10.10: Appendix- Recording Standard Costs and Variances

- Page ID

- 27589

- Explain how to record standard costs and variances using journal entries.

This chapter has focused on performing variance analysis to evaluate and control operations. Standard costing systems assist in this process and often involve recording transactions using standard cost information. When accountants use a standard costing system to record transactions, companies are able to quickly identify variances. In addition, inventory and related cost of goods sold are valued using standard cost information, which simplifies the bookkeeping process.

Recording Direct Materials Transactions

Question: In Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream", we calculated two variances for direct materials at Jerry’s Ice Cream: materials price variance and materials quantity variance. How are these variances recorded for transactions related to direct materials?

- Answer

-

Two journal entries are needed to record direct materials transactions that include these variances. An example of each is shown next. (Typically, many more journal entries would be made throughout the year for direct materials. For the purposes of this example, we will make one journal entry for each variance to summarize the activity for the year.)

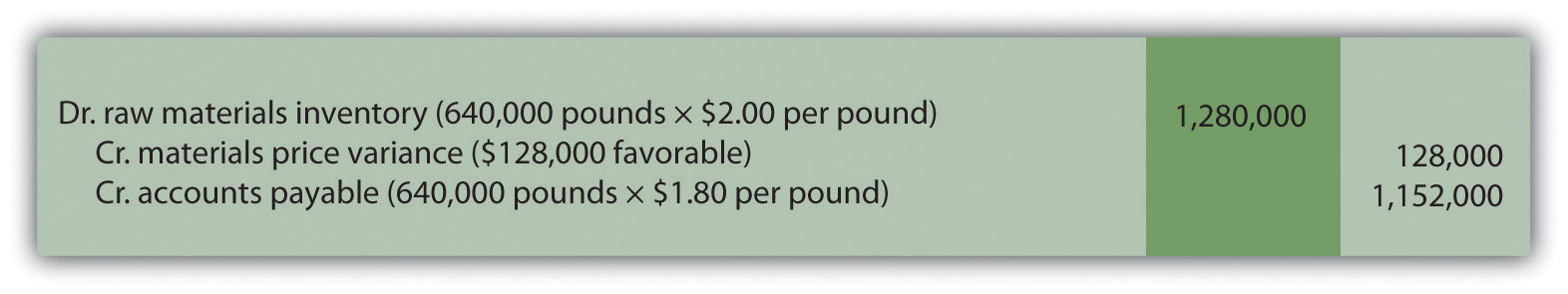

Materials Price Variance

The entry to record the purchase of direct materials and related price variance shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream" is

Notice that the raw materials inventory account contains the actual quantity of direct materials purchased at the standard price. Accounts payable reflects the actual cost, and the materials price variance account shows the unfavorable variance. Unfavorable variances are recorded as debits and favorable variances are recorded as credits. Variance accounts are temporary accounts that are closed out at the end of the financial reporting period. We show the process of closing out variance accounts at the end of this appendix.

