the finished goods inventory account until the tables are sold. (For the purposes of this example, assume the tables are “sold” when delivered to the customer.)

Product Costs on the Income Statement

Question: The costs of materials not yet put into production are included in raw materials inventory. The costs associated with products that are not yet complete are included in WIP inventory. And the costs associated with products that are completed and ready to sell are included in finished goods inventory. What happens to the product costs in finished goods inventory when the products are sold?

Answer: When completed goods are sold, their costs are transferred out of finished goods inventory into the cost of goods sold. Cost of goods sold is an expense account on the income statement that represents the product costs of all goods sold during the period.

For example, suppose Custom Furniture Company sells one table that cost $3,000 to produce (i.e., direct materials, direct labor, and manufacturing overhead costs incurred to produce the table total $3,000). The $3,000 cost is in finished goods inventory until the entry is made to record the sale, at which time finished goods inventory is reduced by $3,000 (the table is no longer in inventory) and cost of goods sold is increased by $3,000.

Table 1.4 Accounts Used to Record Product Costs

| Account Name | Description | Financial Statement |

|---|---|---|

| Raw materials inventory | Cost of unused production materials | Balance sheet (asset) |

| Work-in-process inventory | Cost of incomplete products | Balance sheet (asset) |

| Finished goods inventory | Cost of completed products not yet sold | Balance sheet (asset) |

| Cost of goods sold | Cost of products sold | Income statement (expense) |

Figure 1.6 Flow of Product Costs through Balance Sheet and Income Statement Accounts

Key Takeaway

- The raw materials inventory account is used to record the cost of materials not yet put into production. The work-in-process inventory account is used to record the cost of products that are in production but that are not yet complete. The finished goods inventory account is used to record the costs of products that are complete and ready to sell. These three inventory accounts are assets accounts that appear on the balance sheet. The costs of completed goods that are sold are recorded in the cost of goods sold account. This account appears on the income statement as an expense.

Check Yourself

Match each of the following accounts with the appropriate description that follows.

- _____ Raw materials inventory

- _____ Work-in-process inventory

- _____ Finished goods inventory

- _____ Cost of goods sold

- Used to record product costs of goods that are completed and ready to sell

- Used to record product costs of goods that have been sold

- Used to record product costs of goods that are still in production

- Used to record the cost of materials not yet put into production

Solution

| Raw materials inventory | 4. Used to record cost of materials not yet put into production. |

| Work-in-process inventory | 3. Used to record product costs associated with incomplete goods in the production process. |

| Finished goods inventory | 1. Used to record product costs associated with goods that are completed and ready to sell. |

| Cost of goods sold | 2. Used to record product costs associated with goods that are sold. |

1.8 Income Statements for Manufacturing Companies

Learning Objectives

- Describe how to prepare an income statement for a manufacturing company.

Question: Companies that provide services, such as Ernst & Young (accounting) and Accenture LLP (consulting), do not sell goods and therefore have no inventory. The accounting process and income statement for service companies are relatively simple. Merchandising companies (also called retail companies) like Macy’s and Home Depot buy and sell goods but typically do not manufacture goods. Since merchandising companies must account for the purchase and sale of goods, their accounting systems are more complex than those of service companies. Manufacturing companies, such as Johnson & Johnson and Honda Motor Company , produce and sell goods. Such companies require an accounting system that goes well beyond accounting solely for the purchase and sale of goods. Why are accounting systems more complex for manufacturing companies?

Answer: Accounting systems are more complex for manufacturing companies because they need a system that tracks manufacturing costs throughout the production process to the point at which goods are sold. Since income statements for manufacturing companies tend to be more complex than for service or merchandising companies, we devote this section to income statements for manufacturing companies. Understanding income statements in a manufacturing setting begins with the inventory cost flow equation.

Inventory Cost Flow Equation

Question: How do companies use the cost flow equation to calculate unknown balances?

