2.2: Characteristics of Job Order Costing

- Page ID

- 26034

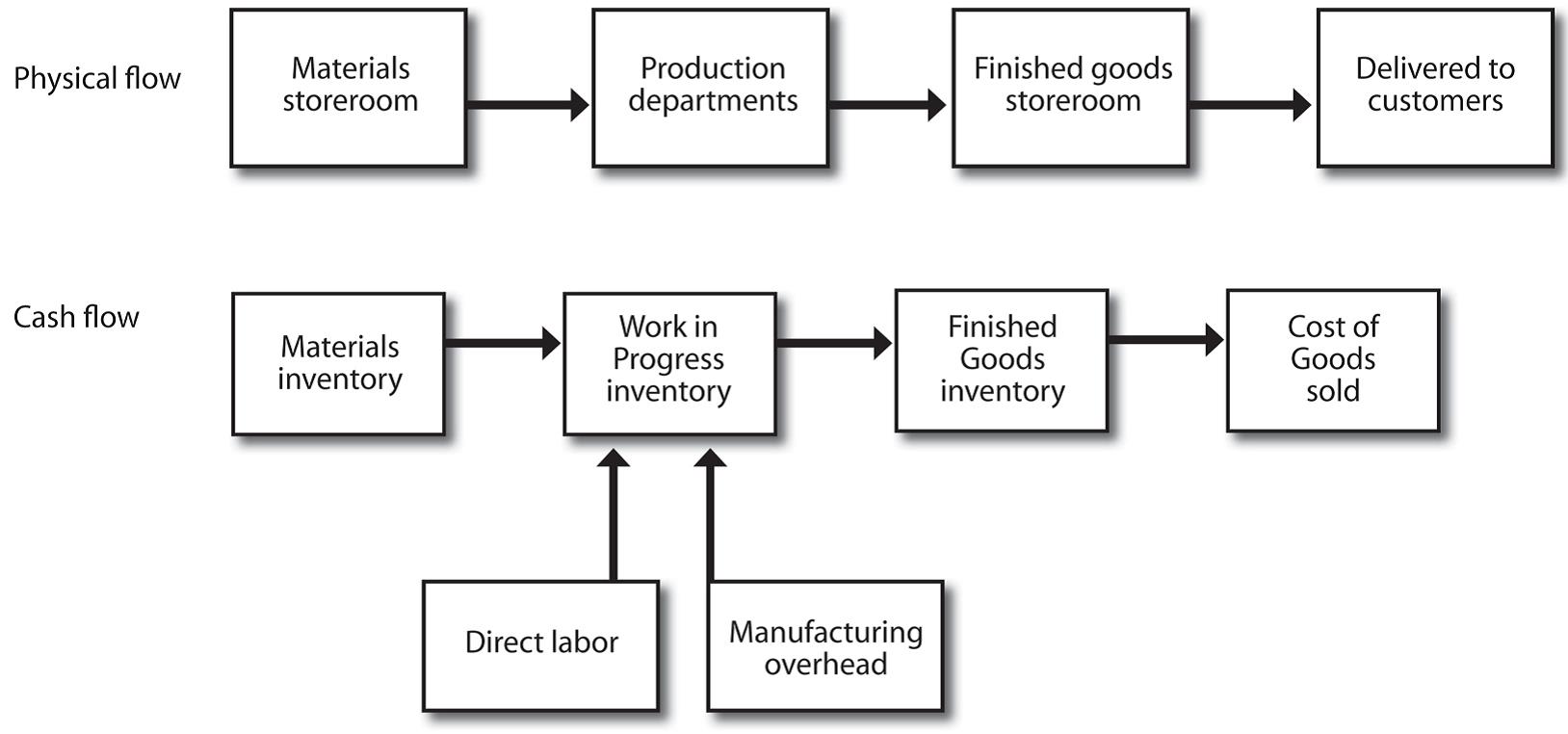

The general cost accumulation model

In general, companies match the flow of costs to the physical flow of products through the production process. They place materials received from suppliers in the materials storeroom and record the cost of those materials when purchasing them to raw materials inventory. As they are needed for production, the materials move from the materials storeroom (raw materials inventory) to the production departments with their cost as shown below.

During production, the materials processed by workers and machines become partially manufactured products. At any time during production, these partially manufactured products are collectively known as work in process (or goods in process). For example, if accountants compute the inventory when the company has partially finished products at the end of the year, this inventory is work in process inventory.

Completed products are finished goods. When the products are completed and transferred to the finished goods storeroom, the company removes their costs from Work in Process Inventory and assigns them to Finished Goods Inventory. As the goods are sold, the company transfers related costs from Finished Goods Inventory to Cost of Goods Sold.

The accounting flow of costs follows the physical flow of the manufacturing process in most companies. In this chapter and the next, we assume costs follow the physical flow of products.In discussing product costing, we described how accountants and managers assign costs to products. Recall that products can be either goods or services, so this discussion applies to service and merchandising companies as well as to manufacturing companies.

What kinds of companies would use job costing? The chart below shows how various companies choose different accounting systems, depending on their products. First, companies producing individual, unique products known as jobs use job costing (also called job order costing). Companies such as construction companies and consulting firms, produce jobs and use job costing.

| Type of production | Accounting system | Type of product |

|---|---|---|

| Job shop | Job costing | Customized |

| Hospital, custom home builder, consulting firm | ||

| Batch production | Mostly job costing | Several different products |

| Furniture manufacturer, winery | ||

| Repetitive manufacturing | Mostly process costing (operations) | Few new products |

| Computer manufacturer, bicycle manufacturer | ||

| Continuous flow processing | Process costing | Standardized |

| Oil refinery, paint manufacturer |

Second, some companies, like furniture manufacturers, produce batches of products. They produce all of the components of a single product (e.g. coffee tables) in one batch. They would then produce the components of another product (e.g. dining room sets) in a new batch. (Some university food service companies prepare meals this way.) Companies such as these use job costing methods to accumulate the cost of each batch.

The last two types of production in use process costing methods described in another chapter, so we give just a brief overview here. Repetitive manufacturing lends itself to the use of automated equipment that minimizes the amount of manual material handling. Automobile assembly plants, bicycle assembly plants, and computer assembly plants use repetitive manufacturing.

Continuous flow processing is the opposite of job shops. Companies using this process continuously mass-produce a single, homogeneous product. Companies might use process cost systems in manufacturing paint, grinding flour, and refining oil.

- Accounting Principles: A Business Perspective. Authored by: James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by: Endeavour International Corporation. Project: The Global Text Project. License: CC BY: Attribution