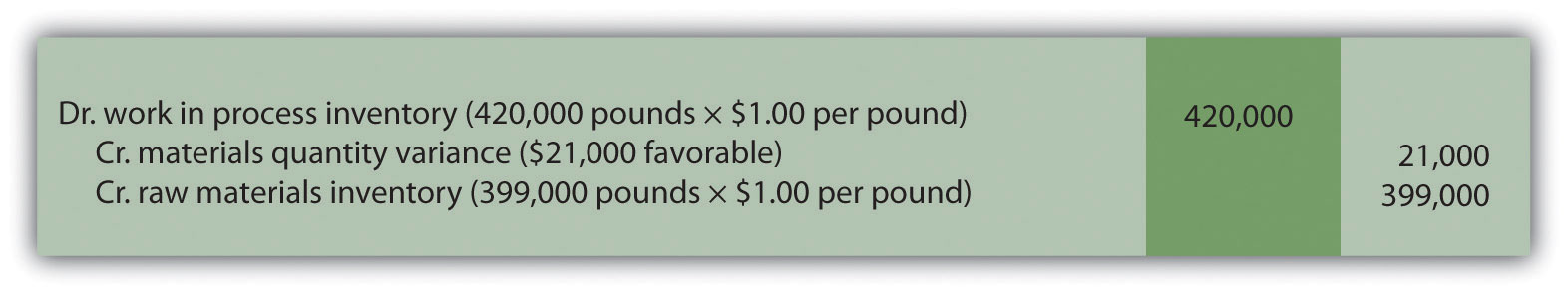

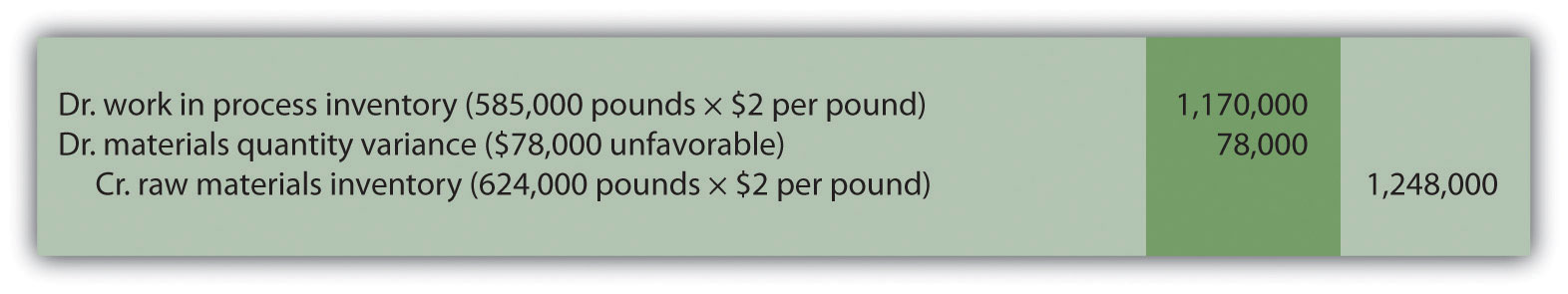

Materials Quantity Variance

The entry to record the use of direct materials in production and related quantity variance shown in Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream" is

Work-in-process inventory reflects the standard quantity of direct materials allowed at the standard price. The reduction in raw materials inventory reflects the actual quantity used at the standard price, and the materials quantity variance account shows the favorable variance.

Recording Direct Labor Transactions

Question: In Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream", we calculated two variances for direct labor at Jerry’s Ice Cream: labor rate variance and labor efficiency variance. How are these variances recorded for transactions related to direct labor?

- Answer

-

Because labor is not inventoried for later use like materials, only one journal entry is needed to record direct labor transactions that include these variances. (Again, many more journal entries would typically be made throughout the year for direct labor. For the purposes of this example, we will make one journal entry to summarize the activity for the year.)