Answer: We can use the basic cost flow equation to calculate unknown balances for just about any balance sheet account (e.g., cash, accounts receivable, and inventory). The equation is as follows:

Key Equation

Beginning balance (BB) + Transfers in (TI) – Ending balance (EB) = Transfers out (TO)

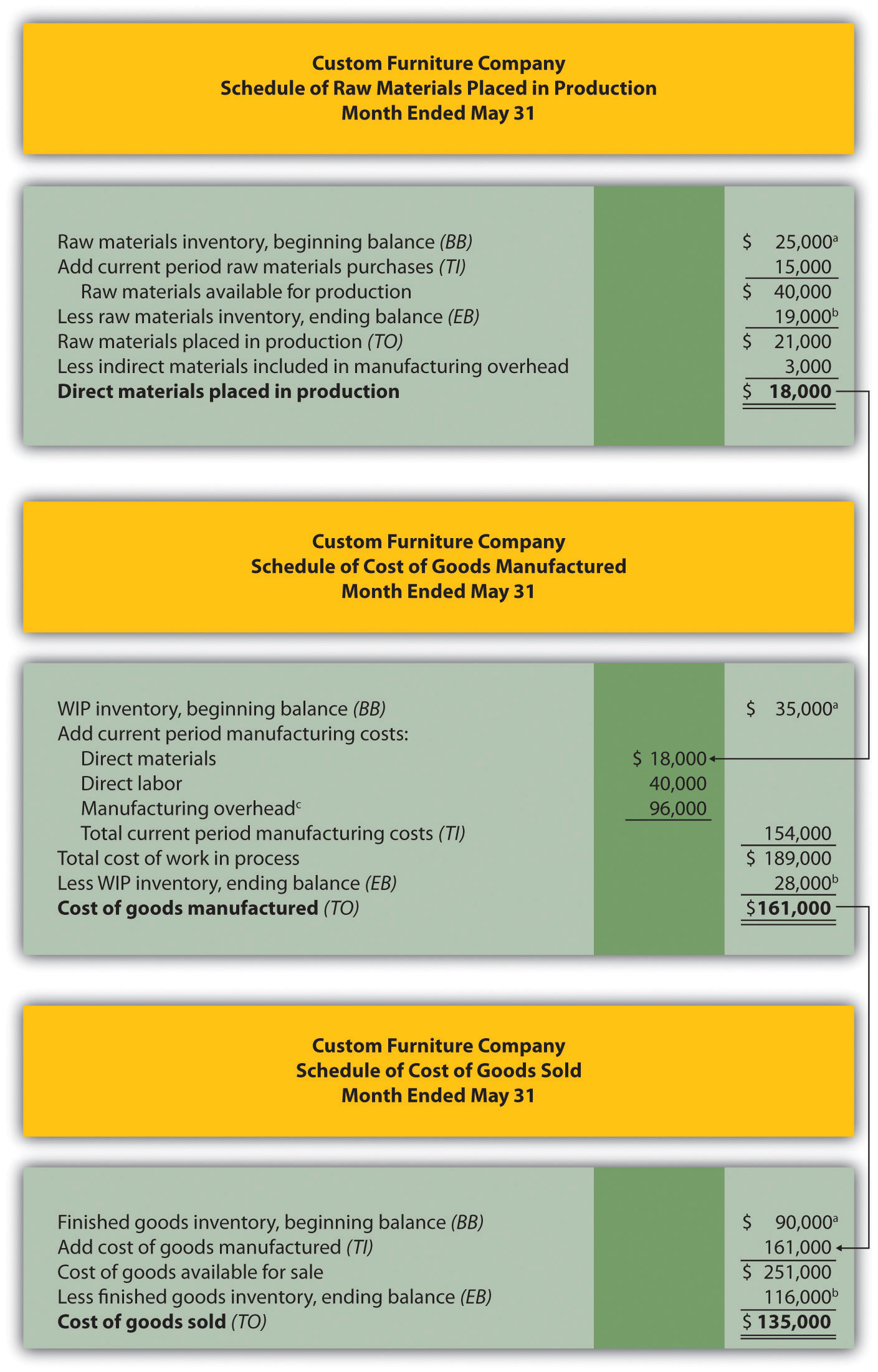

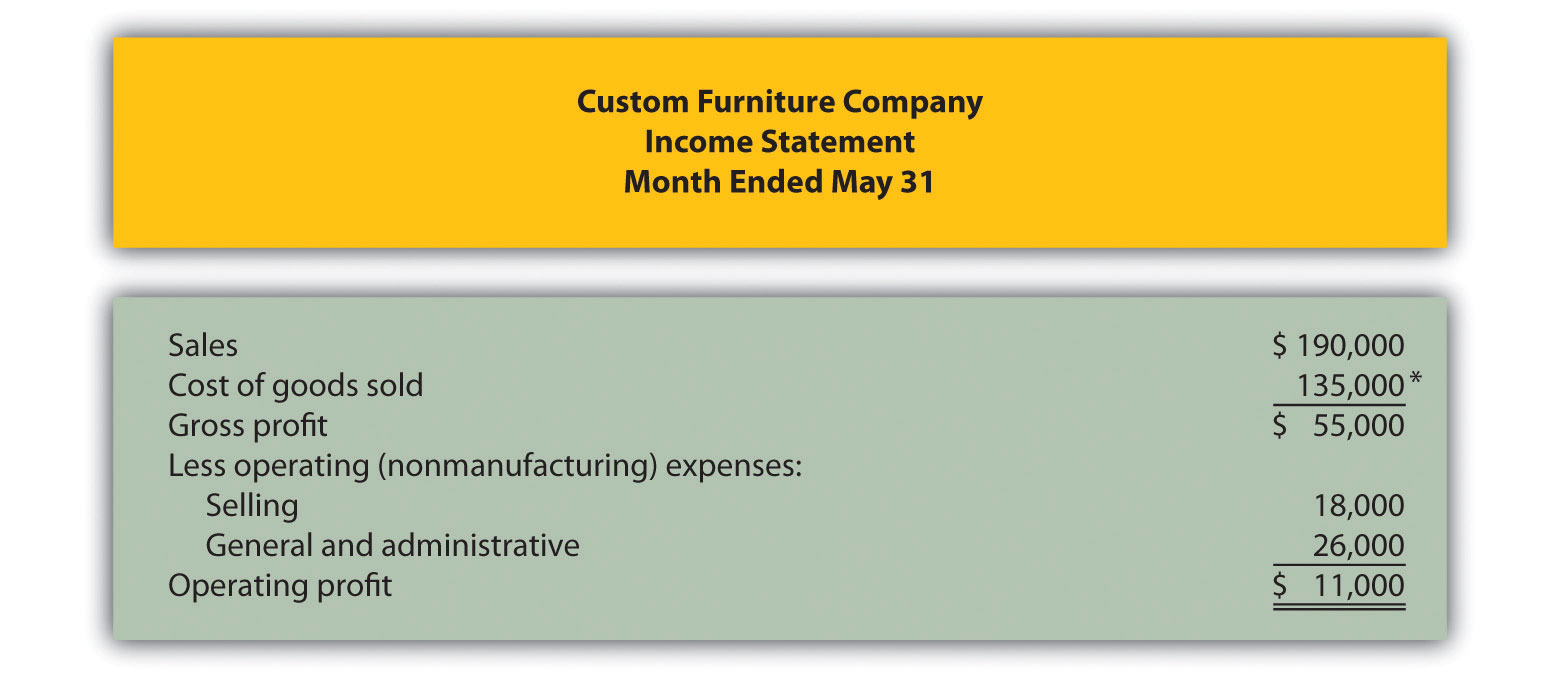

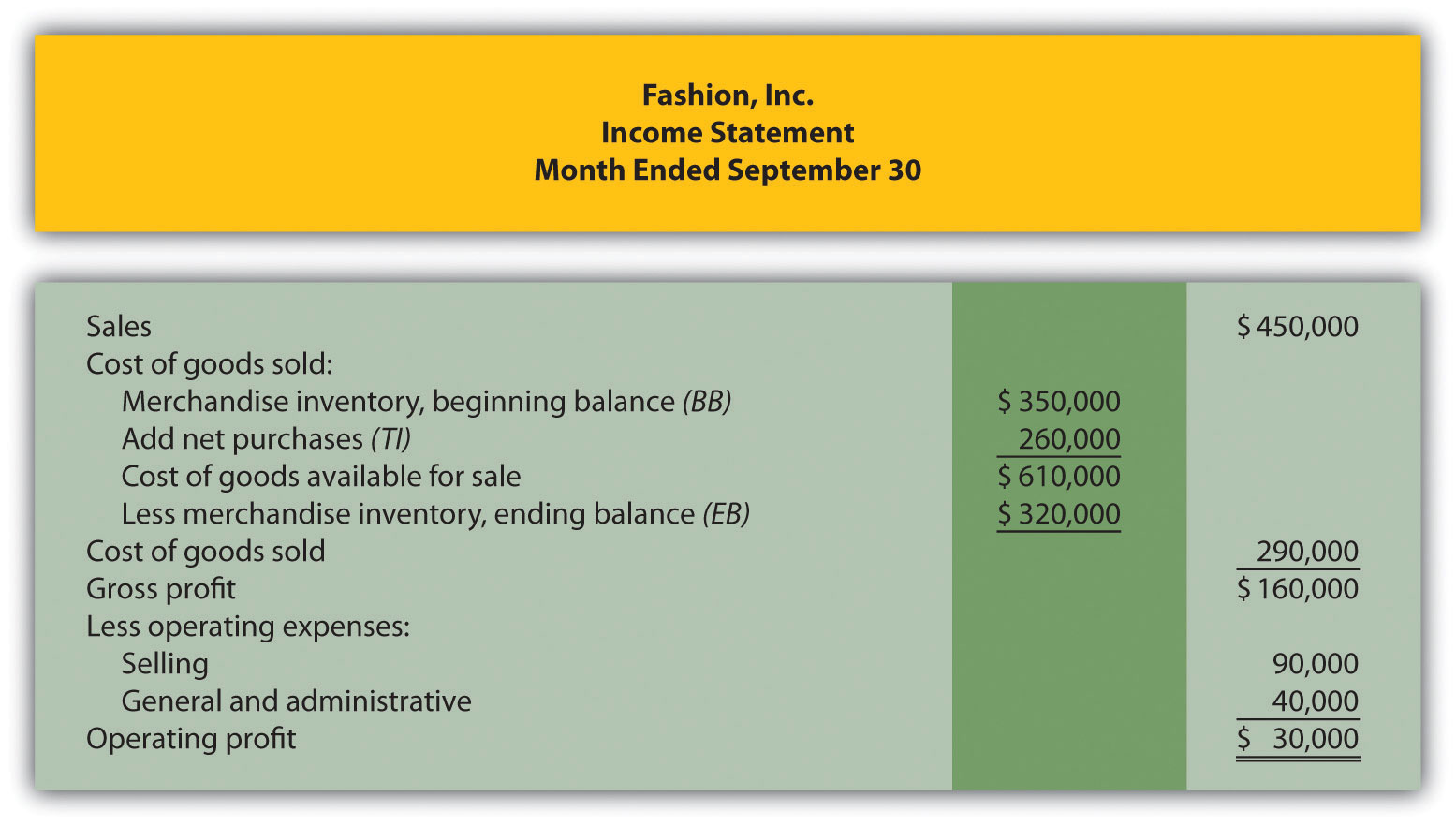

We will apply this equation to the three inventory asset accounts discussed earlier (raw materials, work in process, and finished goods) to calculate the cost of raw materials used in production, cost of goods manufactured, and cost of goods sold.