14.1: Investment Decisions

- Page ID

- 22971

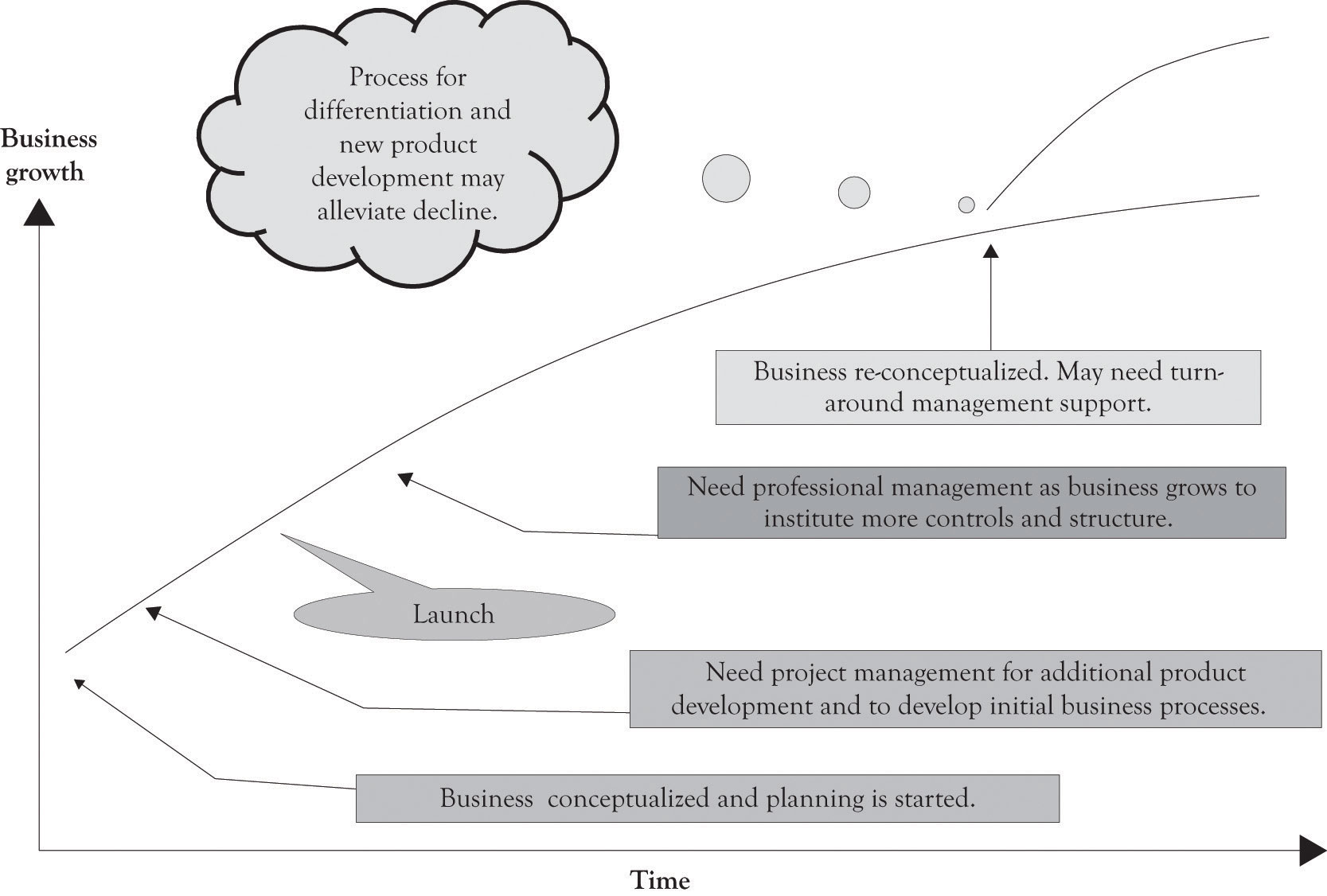

Re-priming the Business Using Real Options Concepts

It does not matter how innovative or how much money the current business is making. There is a life cycle for products and technologies, and eventually, the business will decline unless it can find new opportunities. The business needs to be constantly re-primed with new products and services or it will fade and dissolve (see Figure 14.1 "Critical Organizational Activities During Business Life Cycle"). Critical to re-priming a business is scalability of the business. Scalability means that the business can shrink or grow very quickly with minor changes in the cost structure. Ideally, the ability to grow will not require a large change in variable costs, perhaps even decreasing variable costs and little increase in fixed costs. In addition, a scalable business should be able to handle a large influx of new customers and still be able to handle them without having to drastically change business processes. However, scalability cannot be achieved without investing money and time in stepping stones for future business that provide the business with options. For this reason, real options concepts can be used as the catalyst for differentiation and to re-prime the business pump. This chapter will focus on how real options concepts can be used as the foundation for continually reinventing the business.