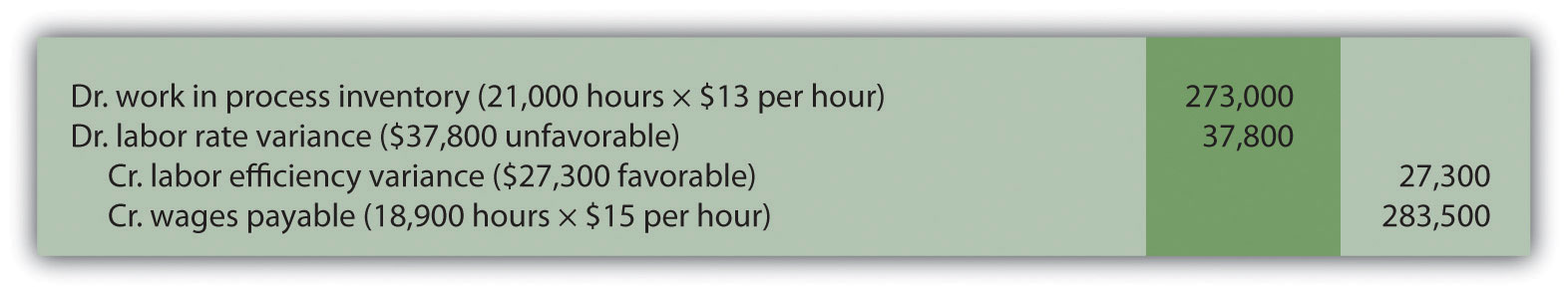

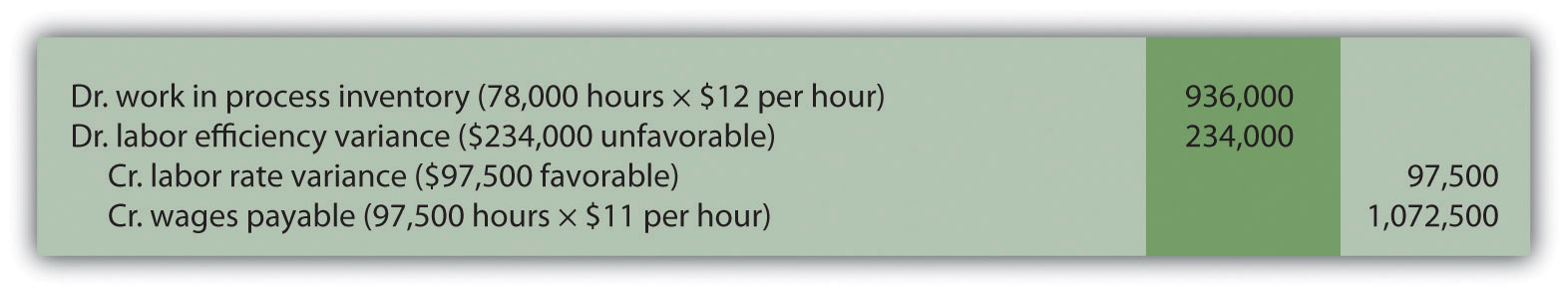

Labor Rate and Efficiency Variances

The entry to record the cost of direct labor and related variances shown in Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream" is

Work-in-process inventory reflects the standard hours of direct labor allowed at the standard rate. The labor rate and efficiency variances represent the difference between work-in-process inventory (at the standard cost) and actual costs recorded in wages payable.

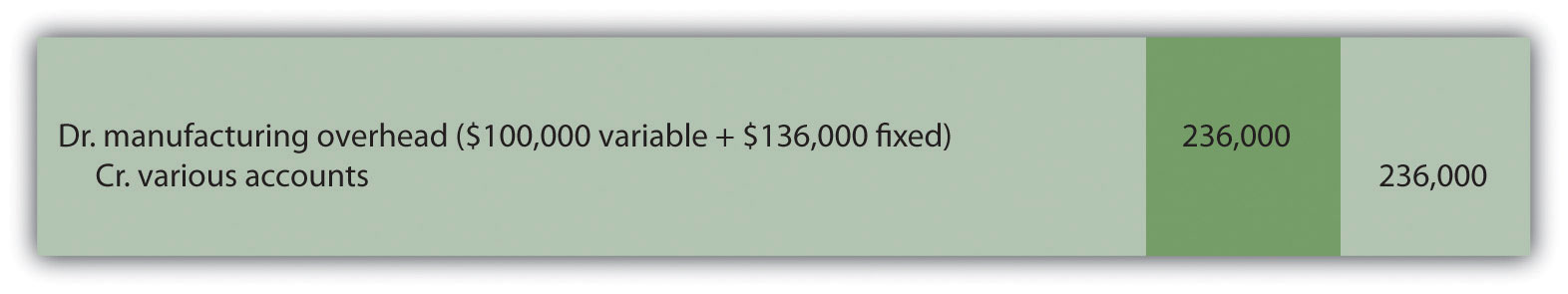

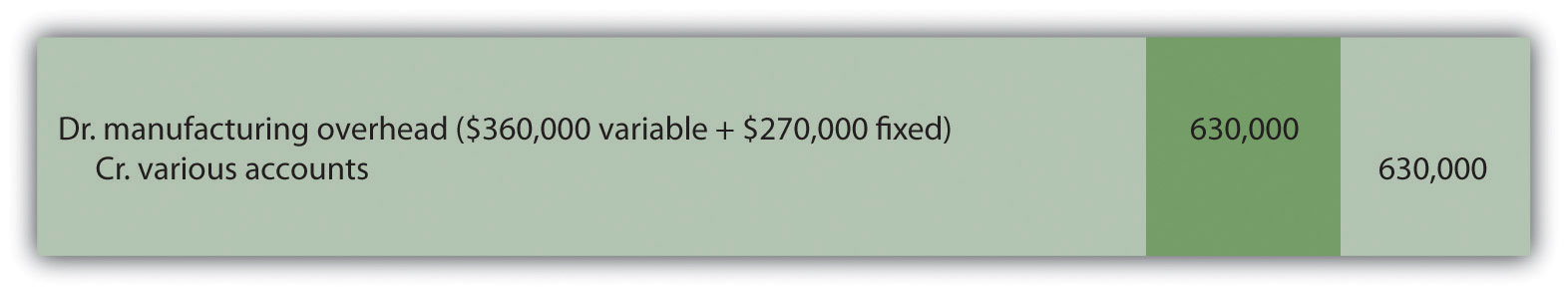

Recording Manufacturing Overhead Transactions

Question: As discussed in Chapter 2 "How Is Job Costing Used to Track Production Costs?", the manufacturing overhead account is debited for all actual overhead expenditures and credited when overhead is applied to products. At the end of the period, the balance in manufacturing overhead, representing overapplied or underapplied overhead, is closed out to cost of goods sold. This overapplied or underapplied balance can be explained by combining the four overhead variances summarized in this chapter in Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream". How are these variances recorded for transactions related to manufacturing overhead?

- Answer

The credit goes to several different accounts depending on the nature of the expenditure. For example, if the expenditure is for indirect materials, the credit goes to accounts payable. If the expenditure is for indirect labor, the credit goes to wages payable.

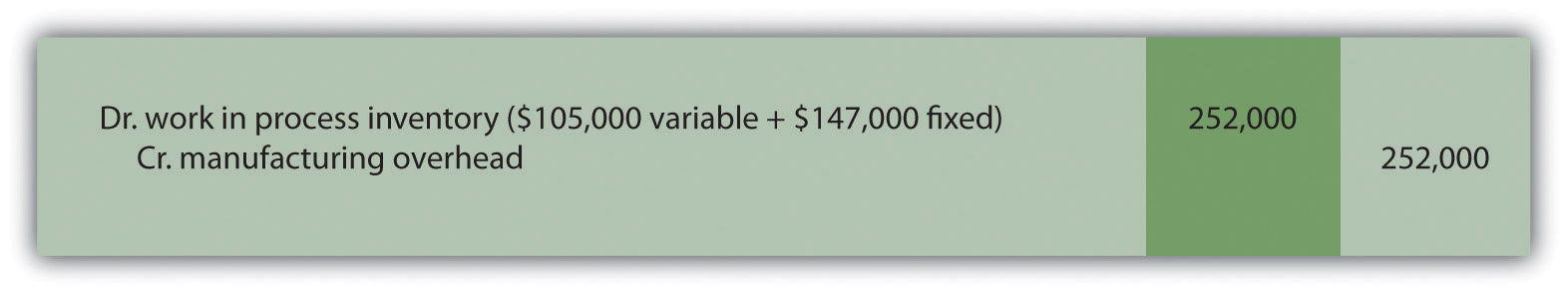

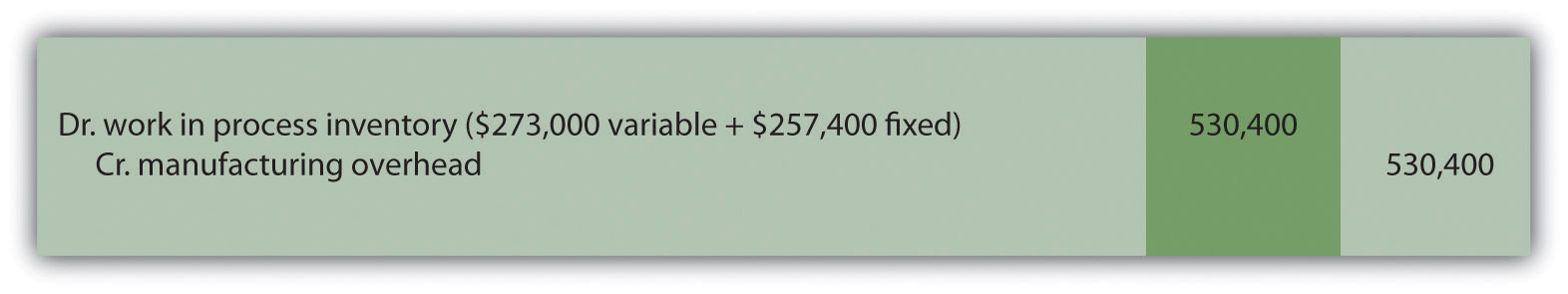

The next entry reflects overhead applied to products. This information comes from the right side of Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream".