Investment Decisions

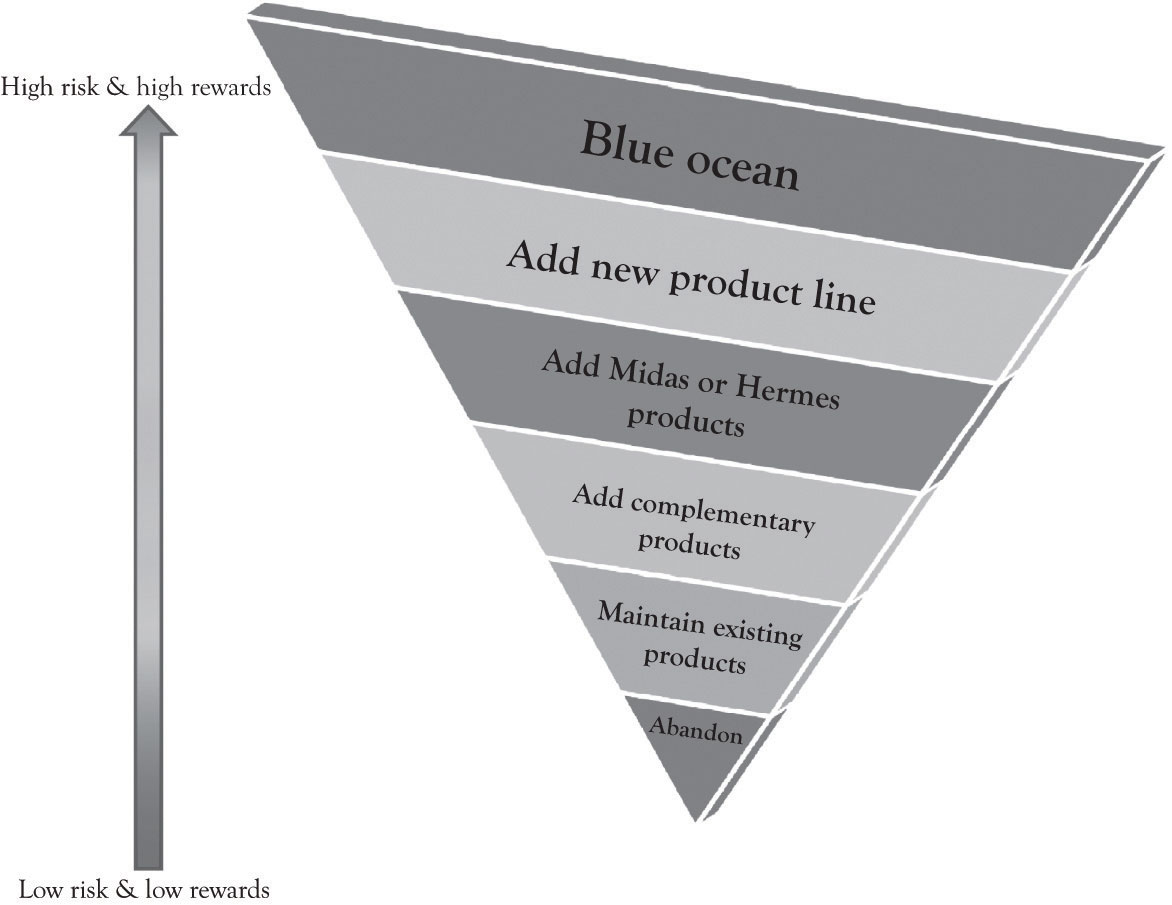

Making the right investment decision on the right projects and the right products at the right time is a combination of having the right information, intuition, and luck. As Figure 14.1 "Critical Organizational Activities During Business Life Cycle" illustrates if there is a process in place for differentiation and new product development, then the decline of the business may be alleviated. There are choices and decisions to be made related to populating the product and project portfolio. These are the critical investment decisions that the entrepreneur has to make. Figure 14.2 "Risk Is Inherent as You Get Closer to the Top" illustrates that the potential profitability is greater as you climb up the inverted pyramid, but there are also greater levels of risk and uncertainty toward the top. All businesses face the following investment decisions while climbing the reward pyramid:

Figure 14.1 Critical Organizational Activities During Business Life Cycle

Figure 14.2 Risk Is Inherent as You Get Closer to the Top

- Maintenance decision: They can maintain their current investment in products, projects, machines, and technologies. This also takes into account investment to deal with depreciation. This is the maintain option. The goal of the maintain strategy is to keep current customers with existing products and services. Learning-about and learn-by-doing are maintained at current levels.

- Growth decision: They have the option to invest a little or a lot in new products, projects, machines, and technologies. There is a step-up in learning-about and learning-by-doing. This is the growth option and it includes a number of approaches:

- Differentiate by scaling-up existing product line. Scaling up your investment and investing even more. For example, adding features for Midas customers and acquiring new Hermes customers on the existing demand curve.

- Differentiate by scoping-up and developing complementary products for existing product line.

- Differentiate by scoping-up and developing new products that are not part of the existing demand curve.

- Differentiate by switching-up the growth path. A switching-up decision incorporates both growth and abandonment options. When a company makes a switch-up decision, it may discard previous investments and take a different path for growth based on the capabilities accumulated from the previous investments. It typically concerns a switch of input, output, or location. For example, instead of using technology A, a firm may use technology B to produce the same thing. Instead of using the current machine to produce product X, a firm may produce product Y (cf. flexible manufacturing system). A company can switch among locations for research and development, manufacturing, distribution, and so forth.

- Develop new Blue Ocean market. This involves scaling-up, scoping-up, and switching-up. This can be a substitute product that competes with an existing line.

- Abandon decision: They have the option to abandon investing in new or existing products, projects, machines, and technologies. The abandon strategy relates to the inadequacy of the current business model and the need to bail.

- Postpone decision: They can defer investing in a product or a technology until a later date. Some investment might occur in the form of monitoring and very early exploratory work. The major investment includes learning-about in the form of search and synthesis.

There are three primary approaches for evaluating investment decisions. They are payback, discounted cash flow analysis, and real options analysis. We discussed the discounted cash flow techniques in the last chapter. The focus of this chapter is on real options analysis.