At this point, manufacturing overhead has a $16,000 credit balance, which represents overapplied overhead ($16,000 = $252,000 applied overhead – $236,000 actual overhead). The following summary of fixed and variable overhead variances shown in Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream" explains the overapplied amount of $16,000:

Recording Finished Goods Transactions

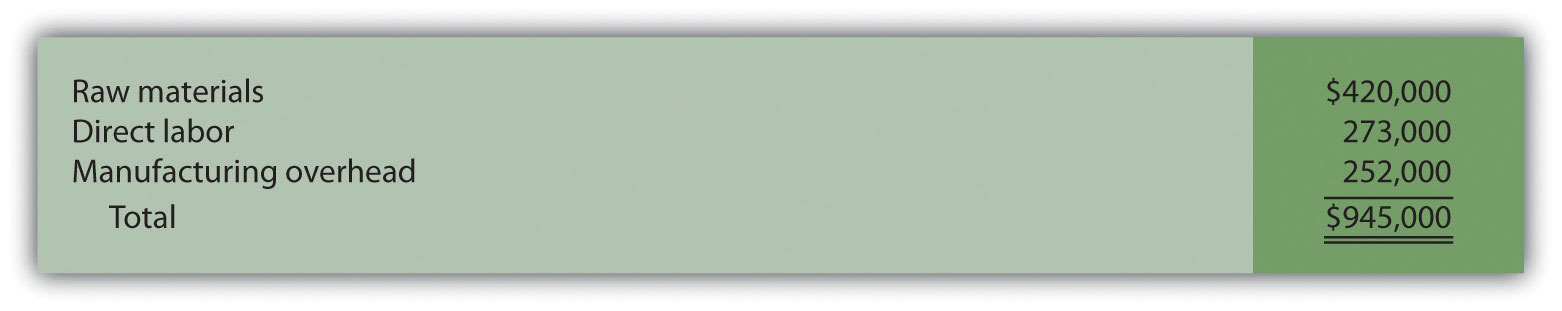

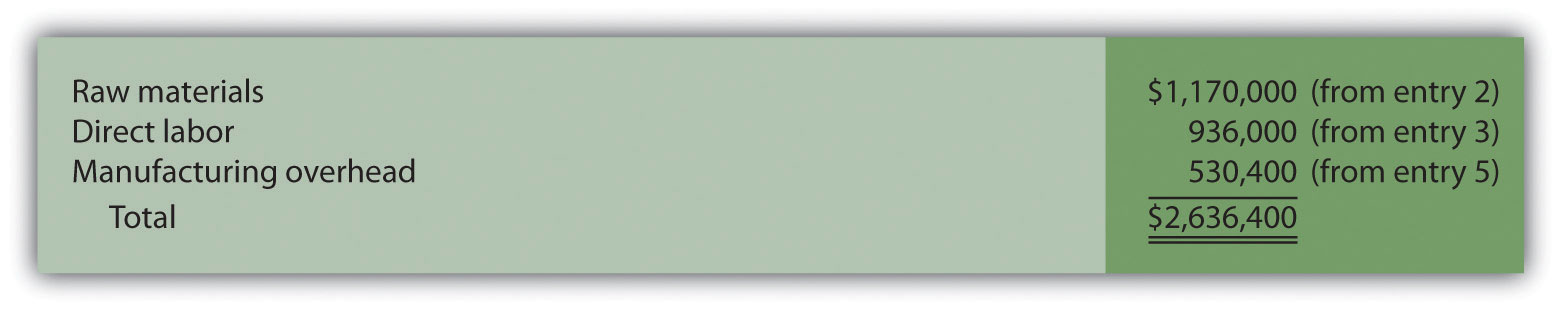

Question: Review all the debits to work-in-process inventory throughout this appendix and you will see the following costs (all recorded at standard cost):

How are these costs transferred from work-in-process inventory to finished good inventory when the goods are completed?

- Answer

-

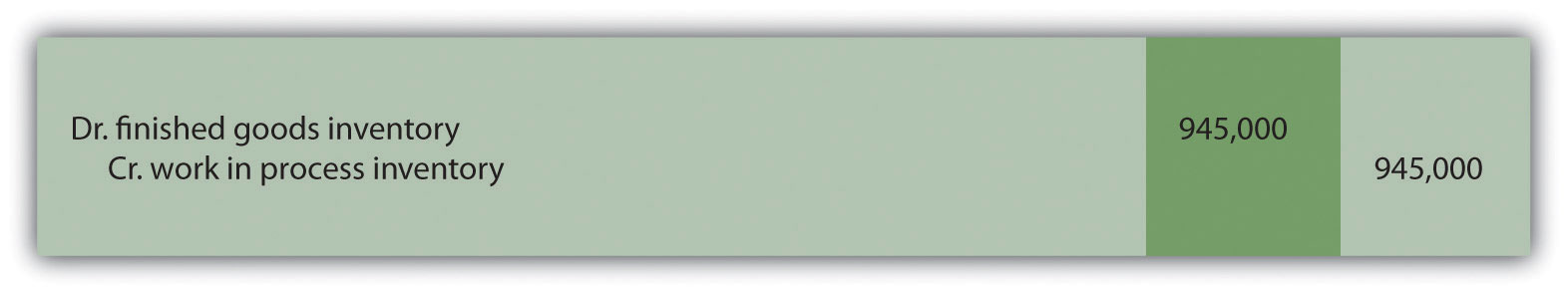

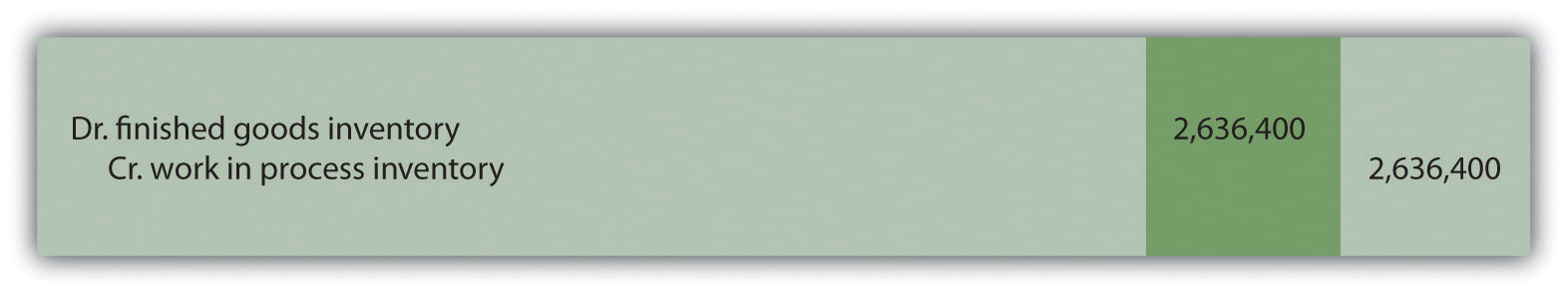

When the 210,000 units are completed, the following entry is made to transfer the costs out of work-in-process inventory and into finished goods inventory.

Note that the standard cost per unit was established at $4.50, which includes variable manufacturing costs of $3.80 (see Figure 10.1 "Standard Costs at Jerry’s Ice Cream") and fixed manufacturing costs of $0.70 (see footnote to Figure 10.12 "Fixed Manufacturing Overhead Information for Jerry’s Ice Cream"). Total production of 210,000 units × Standard cost of $4.50 per unit equals $945,000; the same amount you see in the entry presented previously.

Recording Cost of Goods Sold Transactions

Question: How do we record the costs associated with products that are sold?

- Answer

-

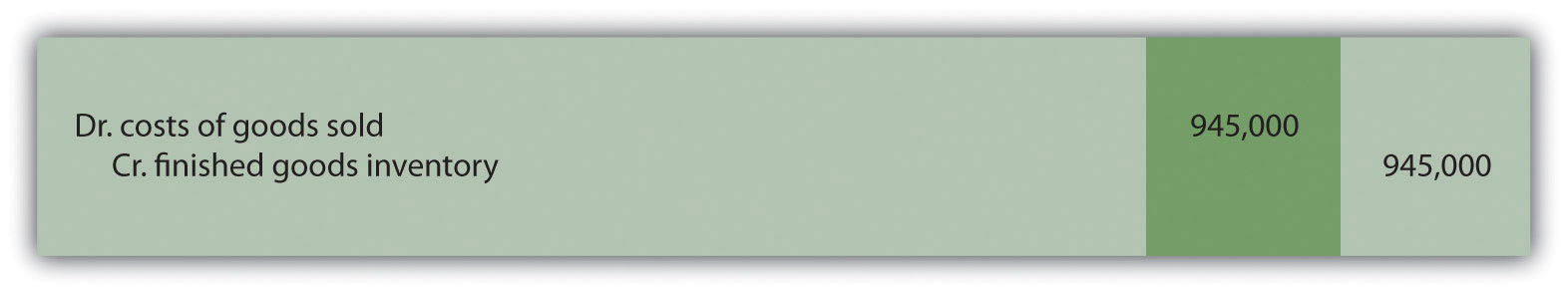

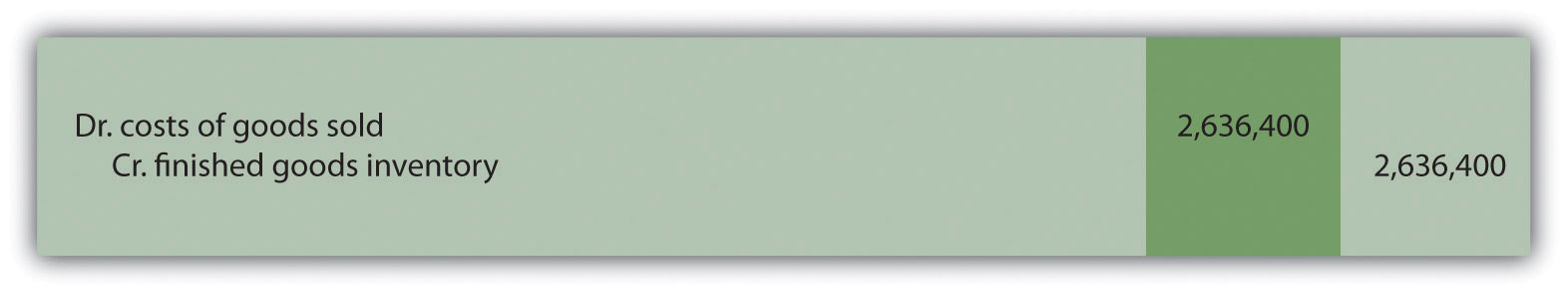

When finished product is sold, the following entry is made:

Note that the entry shown previously uses standard costs, which means cost of goods sold is stated at standard cost until the next entry is made.

Closing Manufacturing Overhead and Variance Accounts

Question: At the end of the period, Jerry’s Ice Cream has balances remaining in manufacturing overhead along with all the variance accounts. These accounts must be closed out at the end of the period. How is this accomplished?

- Answer

-

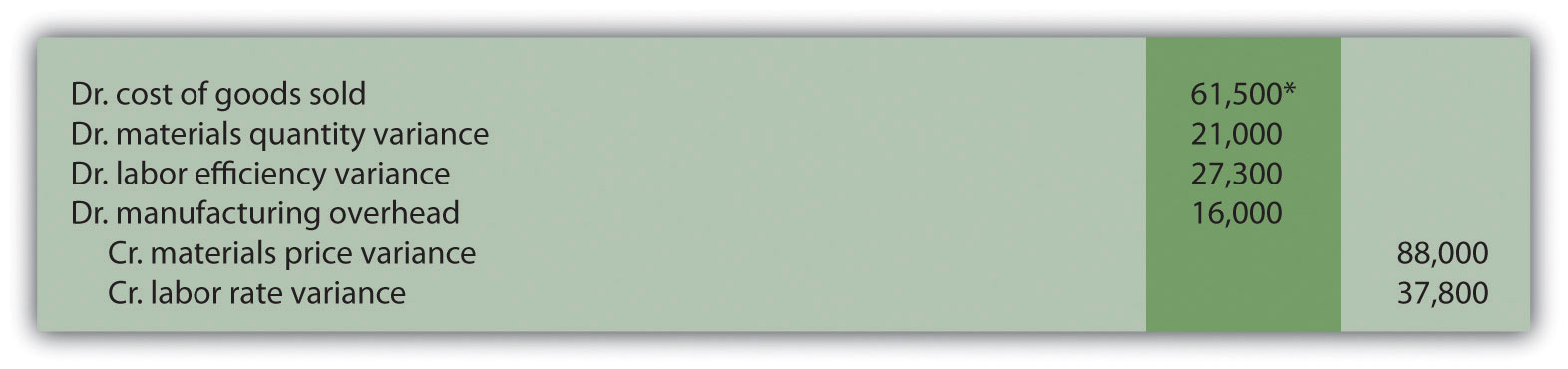

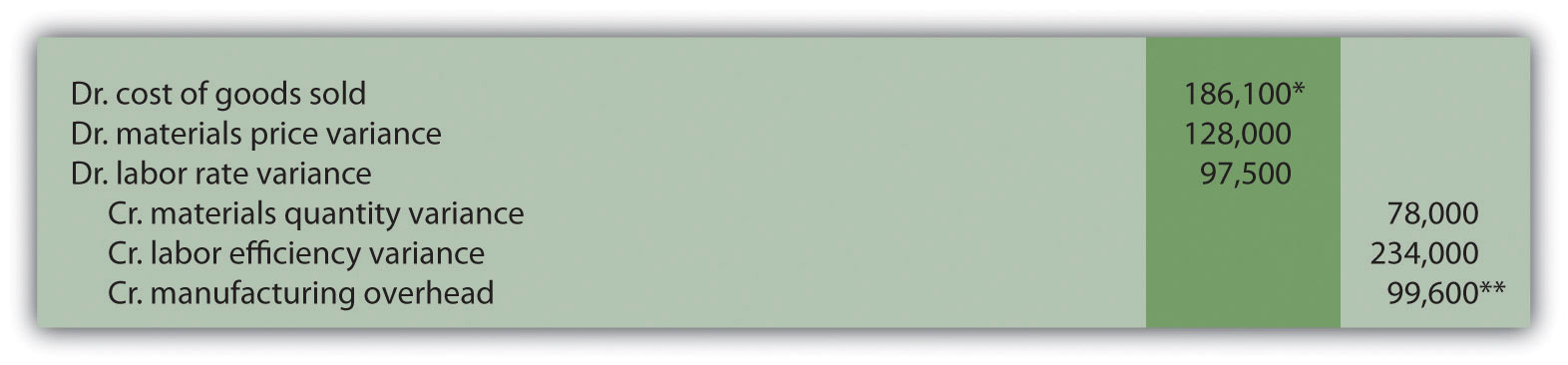

These accounts are closed out to cost of goods sold, after which point cost of goods sold will reflect actual manufacturing costs for the products sold during the period. The following entry is made to accomplish this goal:

*$61,500 = $88,000 + $37,800 – $21,000 – $27,300 – $16,000.

In a standard costing system, all inventory accounts reflect standard cost information. The difference between standard and actual data are recorded in the variance accounts and the manufacturing overhead account, which are ultimately closed out to cost of goods sold at the end of the period.

- Using the solution to Note 10.30 "Review Problem 10.3", prepare a journal entry to record the purchase of raw materials.

- Using the solution to Note 10.30 "Review Problem 10.3", prepare a journal entry to record the use of raw materials.

- Using the solution to Note 10.40 "Review Problem 10.4", prepare a journal entry to record direct labor costs.

- Using the solutions to Note 10.49 "Review Problem 10.5" and Note 10.67 "Review Problem 10.8", prepare a journal entry to record actual variable and fixed manufacturing overhead expenditures.

- Using the solutions to Note 10.49 "Review Problem 10.5" and Note 10.67 "Review Problem 10.8", prepare a journal entry to record variable and fixed manufacturing overhead applied to products.

- Based on the entries shown in items 1 through 5, prepare a journal entry to transfer all work-in-process inventory costs to finished goods inventory.

- Assume all finished goods are sold during the period. Prepare a journal entry to transfer all finished goods inventory costs to cost of goods sold.

- Based on the entries shown in items 1 through 7, close manufacturing overhead and all variance accounts to cost of goods sold.

- Answer

-

1. The following is a journal entry to record purchase of raw materials:

*$186,100 = $78,000 + $234,000 + $99,600 – $128,000 – $97,500.

**$99,600 underapplied overhead = $630,000 actual overhead costs – $530,400 applied overhead. Because this represents a debit balance in manufacturing overhead, the account must be credited to close it. To further prove this is accurate, the sum of all overhead variances must equal $99,600 unfavorable as shown in the following:

| Variable overhead spending variance | $18,750 unfavorable (from Note 10.49 "Review Problem 10.5") |

| Variable overhead efficiency variance | $68,250 unfavorable (from Note 10.49 "Review Problem 10.5") |

| Fixed overhead spending variance | $5,340 unfavorable (from Note 10.67 "Review Problem 10.8") |

| Fixed overhead production volume variance | $7,260 unfavorable (from Note 10.67 "Review Problem 10.8") |

| Total manufacturing overhead variance | $99,600 unfavorable |